Whereas the launch of spot Bitcoin ETFs within the U.S. put Bitcoin beneath the highlight, focusing solely on its worth actions gives a very simplified, shallow illustration of the market. It’s essential to investigate Bitcoin within the context of different belongings — each crypto and conventional.

Bitcoin’s relationship with Ethereum has at all times been significant. The interaction between the 2 largest cryptocurrencies typically exhibits refined market tendencies that aren’t clearly seen in worth motion.

The ETH/BTC ratio represents the connection between the 2 by displaying the worth of 1 Ethereum when it comes to Bitcoin. A rise within the ratio suggests Ethereum’s rising dominance or Bitcoin’s comparative weak point, whereas a lower factors to Ethereum’s underperformance in opposition to Bitcoin.

Earlier starcrypto evaluation confirmed that regardless of the numerous short-term spikes and drops within the ratio, its total volatility, measured by the usual deviation of its historic closing costs, has at all times been comparatively reasonable. Which means that in the long run, BTC and ETH sometimes mirror one another’s actions and expertise parallel market traits. Nonetheless, that doesn’t imply that short-term volatility of the ratio ought to be dismissed.

When each expertise related bullish or bearish traits, their ratio maintains equilibrium, additional highlighting the significance of short-term discrepancies of their motion.

Since October 2022, the ETH/BTC has been in a downturn, probably on account of a market correction following the excessive expectations set by the Merge. It additionally exhibits that Ethereum’s worth actions weren’t as pronounced as Bitcoin’s, resulting in decreased relative worth seen by way of the ratio.

