- Ethereum market evaluation platform tweeted that the Worry and Greed index touched 64.

- Bulls toil exhausting within the purple zone however bears plummet ETH costs.

- If the bears are dominant ETH may tank to assist 1 however the 200-day MA could interject.

Multifactorial Ethereum Market Sentiment Evaluation Platform shared on Twitter that the Worry and Greed Index struck 64 with the value of Ethereum at $1,646. The Worry and Greed Index indicator takes numerous parameters into consideration. It takes into consideration volatility, market momentum/quantity, social media, dominance, and developments.

For the uninitiated, the orange zone on the left of the indicator within the vary (0-24) denotes “Excessive concern”. The 25-49 vary within the (amber/yellow) zone depicts “Worry”. Furthermore, the 50-74 vary within the (gentle inexperienced) signifies “Greed” whereas the 75-100 vary reveals “Excessive greed”. As such, Ethereum is within the greed zone at 64.

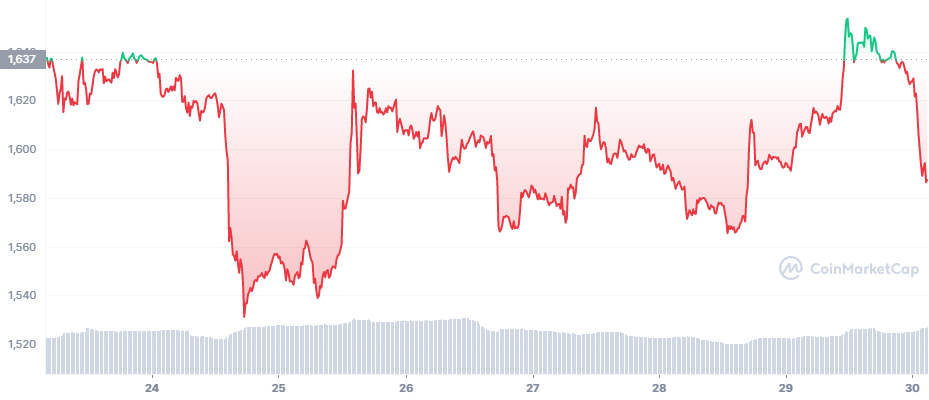

In the meantime, Ethereum began the week with its opening value at $1,637as proven under. However simply after a quick second, it tumbled into the purple zone whereas sometimes sneaking into the inexperienced zone. ETH took a mighty fall on the second day because it crashed from $ 1,617 to $1,531 inside only a few hours. This was the bottom that ETH reached inside the week.

Though throughout the second day, simply earlier than noon, ETH discovered momentum to rise to virtually the floor, it wasn’t in a position to rise above the opening market value. As an alternative, ETH made decrease highs tanking additional into the purple zone. Furthermore, till the sixth day, ETH was fluctuating inside the $1560-$1620 vary.

On the sixth day, it was in a position to overhaul the opening market value and reached a most of $1,653. Nonetheless, ETH was pulled again by the bears under the opening value. At present, ETH is down 1.45% within the final 24 hours and buying and selling at $1,584.

As proven within the chart under, ETH value has damaged out from an exponential curve and is beginning to transfer sideways. The RSI is at 43.95 indicating that the development is properly set. The Bollinger bands are additionally parallel to the horizontal axis, therefore, ETH may transfer sideways. Nevertheless, if the bulls push exhausting, ETH may hit resistance 1. But when the bears take over ETH may tank to Help 1.

However the query lies as as to whether the 200-day MA will be capable to interject ETH’s fall and cease it from crashing additional.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this value evaluation, are revealed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own danger, Coin Version and its associates is not going to be held answerable for any direct or oblique injury or loss.