Bitcoin velocity measures the speed at which cash are circulating throughout the market. It’s calculated by dividing the trailing 1-year estimated transaction quantity—or the cumulative sum of transferred tokens—by the present provide of Bitcoin. Velocity is a crucial metric as a result of it signifies the extent of financial exercise within the community. A better velocity signifies that cash are transferring extra steadily, suggesting increased transactional exercise. In distinction, decrease velocity implies that cash are idle, presumably reflecting a long-term holding mentality.

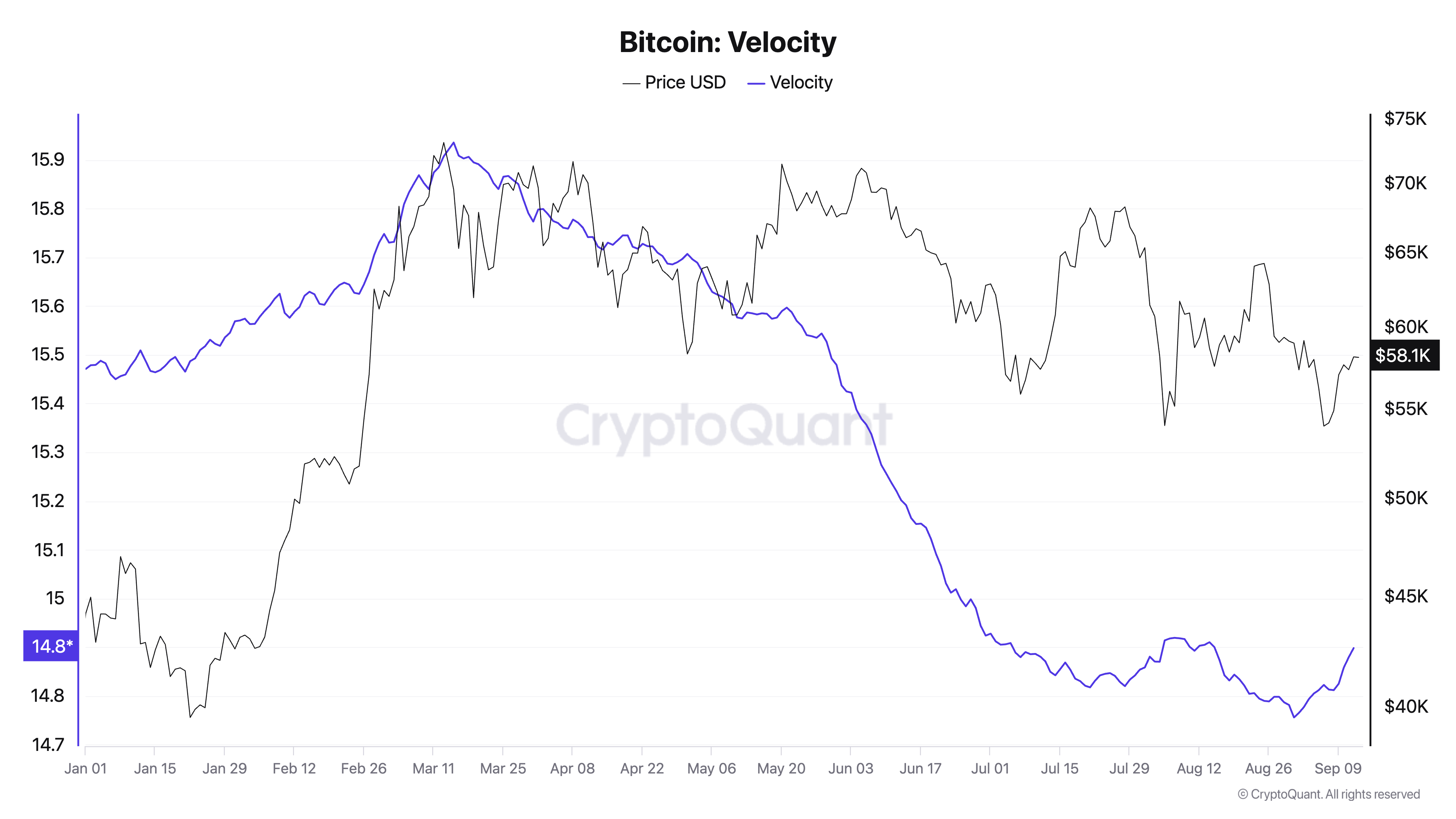

StarCrypto’s evaluation discovered that Bitcoin’s velocity noticed a notable uptick in September. This short-term enhance follows a protracted interval of decline that started in mid-March. To know the importance of this uptick, we should study each the current spike and the long-term downward pattern in velocity.

