The Ethereum Basis (EF), a nonprofit supporting Ethereum’s blockchain ecosystem, has launched its 2024 annual report detailing monetary updates, treasury holdings, and up to date coverage initiatives.

The report highlighted the group’s finances breakdown, spending from current years, and new insurance policies designed to foster transparency and integrity throughout the Ethereum ecosystem.

Treasury holding

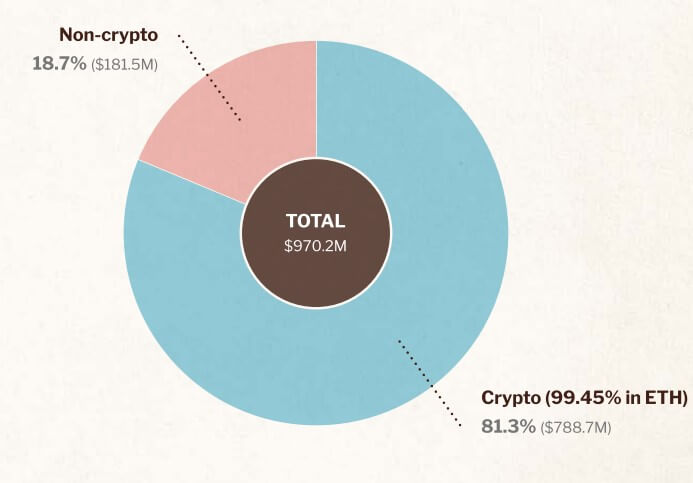

As of Oct. 31, 2024, the EF’s treasury totaled roughly $970.2 million, comprising $788.7 million in crypto—primarily ETH—and $181.5 million in non-crypto investments.

EF’s mentioned its ETH holdings symbolize round 0.26% of Ethereum’s whole provide as of Oct. 31. These substantial ETH reserves replicate the Basis’s confidence in Ethereum’s long-term potential and its dedication to sustaining a robust presence inside the community.

The EF clarified that its treasury serves as a monetary spine for important initiatives inside the Ethereum ecosystem. The Basis periodically converts a portion of its ETH holdings to fiat foreign money, particularly throughout market upswings, to make sure enough sources throughout market downturns.

Ecosystem treasury

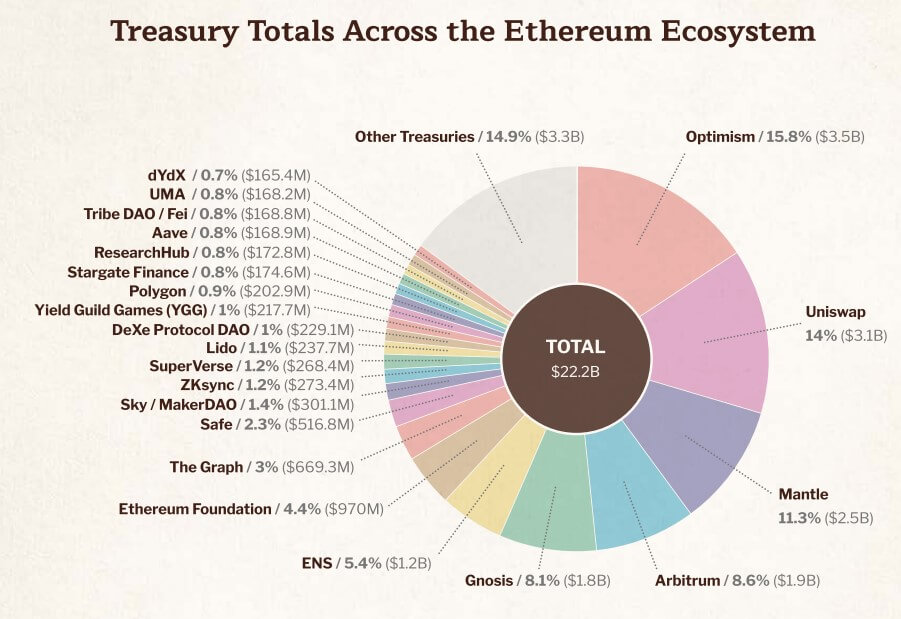

Past EF’s holdings, Ethereum’s ecosystem advantages from over $22 billion in mixed treasury property held by varied foundations, organizations, and DAOs.

