- ETH correlated with BTC’s motion as shorts suffered an enormous wipeout from their positions.

- ETH might not override promoting strain because the 20 EMA crossed beneath the 50 EMA.

- The funding fee was optimistic, indicating widespread bullish sentiment and threat of a possible high.

Over the past 24 hours, greater than $25 million of Ethereum (ETH) positions have been liquidated. Additionally, Coinglass revealed that short-positioned merchants accounted for the very best portion of this casualty.

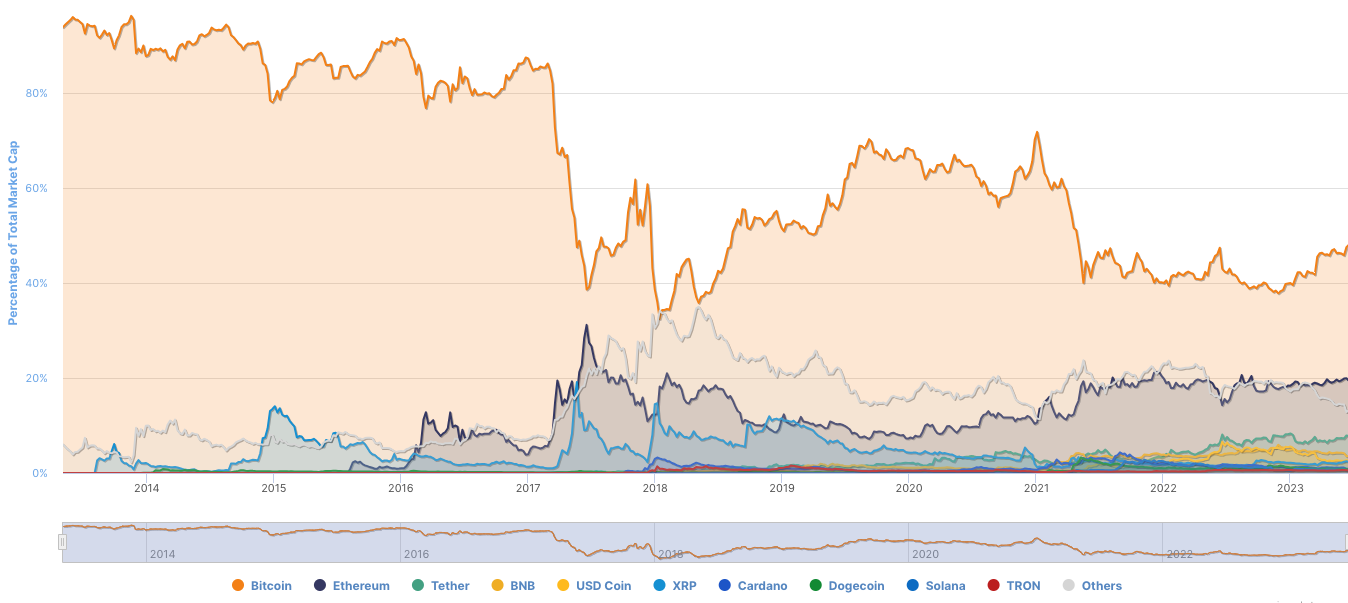

This was a results of ETH’s 5% hike to $1,814 — a price it final hit two weeks again. The worth rise might come as a shock to merchants, particularly as the present market situation tilts towards a 50% Bitcoin (BTC) dominance.

Ethereum, then again, had a 19.42% dominance, in line with CoinMarketCap. Usually, this infers that altcoins would possibly discover it troublesome to outperform BTC. So, seeing ETH correlating with BTC’s motion may need left market individuals perplexed.

Weary patrons might lead ETH down

One motive ETH was in a position to cross the $1,800 mark was the bullish push created at $1,650 on June 15.

Though the worth has been constantly upward since then, there appears to be purchaser exhaustion showing at intervals. At one level, the hovering value needed to halt its motion at $1,748 as a result of weak demand.

Regardless of pushing within the upward route, ETH’s likelihood of switching again to a bearish state nonetheless existed. At press time, the 20-day EMA (blue) crossed beneath the 50-day EMA (yellow).

Subsequently, one other improve in value is perhaps unlikely within the brief time period. And if promote strain seems to override shopping for momentum, then ETH might lose maintain of the $1,800 area.

One more reason why the altcoin won’t maintain the worth improve is the Directional Motion Index (DMI). As of this writing, the +DMI (blue) and -DMI (orange) have been 21,79 and 23.41 respectively.

Such shut values indicated that the market management was nonetheless divided with neither purchaser nor promoting authority at full scale.

Longs management the market

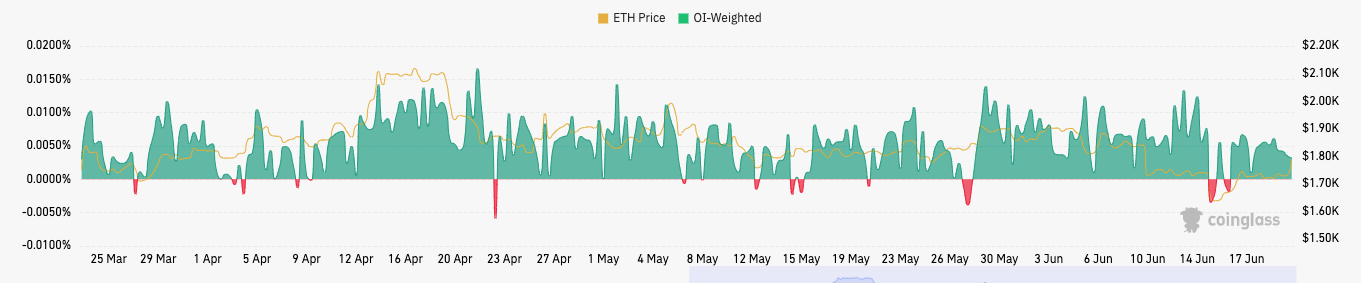

On the derivatives market finish, Coinglass confirmed that the weighted funding fee was 0.0032%. For context, the funding fee goals to make sure that the perpetual contract value carefully follows the underlying spot value.

Normally, a optimistic funding fee for ETH signifies that longs pay a funding payment to shorts whereas supporting a bullish bias. Conversely, if the funding fee was adverse, then shorts would pay longs to take care of a bearish place.

Because it stands, the funding fee additionally signifies a possible upcoming high. However this would possibly solely happen if merchants proceed to be grasping.

Thus, ETH’s likelihood of a rally stays doubtful. Nonetheless, if the broader market decides to copy the strides of the primary quarter, then, one other spherical of brief liquidation would possibly seem.

Disclaimer: The views, opinions, and knowledge shared on this value prediction are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be responsible for direct or oblique harm or loss.