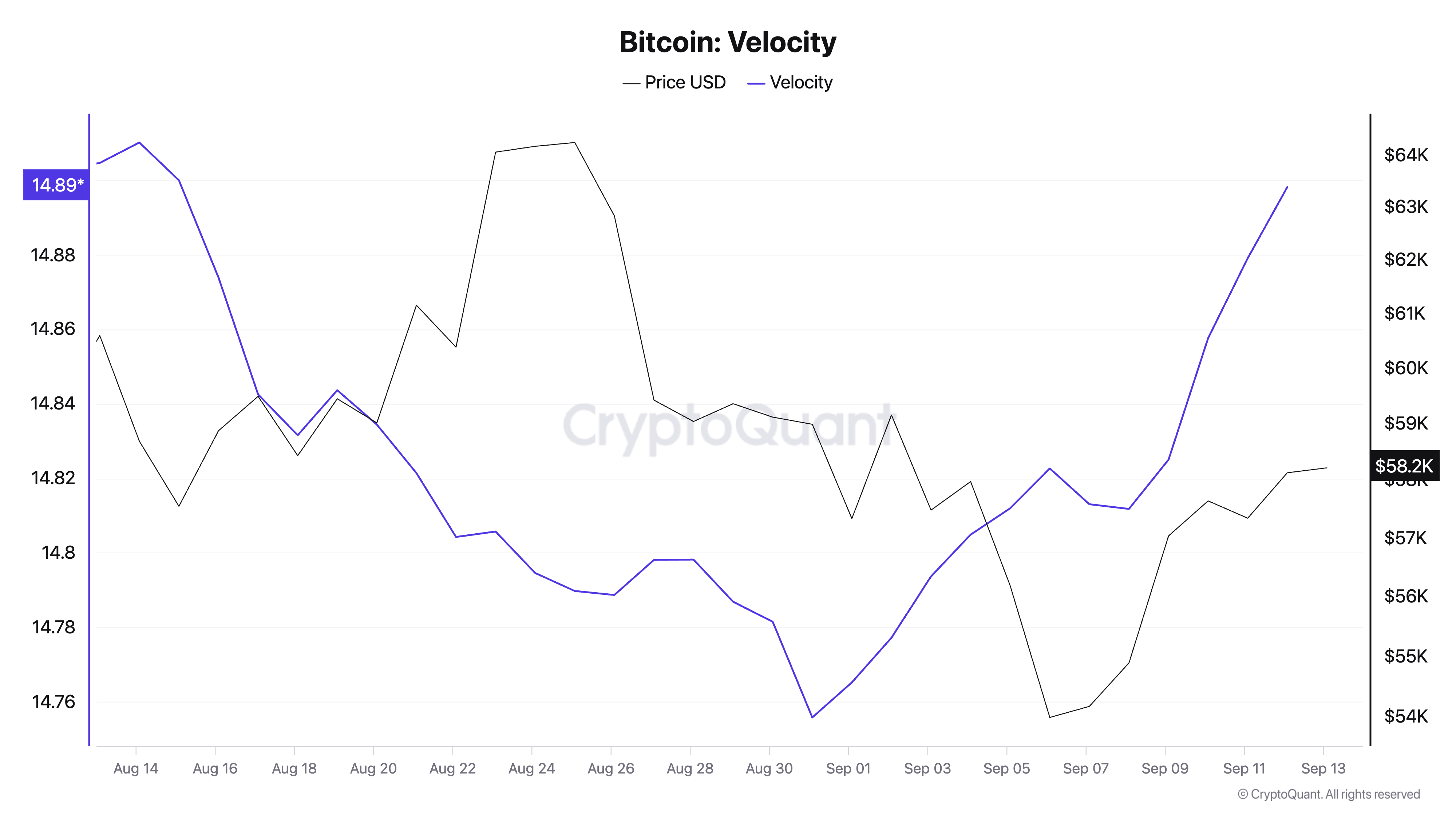

Bitcoin velocity started to extend after months of regular decline on the finish of August 2024. This short-term enhance suggests a renewed wave of market exercise. Whereas the uptick isn’t substantial in absolute phrases, it marks the primary notable rise in Bitcoin velocity in months. This implies that after a interval of consolidation, the market could possibly be making ready for extra energetic participation.

Spurred by exterior developments and expectations of additional value actions, merchants have begun to maneuver their holdings once more. This could possibly be as a result of numerous components, however it often boils all the way down to volatility—when costs transfer considerably, buying and selling exercise spikes because the market races to seize revenue or reduce losses from the value swings, rising transaction quantity and velocity.