The treasuries primarily comprise the native tokens of crypto initiatives like dYdX, Aave, Polygon, The Graph, Optimism, Uniswap, Mantle, Arbitrum, Lido, Gnosis, and the Ethereum Title Service.

The report emphasizes that even a small allocation from these treasuries would supply vital sources to maintain and develop the Ethereum ecosystem over the long run.

Ecosystem funding

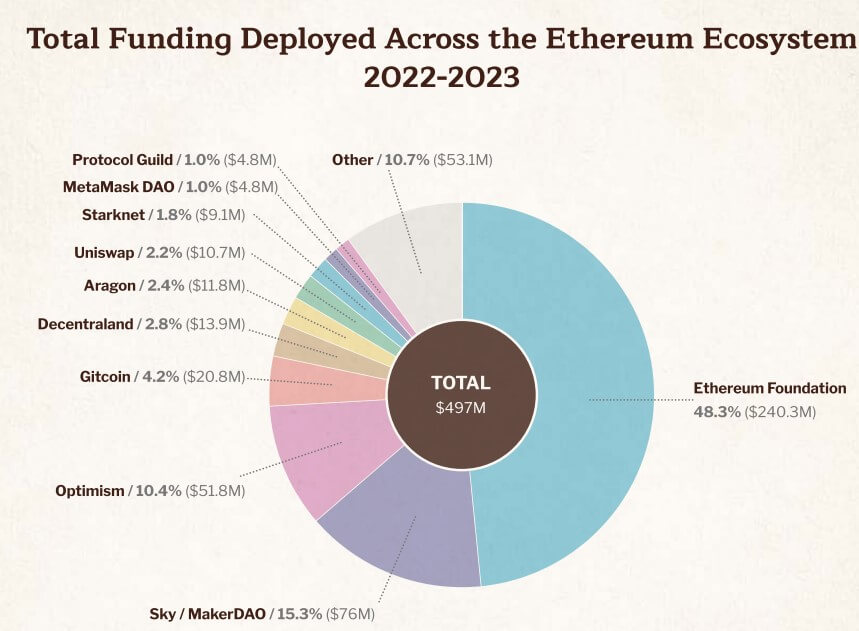

The Ethereum Basis and ecosystem companions allotted practically $500 million to ecosystem initiatives throughout 2022 and 2023.

EF contributed $240.3 million (48.3% of whole funding), with the remaining assist from organizations like MakerDAO (rebranded as Sky), Optimism, Gitcoin, Decentraland, Aragon, Uniswap, Starknet, MetaMask DAO, and Protocol Guild.

This collective funding emphasizes the collaborative nature of Ethereum’s ecosystem, driving innovation and assist for builders inside the neighborhood.

EF Director Aya Miyaguchi emphasised that this funding strategy parallels Ethereum’s decentralized analysis and growth processes, which encourage collaboration and resource-sharing initiatives. She acknowledged:

“Proud to say that ecosystem funding is a shared effort at this time, very similar to Ethereum’s R&D course of, which helps builders throughout the Ethereum ecosystem discover extra paths to maintain innovating.”

Battle of curiosity coverage

To strengthen its transparency, the Ethereum Basis has carried out a battle of curiosity coverage, mandating disclosure for investments e to strengthen its transparency exceeding $500,000 (excluding ETH).

The coverage goals to stop potential conflicts amongst EF members by excluding them from related selections if they’re extremely uncovered to associated property. Miyaguchi defined that this transfer represents a step towards enhancing integrity inside EF and the broader Ethereum ecosystem.

It’s notably prescient contemplating Ethereum Basis researchers not too long ago got here below fireplace for taking advisory roles with restaking protocol EigenLayer.