- Ethereum Basis’s 1,050 ETH sale in September indicators strategic market timing.

- ETH worth holds agency at $2,593 assist, with potential resistance at $2,700 forward.

- Bullish indicators emerge as MACD rises and RSI stays impartial for additional momentum.

The Ethereum Basis has as soon as once more bought a major quantity of ETH, this time 100 ETH at $2,645, in accordance with PANews information. This brings the entire Ethereum (ETH) bought by the Basis to 1,050 ETH in September alone, valued at roughly $2.53 million.

These gross sales came about at costs between $2,301 and $2,645, suggesting a strategic promoting strategy throughout Ethereum’s worth swings. These transactions elevate questions on their potential impression available on the market, particularly as ETH exhibits indicators of restoration.

Ethereum Worth Pattern and Market Exercise

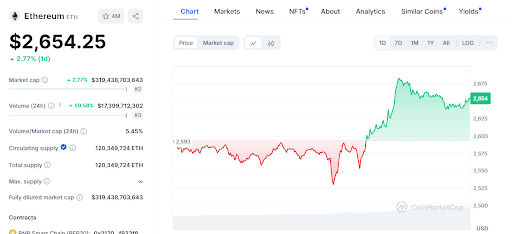

As at presstime, Ethereum’s present worth stands at $2,651.16, reflecting a 2.23% improve over the previous 24 hours. Importantly, this upward motion comes after a interval of volatility the place ETH briefly examined a assist degree close to $2,593 earlier than bouncing again.

Day by day buying and selling quantity has jumped by 59.85%, reaching $17.35 billion. This vital rise in buying and selling exercise signifies elevated market curiosity and the opportunity of extra volatility as buyers react to the Basis’s promoting.

Learn additionally: Ethereum’s Circulating Provide Will increase, Worth Stays Unstable

Bullish Momentum Builds, However Challenges Stay

The current bounce from the $2,593 assist degree has created bullish momentum, pushing ETH in the direction of an area excessive of $2,675. Nonetheless, the value barely retreated and settled round $2,651. Even with this small pullback, the $2,593 assist degree has held agency and will proceed to be an important worth zone within the close to time period.

A number of assist and resistance ranges are rising as vital markers in Ethereum’s worth development. The assist at $2,593 proved its significance when the value bounced from this degree. As well as, one other key assist degree to observe is $2,550, which might present assist if $2,593 doesn’t maintain.

Learn additionally: Ethereum’s ‘Parasitic’ Relationship with L2s: Knowledgeable’s Take

Wanting forward, ETH faces rapid resistance at $2,675, the place the value was briefly rejected. If it breaks by this degree, the subsequent goal could be the psychological resistance at $2,700. Overcoming this level might result in additional beneficial properties, doubtlessly driving ETH greater within the coming days.

Technical Indicators Level to Bullish Pattern

Ethereum’s 1-day Relative Power Index (RSI) is at present at 60.49, inserting it in impartial territory. This studying means that the market is neither overbought nor oversold, leaving room for additional worth motion.

Moreover, the Shifting Common Convergence Divergence (MACD) is buying and selling above the sign line, indicating rising bullish momentum.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be liable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.