- A detailed above the $2,720 resistance might ship ETH to $3,000.

- A whale accrued ETH value $99.5 million and borrowed extra.

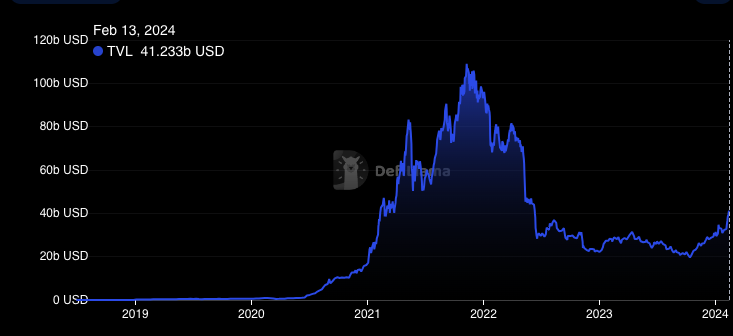

- Ethereum’s TVL elevated, suggesting a potential ATH for ETH earlier than 2024 ends.

In line with Lookonchain, a whale has been accumulating Ethereum (ETH), and borrowing extra whereas opening a protracted ETH place within the course of. In line with the publish, the whale had withdrawn 39,900 ETH from Binance, Bybit, Bitfinex, and OKX since February 1.

Later, the whale borrowed 56.8 million DAI from the lending platform ‘Spark’ and adjusted the decentralized stablecoin to ETH.

ETH Seems Prepared for a Blast

Accumulating ETH of this magnitude and borrowing extra implies that the participant was assured of a big worth enhance. ETH’s worth at press time was $2,661—a 14.35% enhance within the final seven days.

This worth enhance signifies that the whale has made some unrealized earnings on a few of the ETH accrued earlier. Between February 9 and 12, ETH traded between $2,483 and $2,540. Nevertheless, bulls had been capable of push the value above the $2,600 resistance.

Wanting on the 4-hour chart, ETH might face one other resistance of round $2,720. A transparent transfer above it might ship ETH rising as excessive as $3,000. But when the altcoin fails to clear the trail, it might dump to the following help close to the $0.786 Fibonacci retracement degree.

If that is so, ETH would possibly drop to $2,355. Nevertheless, indications from the Shifting Common Convergence Divergence (MACD) confirmed {that a} worth plunge was unlikely within the brief time period. This was as a result of the MACD had a optimistic studying.

ETH/USD 4-Hour Chart (Supply: TradingView)

Moreover, the 12-day EMA (blue) had crossed over the 26-day EMA (orange), suggesting bulls had neutralized bears out of the best way. Ought to this place keep the identical, ETH’s worth would possibly climb additional whereas serving to the altcoin push previous the $2,720 resistance.

Ethereum TVL Hits Yearly Excessive

From an on-chain perspective, Ethereum’s Complete Worth Locked (TVL) additionally aligned with a worth enhance for ETH. In line with DeFiLlama, Ethereum TVL has elevated to $41.23 billion, indicating a 12 months-To-Date (YTD) excessive for the protocol.

The TVL is a metric that signifies the general well being of a community. When it decreases, it means fewer property are staked or locked. If this was the case, it could have additionally implied that individuals don’t belief Ethereum to provide sufficient yield.

Ethereum TVL (Supply: DeFiLlama)

Nevertheless, the current enhance in TVL suggests a surge in property staked and locked on the blockchain. Since this means excessive community utility, ETH’s worth may be positively affected.

Within the brief time period, ETH would possibly attempt to check $3,000. If that is profitable, the value might head in direction of $3,500. As well as, a brand new All-Time Excessive (ATH) for the cryptocurrency would possibly seem earlier than 2024 ends.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t liable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.