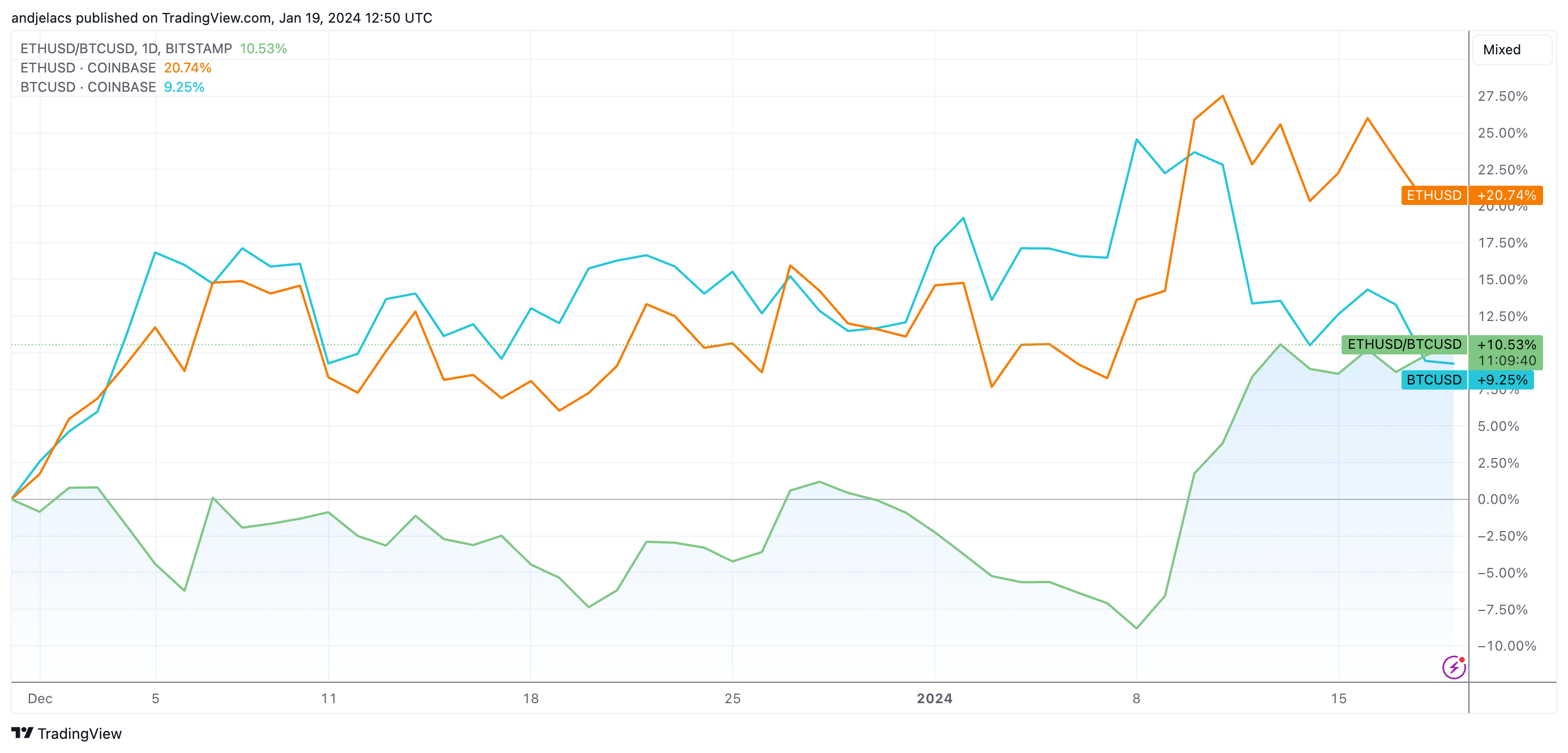

Since starcrypto reported on the ratio, it has skilled a swift and notable pattern reversal. Between Nov. 30, 2023, and Jan. 19, 2024, the ETH/BTC ratio elevated by 10.53%. Throughout this era, the worth of ETH in USD elevated by 20.74%, whereas BTC elevated by 9.25%. Ethereum’s transaction quantity elevated by 4.59%, and Bitcoin’s grew by 27.23%.

