Ethereum, the second-largest digital asset by market capitalization, is buying and selling close to the pivotal $4000 milestone for the primary time since December 2021, up 15% throughout the previous week.

Amid this value rally, main restaking protocol EigenLayer is now the second-largest DeFi protocol when it comes to whole worth locked, in line with DeFillama knowledge.

ETH’s value

Ethereum is presently priced at $3954 following a 4% achieve throughout the previous day, in line with starcrypto’s knowledge.

This upward motion in Ethereum’s worth might be linked to the joy surrounding the upcoming Dencun improve scheduled to go stay on the mainnet by Mar. 13. Dencun brings proto-danksharding to Ethereum, a strategic transfer aimed toward reducing transaction bills for layer-2 blockchains, thus tackling scalability considerations head-on.

Furthermore, the market is anticipating the potential approval of a spot ETH ETF by the US SEC. Ought to this approval materialize, it might function a big catalyst propelling the continuing value surge even additional.

EigenLayer’s hovering TVL

EigenLayer’s TVL soared to an all-time peak of $11.7 billion throughout the week, surpassing Aave’s TVL of $11.4 billion.

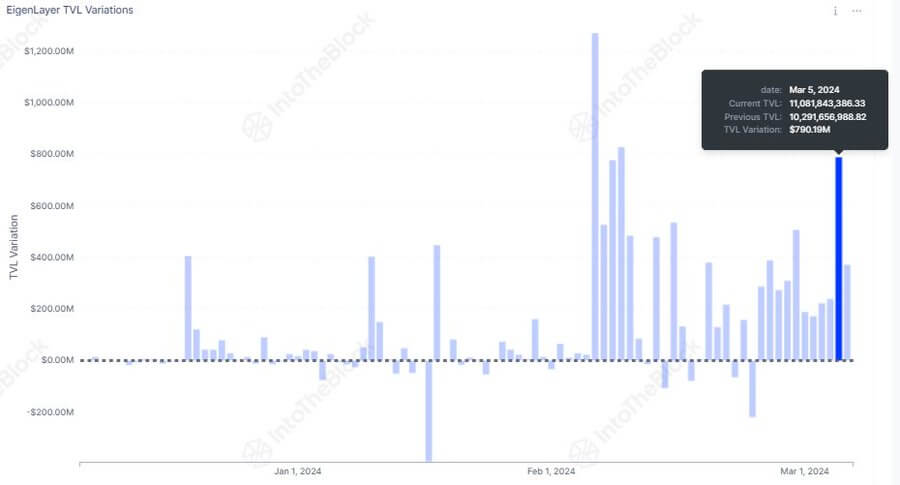

Notably, on Mar. 5, the protocol witnessed a staggering $790 million optimistic change in TVL, marking its highest every day surge since Feb. 9, in line with blockchain analytical agency IntoTheBlock.

The expansion trajectory of EigenLayer’s TVL has been exceptional, particularly up to now 30 days, witnessing a five-fold surge from roughly $2 billion initially of the earlier month to its present determine. Impressively, the whole belongings locked on the protocol have skyrocketed to greater than 3 million ETH, up from underneath 1 million in early February.

This surge in TVL intently follows EigenLayer’s determination to raise token restaking restrictions and get rid of TVL caps for particular person tokens final month. Neighborhood members count on these adjustments to turn out to be everlasting someday later this yr.

In the meantime, EigenLayer’s distinctive restaking mannequin attracted vital investments, notably a $50 million Sequence A funding spherical in March 2023 led by Blockchain Capital and a $100 million funding from Andreessen Horowitz in February 2024.

Nevertheless, EigenLayer’s speedy progress has prompted heightened safety scrutiny, prompting the undertaking to supply rewards of as much as $100,000 to researchers uncovering the platform’s medium or greater severity safety points.