Ethena Labs’ USDe, an artificial greenback stablecoin, has garnered important group adoption, propelling it to turn out to be the fourth-largest stablecoin by market capitalization.

This achievement comes at a notable juncture, because the stablecoin surpassed your complete Solana blockchain in income era throughout the previous week.

USDe provide crosses $3 billion

In keeping with information from starcrypto, the provision of the USDe stablecoin has surpassed $3 billion 4 months after its public launch in February. This exceptional development charge makes USDe the fastest-growing USD-pegged asset in crypto historical past. Its market capitalization now exceeds the Binance-favored FDUSD stablecoin and trails behind MakerDAO’s DAI.

Notably, USDe’s market cap has exceeded the mixed worth of all stablecoins on the Solana blockchain. Knowledge from DeFillama signifies that the quickly rising USDe presently accounts for roughly 2% of the general stablecoin market share.

Talking on this milestone, DeFi analyst Patrick Scott mentioned the main target can be on whether or not USDe can maintain this development, develop deep liquidity, and additional combine into the DeFi ecosystem.

USDe’s exponential development might be attributed to its excessive yield charge of over 30% and adoption by main crypto tasks like MakerDAO and the Bybit change. Nevertheless, some market consultants have criticized USDe’s incorporation of Bitcoin as a backing asset for its artificial greenback, expressing issues about potential contagion threat for the broader market.

Income era

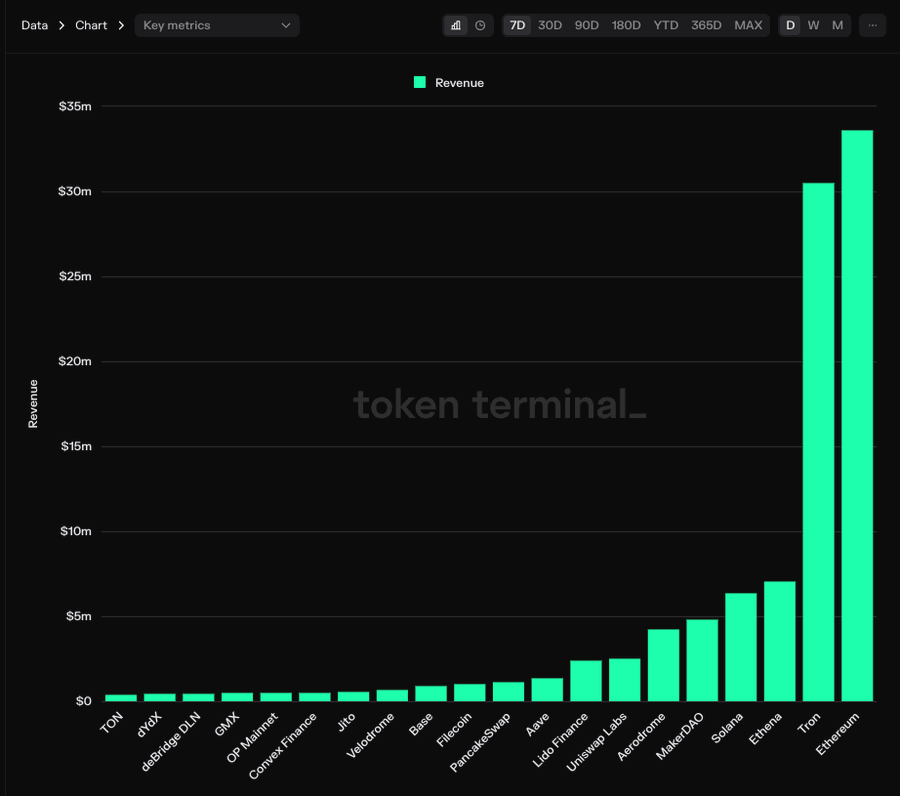

Through the previous week, Ethena’s USDe emerged because the highest-earning decentralized utility (DApp), producing a formidable $7 million in income. This determine surpasses Solana’s $6.3 million income throughout the identical interval.

Notably, the Token Terminal information shared by Ethena founder Man Younger on X confirmed that solely Tron and Ethereum outperformed the DApp’s income era.

This exceptional achievement lends credence to the prediction made by Token Terminal that Ethena is on observe to generate a staggering $222.5 million in income over the following 12 months.

José Maria Macedo, the CEO of Delphi Labs, acknowledged that Ethena Labs is poised to turn out to be the best revenue-generating crypto challenge available in the market. He mentioned:

“USDe will turn out to be the most important stablecoin exterior of USDC/USDT in 2024. Ethena will turn out to be the best revenue-generating challenge in all of crypto.”