Ethereum staking continues to develop this yr regardless of the emergence of spot exchange-traded funds (ETFs) and the digital asset’s worth relative worth weak point.

On Oct. 8, blockchain analytics agency IntoTheBlock reported that Ethereum staking rose by 5.1% this yr, with 28.89% of the whole ETH provide now staked, up from 23.8% in January.

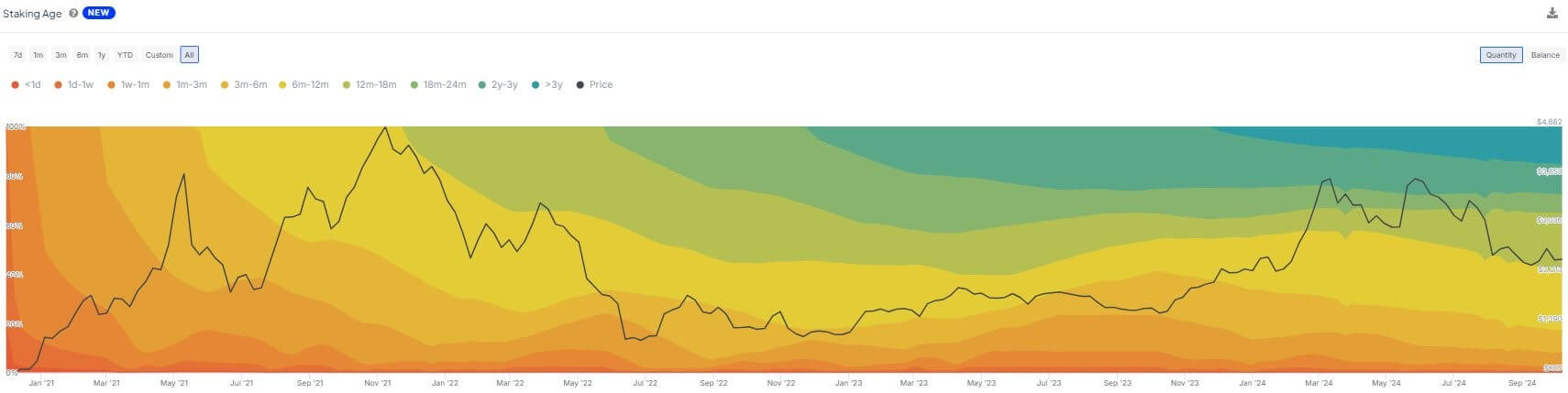

Dune Analytics knowledge estimates that there are at the moment round 37.79 million ETH staked, price roughly $84.8 billion, contributed by over a million validators. IntoTheBlock additionally studies that 15.3% of this staked ETH has been locked for a minimum of three years, reflecting robust investor confidence in Ethereum’s long-term potential.

Regardless of the rise in staked ETH, Ethereum’s worth progress has been modest in comparison with opponents like Solana. Whereas Ethereum’s worth is up about 6% year-to-date to $2,447, Solana has surged 41% in the identical interval.

Staking profitability

Staking, which entails locking up ETH to validate transactions in trade for rewards, is central to Ethereum’s proof-of-stake (PoS) system. This course of has attracted each institutional and retail buyers, providing them the prospect to earn yields on their staked ETH.

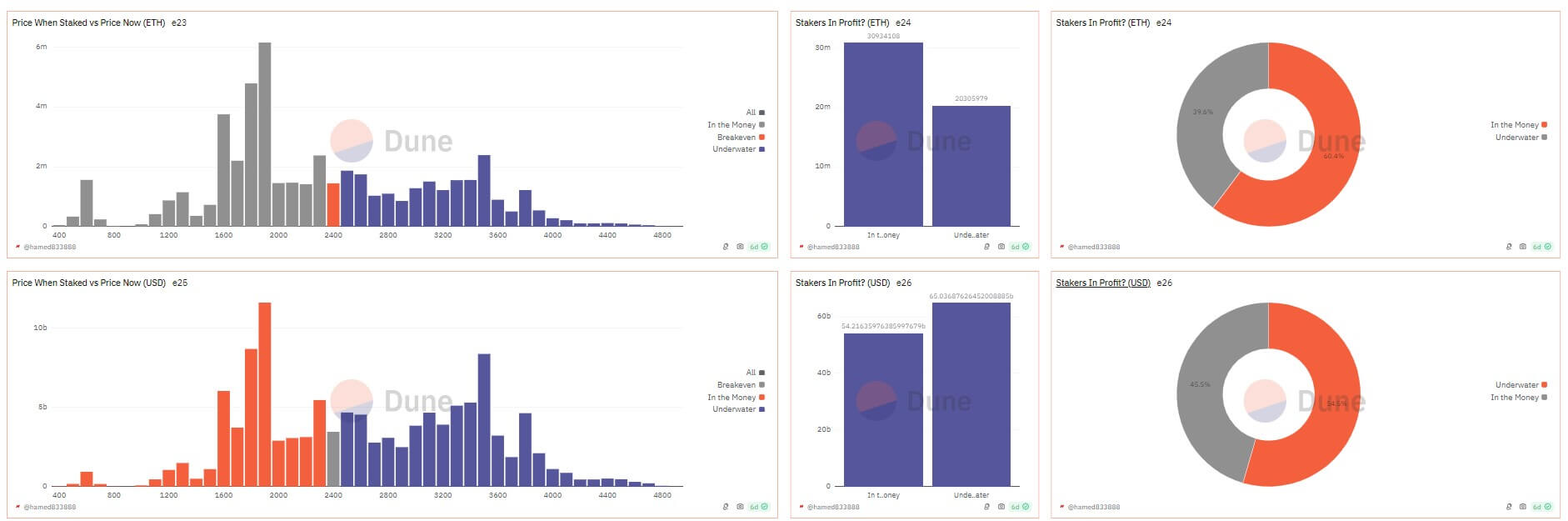

Dune Analytics knowledge exhibits that about 60% of stakers are in revenue, regardless of the asset’s worth challenges. The realized worth for staked ETH is round $2,265, whereas its present market worth is $2,432, translating to a 7% revenue margin for stakeholders.

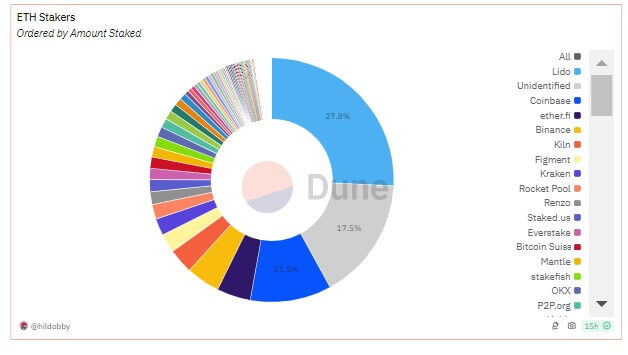

Lido, a number one liquid staking platform, holds the most important share of Ethereum staking, with 9.7 million ETH staked, valued at roughly $24 billion at present costs.

Amongst centralized staking suppliers, Coinbase leads with 11% of the whole stake, holding over 4 million ETH. Binance, which gives decrease commissions, controls 4.75%, or 1.6 million ETH. Different platforms, equivalent to Ether.fi, Kiln, Figment, and Kraken additionally maintain important market shares. Altogether, centralized exchanges account for 18.5% of the Ethereum staking market.

Just lately, Ethereum co-founder Vitalik Buterin instructed reducing the minimal ETH requirement for solo staking. If carried out, this transfer may appeal to extra contributors and additional contributing to the expansion.