- On-chain information revealed that Ethereum whales have been taking Vitalik’s recommendation to maintain belongings off exchanges.

- ETH confronted a good buying and selling vary between $1,846 and $1,916, as short-term holders took earnings.

- Whereas the altcoin moved towards the oversold zone, long-term prospects stay bullish.

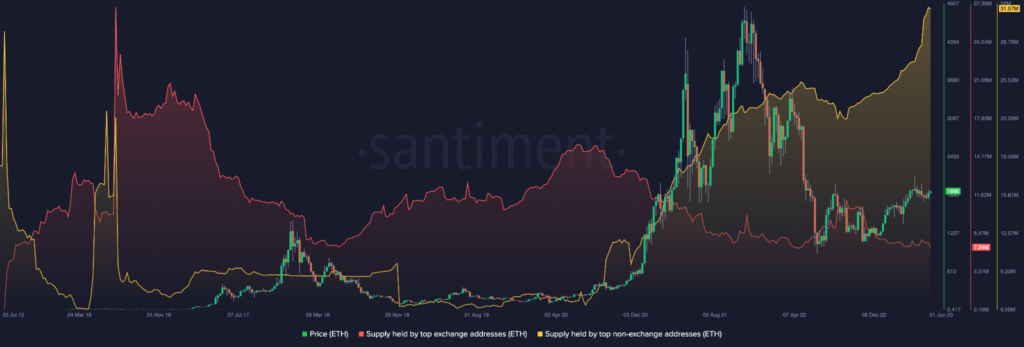

Whale addresses holding Ethereum (ETH) in self-custody have added extra of the altcoins to their portfolio. The event, revealed by Santiment on 5 June, confirmed that the ten largest whales now have a mixed holding value $59.47 billion.

The on-chain analytic platform, by way of its official account, tweeted, “As increasingly Ethereum has been shifting into self custody & DeFi choices, many of those cash have been absorbed by the most important whale addresses on the community. The ten largest non-exchange addresses now maintain an AllTimeHigh 31.8M $ETH value $59.47B”

From the info shared by Santiment, the numerous rise started final 12 months. And this occurred on the expense of the alternate provide held on exchanges (pink) which have been on a fast fall since September 2022.

Heeding the founder’s name

Curiously, the transfer may very well be linked to Vitalik Buterin’s name for self-custody on two separate events.

In November 2022, the Ethereum co-founder urged the crypto group to maneuver belongings away from centralized platforms. This occurred a number of weeks after the FTX collapse, calling the exchanges “evil by default”.

On 17 March, he doubled down on his opinion. At the moment, he urged the adoption of multisig wallets. He additionally talked about that ERC-4337 might tackle the issues of custodial storage.

Multisig wallets, whose full that means is multi-signature require completely different cryptographic keys to execute transactions. Thus, fostering improved safety. Then again, ERC-4337 is an Ethereum normal that permits the biometric signing of transactions to assist the security of belongings.

Moreover safety, the transfer by these whales might function an indicator of long-term bullishness. If the provision on exchanges had elevated this fashion, the ETH would possibly face a attainable lower in worth.

On the time of writing, the altcoin intra-day buying and selling worth was $1,869. This depicts a 1.68% lower within the final seven days, based on CoinMarketCap.

ETH’s momentum is tilting towards the bearish space

Between Might 29 and the time of writing, ETH’s buying and selling vary has been between $1,846 and $1,916, based mostly on the 4-hour chart. The upswing on June 1, adopted a resistance at $1,903 on June 3.

Whereas it solely flipped the market construction barely from the interval, ETH largely retreated from the higher vary. So, until the bear succumbs to stress or Bitcoin (BTC) blasts previous the $26,000 vary, bulls would possibly discover it troublesome to bypass the downtrend.

Moreover, patrons have discovered it difficult to regain management, as indicated by the Relative Power Index (RSI). At press time, the momentum indicator was 40.43.

This implies it was nearer to the oversold stage of 30. This was attributable to attainable profit-taking across the $1,908-$1,904 area.

Due to this fact, ETH’s present pattern helps a possible bearish motion. However in the long run, if whale accumulation continues, then the altcoin might rally.

Disclaimer: The views, opinions, and knowledge shared on this worth prediction are printed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates is not going to be accountable for direct or oblique harm or loss.