- Galaxy Digital’s $10.24M ETH withdrawal highlights market affect.

- Ethereum’s worth dips to $2,736, with key assist at $2,730 and resistance at $2,750.

- RSI at 44.58 suggests Ethereum is barely oversold with MACD indicating attainable decline.

Galaxy Digital lately pulled a large 3,735 ETH from Binance. This withdrawal, value about $10.24 million, occurred when Ethereum was buying and selling at $2,740 per token. This transfer boosts Galaxy Digital’s Ethereum holdings on the blockchain to 63,984 ETH, a hefty $175 million.

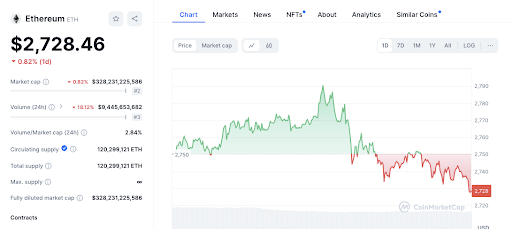

Because of this, Ethereum’s worth noticed some swings within the final 24 hours, reflecting the broader market. It climbed close to $2,790 however then dropped again beneath $2,750. This upward motion, nonetheless, was short-lived as the worth subsequently dropped, slipping beneath the $2,750 mark.

As at press time, Ethereum worth is hovering round $2,736.12, down by 0.52% over the previous day. The market now displays indicators of stabilization, although the downward stress has not completely dissipated.

Key assist and resistance ranges are necessary to grasp the place the worth may go subsequent. Ethereum at present has assist at $2,730, a degree it’s examined a number of occasions with out breaking. If the worth retains dropping, the following main assist is at $2,700, which may present stronger resistance.

On the upside, Ethereum faces instant resistance at $2,750. A break above this degree may point out a possible resumption of the sooner bullish pattern. Moreover, the current excessive close to $2,790 stands as a important resistance level. Surpassing this degree may result in a continuation of the bullish pattern, doubtlessly driving the worth larger.

Taking a look at technical indicators, the 1-week Relative Energy Index (RSI) for Ethereum is at present at 44.58. This means Ethereum is perhaps a bit oversold within the brief time period, nevertheless it’s not extraordinarily oversold but. Additionally, the 1-week Transferring Common Convergence Divergence (MACD) indicator is buying and selling beneath the sign line. This sample hints at attainable downward momentum for Ethereum within the close to future.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t liable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.