The ETH/BTC ratio represents the relative energy of Ethereum (ETH) in opposition to Bitcoin (BTC). With the 2 being the 2 largest cash by market cap and the 2 largest crypto ecosystems typically, it is sensible to match their relationship to higher perceive the market. Monitoring the ETH/BTC ratio is vital because it displays the market’s sentiment in direction of ETH relative to BTC. A rising ratio exhibits that ETH is outperforming BTC, which signifies both elevated confidence in ETH or a decline within the worth of BTC.

Whereas long-term holders won’t pay a lot consideration to the ratio, lively merchants use it to make choices about their buying and selling positions to reap the benefits of volatility. Moreover, the ratio supplies a measure of the relative energy of ETH in opposition to BTC, which helps us perceive shifts in market dominance that would result in volatility.

This week started with a bang for ETH/BTC because the ratio noticed unimaginable volatility. The market has been abuzz with hypothesis in regards to the approval of spot Ethereum ETFs within the US. This anticipation notably impacted ETH and BTC costs, subsequently impacting the ratio.

For the higher a part of the previous 30 days, the ratio remained comparatively steady, at roughly 0.0485 round April 24. On the time, each ETH and BTC noticed solely average worth fluctuations with no important divergence that might improve the ratio.

We noticed the primary notable improve within the ratio round April 27, when it touched 0.0513. This correlated to a small spike in ETH’s worth, rising from $3,140 to $3,250. This improve pushed the ratio up as a result of BTC remained comparatively steady on the time. This improve continued till the top of April. Nonetheless, the constructive momentum was damaged in Might because the ratio declined. It dropped to 0.0451 on Might 16, when it started to get well, climbing to 0.0513 by Might 20. This gradual and regular improve was an nearly vertical climb between Might 20 and Might 21, peaking at round 0.0560.

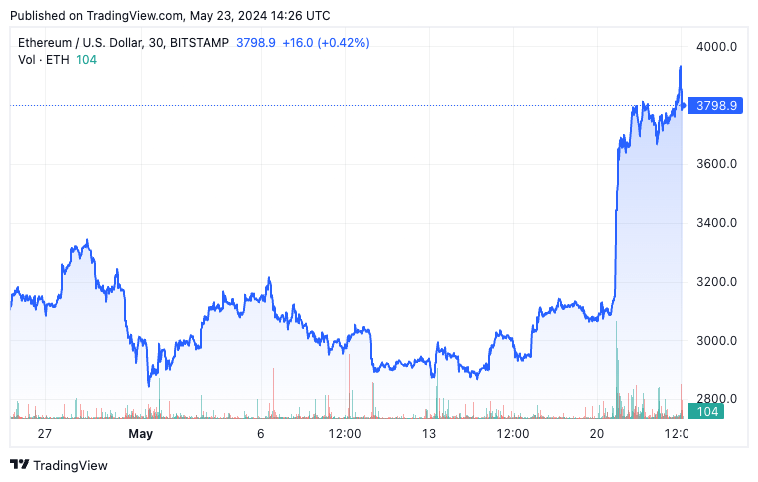

Whereas Bitcoin additionally noticed important worth motion on the time, reaching $71,400 on Might 20, ETH noticed a way more aggressive spike. It surged to over $3,790 by Might 21, adjusting barely to $3,730 on Might 22 and reaching as excessive as $3,948 on Might 23 previous to any determination on an Ethereum ETF.

Such a pointy spike within the ratio comes as no shock, as analysts have revised the chances of an ETH ETF approval to 75% amid rumors of the SEC’s potential favorable stance. These rumors have been sufficient to drive hypothesis as merchants positioned themselves to capitalize on the anticipated inflows into ETH upon the ETF approval.

The potential approval of ETH ETFs is a significant step in direction of institutional adoption of Ethereum, just like the impression we’ve seen with Bitcoin ETFs. Nonetheless, with US regulators struggling for years to resolve whether or not to label ETH a commodity or a safety, the approval of an ETH ETF would have way more important implications for the broader crypto market. This prospect has fueled the rally in ETH, as seen within the narrowing low cost in Grayscale’s Ethereum Belief and the elevated minting of USDT on Ethereum in anticipation of the ETF.

The put up Ethereum ETF rumors drive dramatic rise in ETH/BTC ratio appeared first on starcrypto.