France’s banking and insurance coverage regulator, the Autorité de contrôle prudentiel et de résolution (ACPR), has revealed a abstract of its findings from a public session on regulating decentralized finance (DeFi.)

The session obtained vital engagement from international DeFi stakeholders, offering helpful insights to tell potential regulatory approaches in Europe.

In line with the ACPR, the two-month session enabled a deeper understanding of DeFi’s dangers and alternatives. Whereas DeFi is usually described as “decentralized,” the regulator argues that “disintermediated” could also be extra correct given the focus of infrastructure with main cloud suppliers, representing a possible operational vulnerability.

The session additionally revealed broad assist for certifying good contracts, core to DeFi protocols, with recommendations round proportionality and incident reporting. Regulating intermediaries and person interfaces likewise obtained widespread consensus.

Most individuals advocated persevering with deployment on public blockchains whereas strengthening resilience. The suggestions will assist form the ACPR’s contributions to European regulatory discussions following the Markets in Crypto-Belongings (MiCA) laws, targeted on points like:

- Guidelines governing blockchain reliability vital to DeFi.

- Sensible contract certification frameworks.

- Governance and conduct requirements for DeFi platforms.

In line with the ACPR, regulating infrastructure, good contracts, and companies would permit DeFi to develop whereas defending customers. Crypto-native and incumbent monetary establishments submitted suggestions alongside auditors and consultants, offering various views.

Whereas MiCA gives a basis, the regulator believes additional guidelines are wanted for the distinctive nature of DeFi and tokenized finance. The session enabled the compiling of particular suggestions to develop the regulatory perimeter.

DeFi centralization drawback continues.

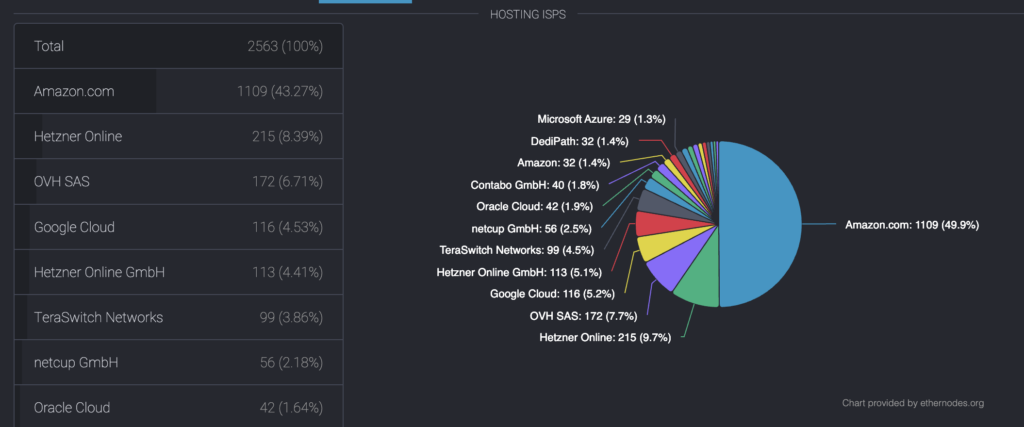

The ACPR’s sentiment that DeFi has a {hardware} centralization drawback is shared by some inside the crypto group itself, as the information reveals. In July 2022, starcrypto reported that Amazon AWS facilitated round 32% of Ethereum nodes on the time, with 47% of whole nodes operating by way of main US web and cloud suppliers. Analysts on the time argued the community’s reliance on firms like AWS may nonetheless permit coordinated assaults throughout suppliers to disrupt operations.

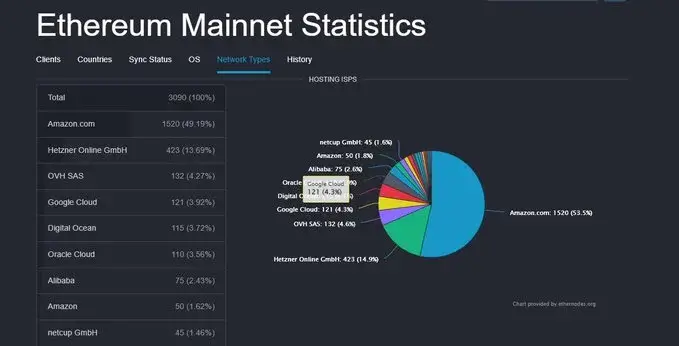

The under charts present the distribution of Ethereum nodes by supplier in July 2022 and on Oct. 12, 2023. At the moment, 52.3% of nodes run on internet hosting providers, a 5.3% enhance.

In line with the newest knowledge, Amazon has elevated its market share by roughly 4% over the previous 15 months.

The put up French regulator calls out DeFi centralization as AWS beneficial properties 4% in ETH node market share appeared first on starcrypto.