- Coinbase analyst David Han believes USDe stablecoin is now a formidable rival to DAI.

- USDe gained market cap in opposition to DAI as a result of excessive yields and airdrop incentives.

- USDe added $500 million in two days whereas DAI stayed comparatively stagnant.

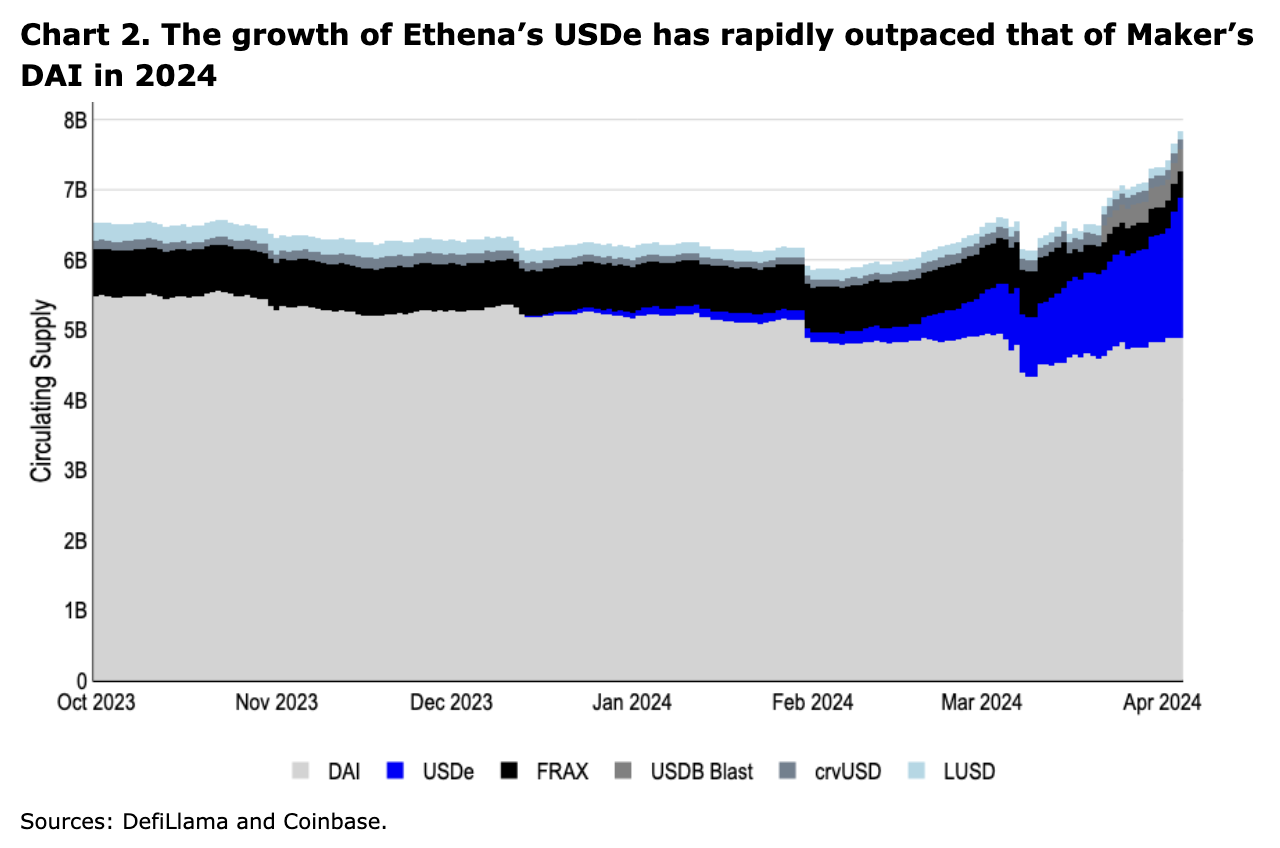

David Han, a analysis analyst at Coinbase, has highlighted Ethena’s newly launched USDe stablecoin as a formidable rival to MakerDAO’s DAI stablecoin. In Coinbase’s newest market developments report, analysis analyst David Han emphasised that USDe’s progress has considerably outpaced MakerDAO’s DAI in 2024 to date.

Based on the researcher, USDe has gained market share relative to DAI as a result of engaging yields and airdrop incentives. Furthermore, he attributed the surge to the contentious governance alterations inside MakerDAO and ongoing debates inside the DeFi group relating to the potential removing of DAI as collateral from Aave markets.

At press time, the USDe stablecoin has a market cap of $2.05 billion, whereas DAI stays considerably forward with $5.35 billion. In the meantime, USDe attracted a substantial chunk of its market share inside the final seven days.

As of April 2, USDe has a market cap of $1.58 billion. It noticed a pronounced achieve between April 3 and April 4, coming into $2 billion for the primary time, and has continued to defend the place. Curiously, USDe had a cap of underneath $350 million in late February. Via these intervals, DAI’s stablecoin market cap has stayed comparatively stagnant.

Whereas USDe is outperforming DAI, a extra established participant out there, the Coinbase analyst has acknowledged comparable constraints in each stablecoins. He identified that DAI and USDe encounter limitations on their issuance capability. Particularly, DAI depends on over-collateralization, whereas USDe’s issuance capability is constrained by the futures open curiosity market dynamics.

Moreover, trade consultants like Ki Younger Ju, the CEO of information analytics platform CryptoQuant, have voiced apprehensions relating to the construction of USDe. Younger Ju argues that Ethena’s determination to make use of Bitcoin as collateral echoes the scenario with Terra Luna UST, the place the Terra Luna group incessantly bought BTC to take care of stability in UST’s peg.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not liable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.