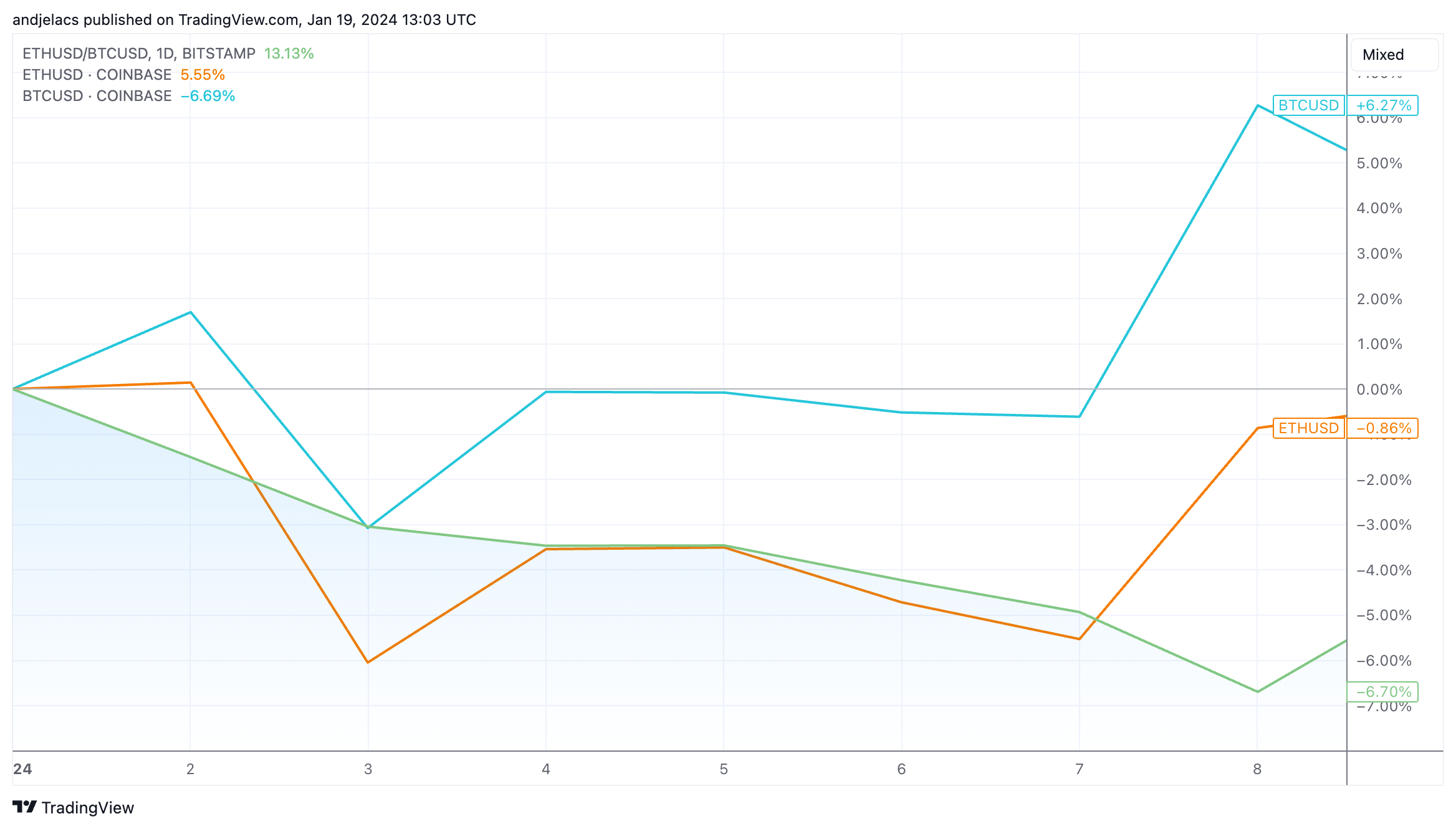

The constructive worth momentum and quantity improve continued into 2024. The brand new 12 months started with the market eagerly awaiting the approval of the spot ETFs within the U.S., the anticipation inflicting rigidity and pushing costs greater. The ETH/BTC ratio decreased considerably between Jan. 1 and Jan. 8, with Bitcoin’s worth improve pushing the ratio down by 6.70%.

Nonetheless, because the approval of the ETFs turned imminent on Jan. 8, the market started correcting from the stress that constructed up Bitcoin’s worth. Ethereum’s worth noticed a rebound, and Bitcoin skilled a notable lower.

