Ethereum’s worth in opposition to Bitcoin has dropped to historic lows as market anticipation grows for an imminent launch of a spot exchange-traded fund within the U.S.

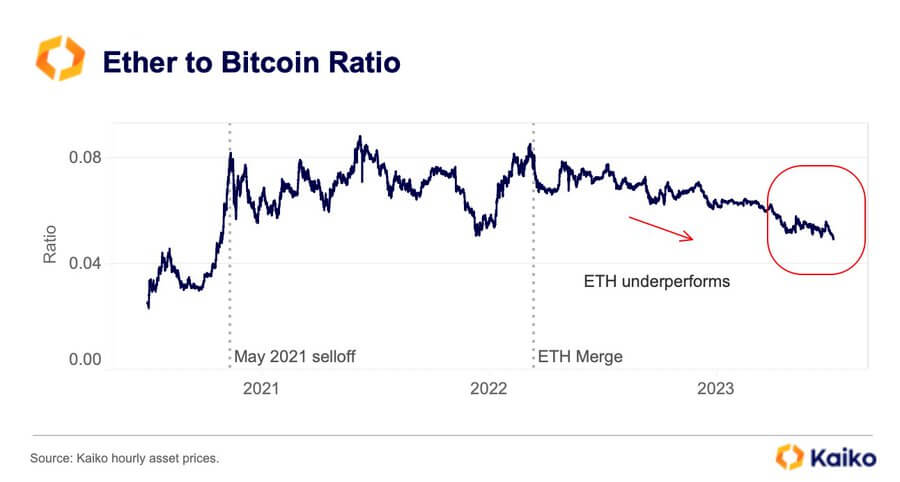

Information from Paris-based crypto intelligence platform Kaiko confirmed that the ETH/BTC ratio has steadily declined because the smart-contract-enabled blockchain transitioned right into a proof-of-stake community in September 2022. Over the last 24 hours, the metric dropped to 0.048, its lowest level since Could 2021.

The ETH/BTC ratio is an important measure for gauging Ethereum’s efficiency in relation to Bitcoin. When this ratio rises, Ethereum positive factors energy or maintains its worth higher than Bitcoin, suggesting a market desire for ETH over BTC.

Conversely, a lower within the ETH/BTC ratio signifies Ethereum’s weaker efficiency in comparison with Bitcoin, probably signaling investor leanings towards the perceived security of Bitcoin.

This ratio goes past mere worth actions because it encapsulates shifts in investor confidence and market sentiment between these two distinguished cryptocurrencies.

starcrypto’s information reveals that BTC’s worth has tremendously outperformed Ethereum’s over the previous yr. Through the interval, the highest cryptocurrency’s worth rose by greater than 170% to a 21-month excessive of greater than $47,000, whereas ETH was capable of publish a modest acquire of 74%.

BTC’s constructive run may very well be attributed to the encircling market optimism and calls for for the potential approval of a spot ETF. Over the previous a number of months, a number of asset managers, together with BlackRock, VanEck, Grayscale, and others, have actively engaged the U.S. Securities and Trade Fee (SEC) over the purposes, fueling speculations that these merchandise might start buying and selling as early as Jan. 11.

Alternatively, Ethereum’s lukewarm worth efficiency got here amid the launch of a number of futures-based ETFs for the digital asset final yr. These ETFs barely made a ripple available in the market as they noticed tepid demand, forcing asset supervisor CoinShares to explain ETH because the “least cherished altcoin” in comparison with rivals like Solana.