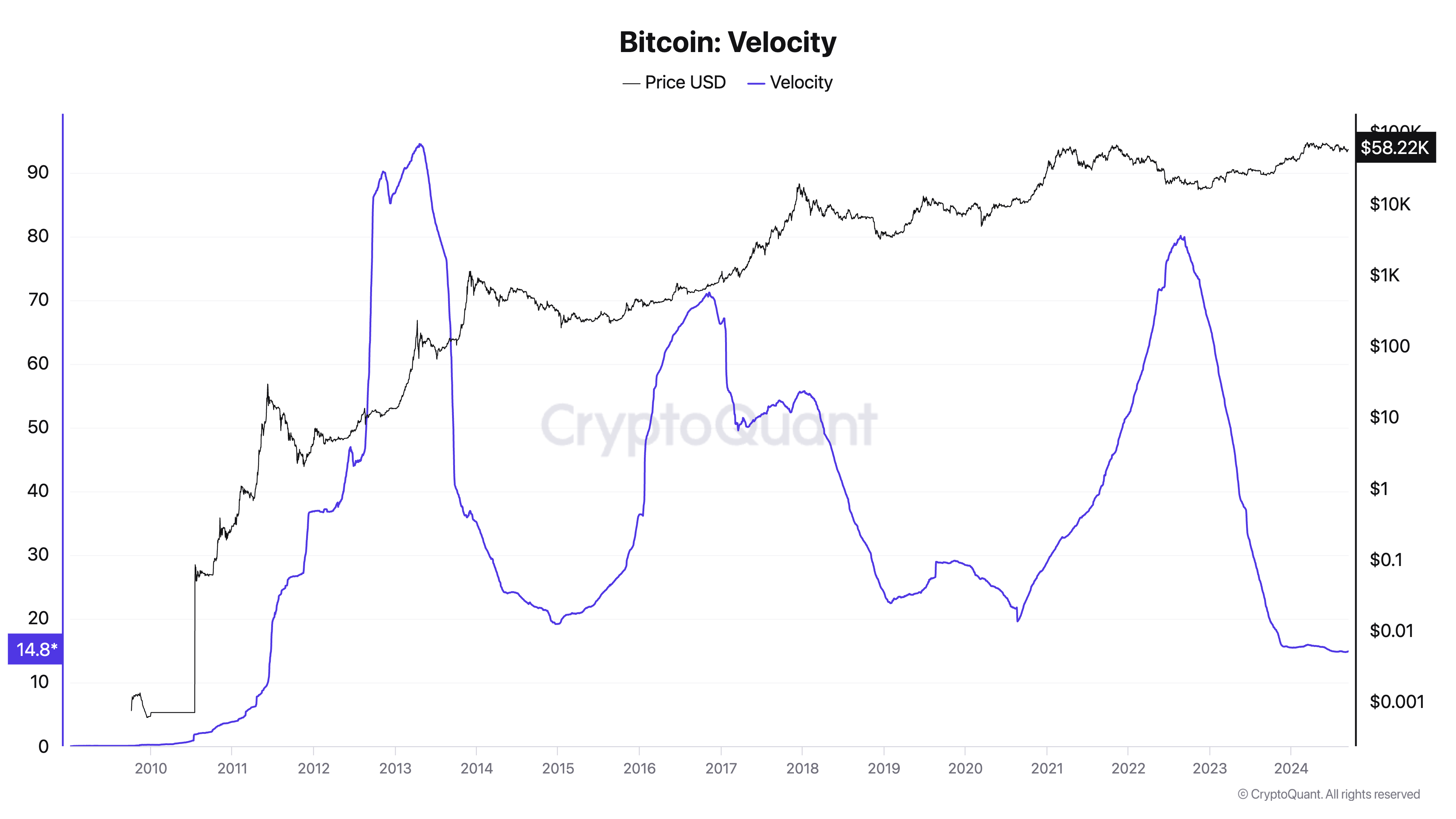

Nonetheless, this short-term spike stands in stark distinction to the broader pattern. Traditionally, Bitcoin’s velocity has been on a gradual decline. After reaching its peak throughout the 2013 bull market, velocity has declined considerably. Whereas there have been notable spikes in 2017 and 2021, corresponding with Bitcoin’s historic bull runs, velocity rapidly dropped off afterward, returning to decrease ranges. This extended decline displays a big shift in how Bitcoin is used throughout the market.

Over time, Bitcoin has more and more been perceived as a retailer of worth fairly than a medium of trade. Lengthy-term holders are inclined to accumulate Bitcoin with the expectation of future appreciation, decreasing the necessity for frequent transactions. As institutional adoption has grown, so has the long-term accumulation pattern.

Massive institutional gamers have a tendency to maneuver Bitcoin in bigger however much less frequent transactions. This habits contributes to the decrease total velocity, as establishments are typically much less concerned with frequent buying and selling than retail individuals. This has change into particularly evident in 2024 with the spike in institutional demand from spot Bitcoin ETFs.

Whereas the spike in velocity we’ve seen for the reason that starting of September is important within the brief time period when contemplating the market, it’s nonetheless minuscule in comparison with the overall downward pattern in 2024.

The present uptick in velocity means that the market could also be coming into a extra energetic section after a protracted interval of consolidation. It could possibly be an early indicator of renewed curiosity and speculative exercise, presumably signaling a bullish outlook.

The broader market continues to be dominated by long-term holders, with HODLing and institutional involvement contributing to the general decline in velocity. Except this current uptick is accompanied by sustained value appreciation and broader market exercise, it’s unlikely to result in a long-term reversal of the declining velocity pattern.

The put up First important rise in Bitcoin velocity since March reveals spike in buying and selling appeared first on StarCrypto.