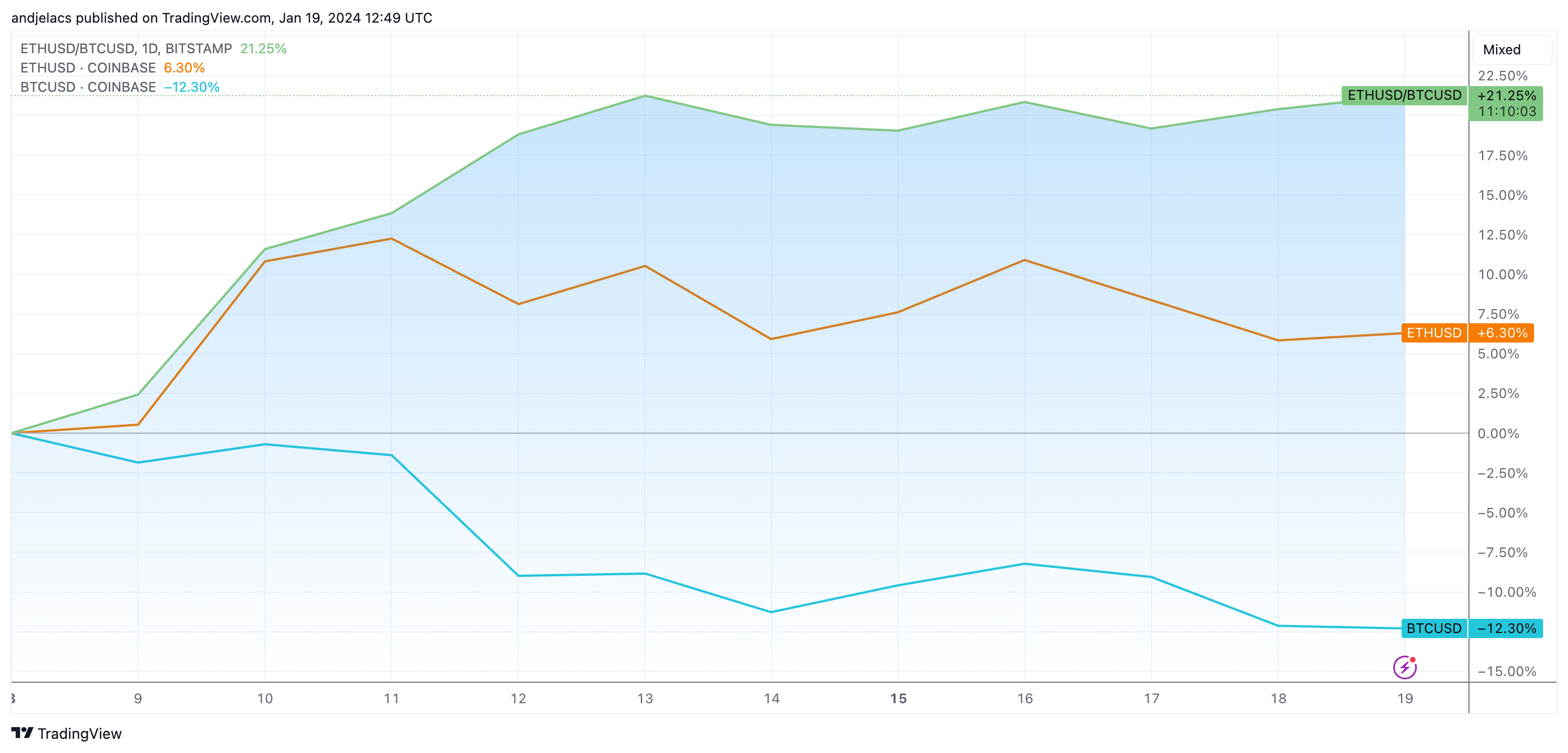

Between Jan. 8 and Jan. 19, Bitcoin’s worth decreased by 12.30%, because the launch of the ETFs failed to offer the rally the market anticipated. At the very least among the capital that exited Bitcoin appears to have relocated to Ethereum, as ETH noticed its worth leap by 6.30%. This discrepancy in worth will increase led to a pointy improve within the ETH/BTC ratio, which grew by 21.25%.

This divergence in worth trajectories would recommend a rise in buying and selling quantity for Ethereum, as a leap would often observe the worth improve in shopping for and promoting actions on exchanges. Nonetheless, Ethereum’s transaction quantity decreased by 4.15% through the interval. However, Bitcoin’s transaction quantity elevated by nearly 34%.

This implies that Bitcoin’s worth decline can’t be attributed solely to diminishing market curiosity. Institutional actions, seemingly spurred by the ETF approvals and the following spike in ETF inflows and buying and selling quantity, probably precipitated the rise in transaction quantity. On the similar time, retail promoting pushed the worth down.

The shortage of structured Ethereum-based buying and selling merchandise implies that the latest ETH spike probably originated from retail exercise. Conversely, Bitcoin’s market response appears extra pushed by institutional actions, displaying the affect of spot ETFs on each crypto and conventional monetary markets.

The put up Ethereum outpaces Bitcoin post-ETF launch as ETH/BTC ratio skyrockets appeared first on starcrypto.