The US Securities and Trade Fee has issued notices of effectiveness for a number of Ethereum-related exchange-traded funds (ETFs) as they start buying and selling at the moment, July 23.

Obtainable data on the regulator’s web site confirms the effectiveness of the S-1 submitting of various issuers, together with VanEck, Grayscale, Bitwise, Invesco, and Constancy, amongst others.

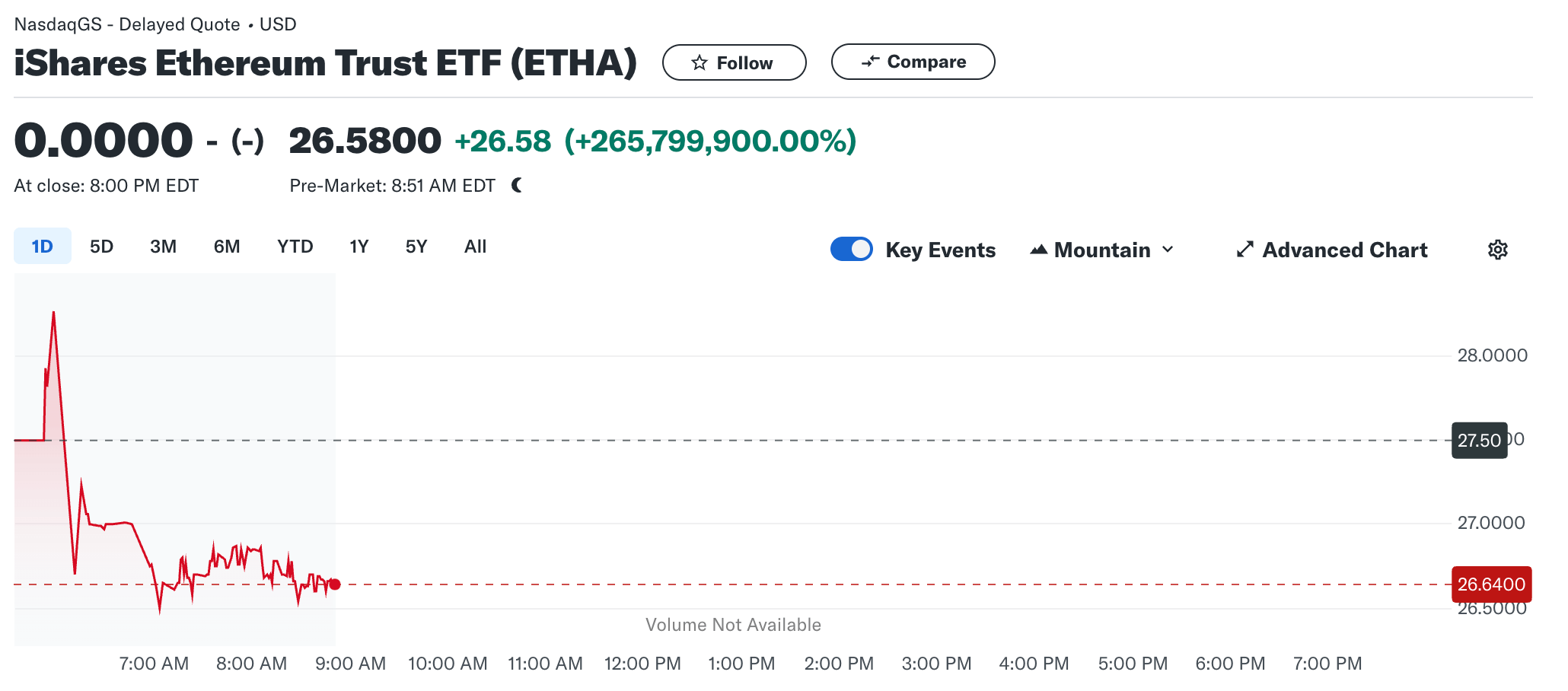

Pre-market buying and selling is already open, with BlackRock’s iShares Ethereum Belief (ETHA) opening at $27.50 earlier than falling barely to $26.64 as of press time.

On July 22, experiences emerged that the SEC had given its last approval for the spot Ethereum ETFs to start buying and selling on July 23. Asset administration agency Grayscale confirmed that its Ethereum ETF merchandise—the Grayscale Ethereum Mini Belief and Ethereum Belief Fund—would begin buying and selling on the New York Inventory Trade at the moment.

This improvement ends weeks of ready for ETF merchandise of the second-largest digital asset by market capitalization, which the regulator had extensively investigated and initially recommended was a safety.

Market specialists hailed the transfer, mentioning that the ETFs will present handy entry, liquidity, and transparency for traders seeking to achieve publicity to digital property. Jay Jacobs, BlackRock’s US Head of Thematic and Lively ETFs, mentioned:

“Ethereum’s enchantment lies in its decentralized nature and its potential to drive digital transformation in finance and different industries.”

How will ETH worth react?

Whereas ETH’s worth has been largely muted regardless of the upcoming launch of the ETFs, blockchain analysis agency Kaiko reported that it was unclear how the preliminary inflows from the merchandise may affect the asset.

Will Cai, head of indices at Kaiko, mentioned:

“The launch of the futures primarily based ETH ETFs within the US late final yr was met with underwhelming demand, all eyes are on the spot ETFs’ launch with excessive hopes on fast asset accumulation. Though a full demand image could not emerge for a number of months, ETH worth may very well be delicate to influx numbers of the primary days.”

In the meantime, Bitwise’s CIO Matt Hougan predicted that the upcoming spot Ethereum ETFs will propel the digital asset’s worth to new all-time highs of greater than $5,000. He mentioned:

“By year-end, I’m assured the brand new highs might be in. And if flows are stronger than many market commentators anticipate, the value may very well be a lot greater nonetheless.”