- Analyst predicts ETH to hit increased highs, after the formation of the bull flag.

- Ethereum is closing in on the median line of the linear regression channel, it could rise into the primary half of the channel.

- Merchants could must take precautions as ETH could also be going by means of a correction or could search help on the decrease pattern line.

Crypto Analyst and Dealer Bluntz tweeted that he hoped to see Ethereum attain new highs. He made this prediction after witnessing Ethereum sweep its earlier low, adopted by a bull flag.

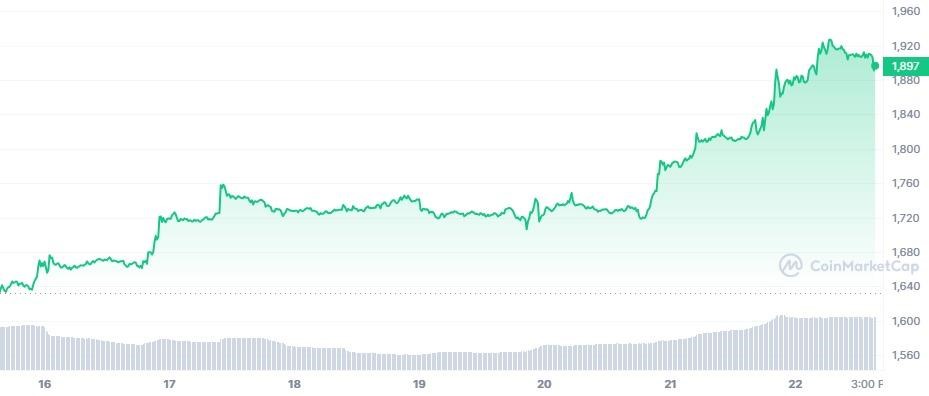

When looking on the above chart, Bluntz’s optimistic view could possibly be justified. Ethereum has been triumphant in the course of the previous week. Particularly, it opened the market at $1,633 on June 16 however abruptly rose to $1,758 by June 17. Nonetheless, from June 17 to June 20, Ethereum consolidated between the $1,720-$1,760 vary earlier than rising once more.

The above chart reveals Ethereum fluctuating inside a linear regression channel. Most of its exercise appears to be within the prime half of the channel. Every time ETH broke into the decrease part of the linear regression channel it was solely to search out help on the decrease pattern line.

Now that ETH is presently near the median line of the pattern channel, and appears to be transferring up, it’s fairly evident to suppose, it could rise additional and attain the highest pattern line of the regression channel — Resistance 1 at $2,140.

Nonetheless, the Bollinger bands appear to contradict the above thesis. Since ETH has touched the higher Bollinger band, the possibilities of it rising additional are fairly slim. Therefore, we may even see ETH going by means of a interval of correction. Furthermore, the Bollinger bandwidth indicator which supplies a studying of 0.17 is positioned parallel to the horizontal axis. As such there could possibly be consolidation.

Nonetheless, the probabilities for a surge can’t be uncared for, when scrutinizing ETH’s spike in January 2023. Particularly, ETH has this function of constantly touching the band and when the market deems it as overbought, then there’s a slight correction.

The correction typically doesn’t even contact the SMA of the Bollinger band earlier than the ETH begins to surge once more. Therefore, if there’s a slight correction for ETH, then, the merchants could must see the formation of bullish candlesticks earlier than getting into an extended place.

Within the occasion, ETH breaks under the SMA, then we may even see it resorting to Help on the decrease pattern line of the linear regression channel. The previous pattern line presents a superb entry level for patrons.

Disclaimer: The views and opinions, in addition to all the data shared on this value evaluation, are revealed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates won’t be held answerable for any direct or oblique injury or loss.