- US deficits preserve rising regardless of the economic system rising

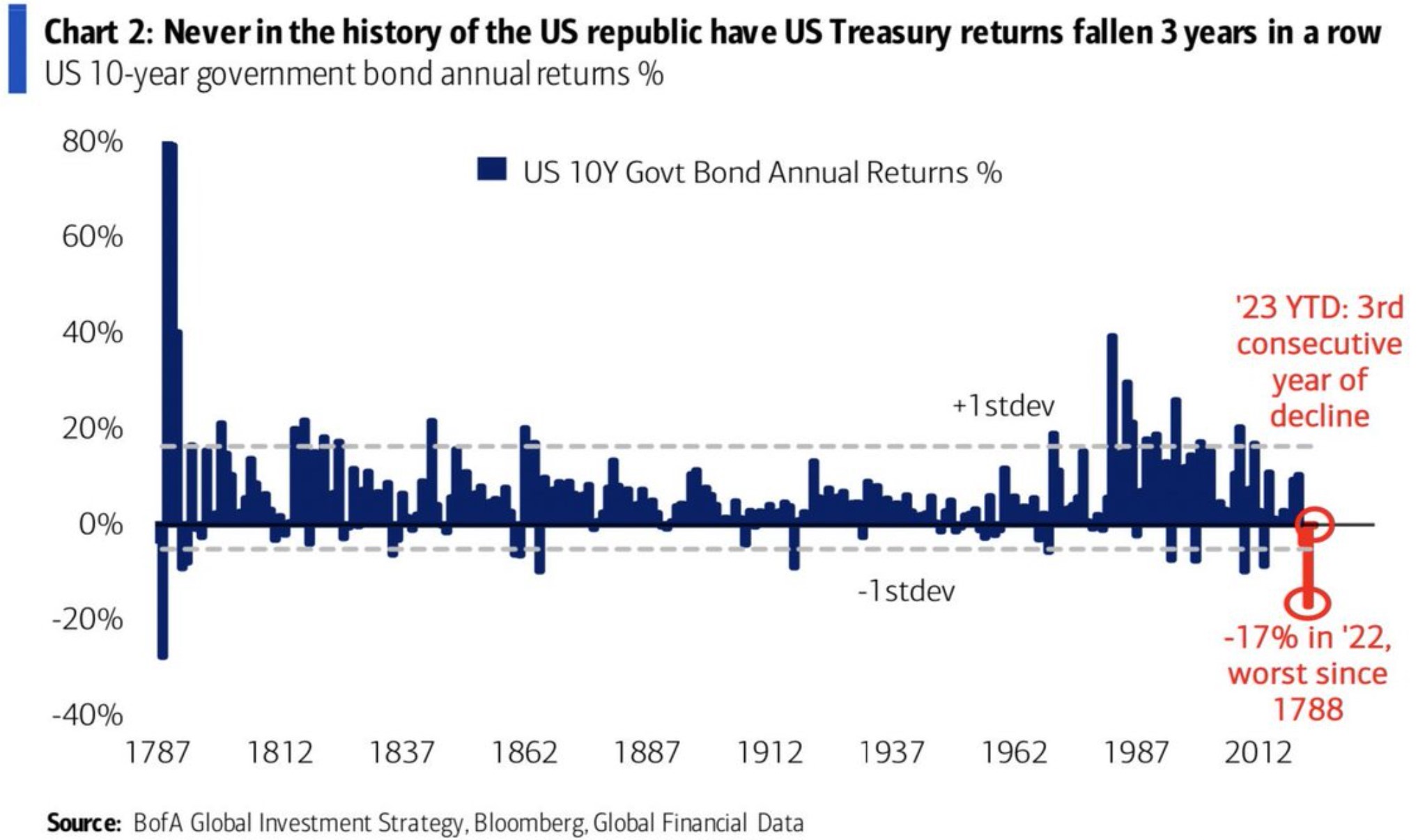

- US Treasury returns dropped for the previous three years in a row

- A weakening greenback would possibly trigger cryptocurrencies’ subsequent step larger

In earlier articles revealed right here, I’ve argued that the subsequent transfer within the cryptocurrency market will doubtless be pushed by the US greenback reasonably than crypto-related information. Given the present rate of interest ranges, the surging deficit makes elevating cash troublesome for the US authorities.

Therefore, one solution to make it simpler is to decrease the charges.

The Federal Reserve won’t ever inform market members that charges can not transfer a lot larger. The second it does that, inflation expectations should not anchored anymore.

Nonetheless, one would possibly take time to grasp what the bond market tells. For the primary time within the historical past of america, US Treasury returns dropped three years in a row.

A vicious circle might spark the US greenback’s weak point

The worth of a bond is inversely associated to its yield. Decrease bond costs imply larger yields and a method for bond costs to bounce again is for yields (i.e., rates of interest) to say no.

However the deficit poses an enormous drawback. Deficit spending is likely one of the the reason why bonds underperform.

As a result of deficits surged even because the economic system grew, extra bonds are issued to pay for it. Nonetheless, issuing extra bonds means issuing extra debt, however rates of interest should not low anymore as they had been previously years.

Due to this fact, rate of interest bills would enhance, offsetting the income collected from promoting the bonds.

One solution to remedy this drawback is to let the greenback slip. The place to begin may be a sign that the Fed has already reached the terminal fee.

If the greenback begins weakening, its decline ought to be generalized and still have ramifications for the cryptocurrency market. Due to this fact, if Bitcoin is about to make a transfer larger, one ought to regulate the US deficit and the greenback.