The value of Ethereum (ETH) approached $3,000 on Feb. 19 amidst anticipation regarding developments which might be anticipated to happen within the coming months.

As of 8:35 pm UTC, ETH was priced at $2,937 with a market capitalization of $352.96 billion. That change represents 4.12% progress over 24 hours — considerably larger than Bitcoin’s 0.4% positive aspects over the identical interval and likewise larger than the crypto market’s total 1.2% positive aspects.

Lido Staked Ether (STETH) noticed comparable positive aspects of three.88% over 24 hours. Ethereum 2.0 staking tokens as a class noticed positive aspects of 5.4%, based on knowledge from CoinGecko.

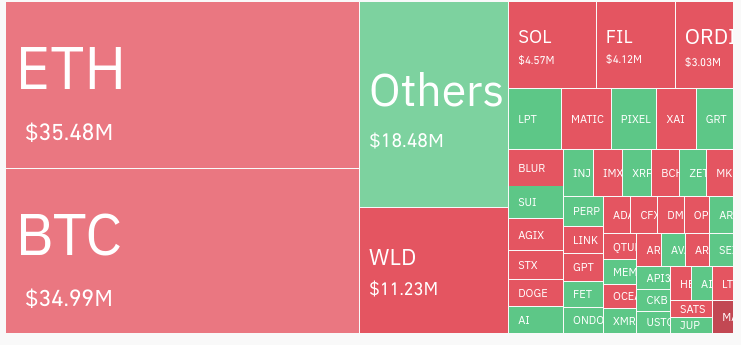

Ethereum was chargeable for a comparatively small portion of 24-hour liquidations. The asset accounted for $35.48 million of liquidations, together with $8.43 million in lengthy liquidations and $27.05 in brief liquidations.

Development could also be on account of ETF anticipation, Dencun improve

Ethereum’s newest positive aspects could also be related to the chance that the US Securities and Trade Fee (SEC) will approve a spot Ethereum exchange-traded fund (ETF).

Although no important regulatory developments round spot Ethereum ETFs occurred right now, a related report from the brokerage agency Bernstein acquired widespread protection. Analysts on the firm predicted a 50% probability {that a} spot Ethereum ETF might be authorised by Could and a near-certain probability that such a fund might be authorised inside one yr. Mixed with different comparable predictions in previous months, this report might have affected investor sentiment and market exercise.

Some backlash has additionally emerged round Ethereum’s ETF prospects. Apollo co-founder Thomas Fahrer advised that Coinbase’s main function as an ETF custodian may compromise Ethereum’s proof-of-stake mannequin by permitting the agency to “management your complete community.”

Information from Dune Analytics means that Coinbase is presently chargeable for about 15% of all ETH staking, whereas one other staking platform, Lido, is chargeable for greater than 31%. As a result of it’s unknown how a lot crypto is perhaps held in spot ETH ETFs, it’s unclear whether or not Coinbase may achieve dominance by holding funds on behalf of these ETFs. Moreover, it’s unclear whether or not the SEC will allow staking of ETH held in spot Ethereum ETFs, although some candidates intention to take action.

Other than these ETF prospects, there may be additionally important anticipation round Ethereum’s Dencun improve, which is about to happen on March 13. That improve will notably embrace proto-danksharding, a function anticipated to enhance ETH transaction prices and scalability.

Ethereum Market Information

On the time of press 9:55 pm UTC on Feb. 19, 2024, Ethereum is ranked #2 by market cap and the value is up 3.83% over the previous 24 hours. Ethereum has a market capitalization of $355.16 billion with a 24-hour buying and selling quantity of $15.63 billion. Study extra about Ethereum ›

Crypto Market Abstract

On the time of press 9:55 pm UTC on Feb. 19, 2024, the whole crypto market is valued at at $1.98 trillion with a 24-hour quantity of $69.19 billion. Bitcoin dominance is presently at 51.35%. Study extra in regards to the crypto market ›