- Brief-term BTC unloaded over $4 billion in revenue via crypto exchanges.

- The large sell-off occurred in two waves, from Thursday to the weekend.

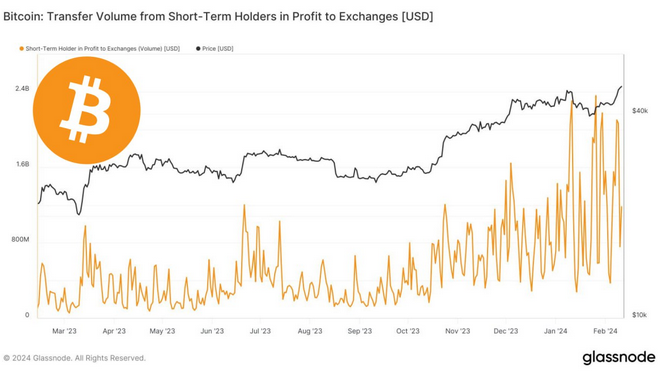

- Glassnode knowledge attested to the uptick within the inflow of funds from BTC merchants to exchanges.

Knowledge from outstanding market intelligence platform Glassnode has proven appreciable profit-taking by Bitcoin merchants throughout latest market positive factors. Market contributors referred to as consideration to the pattern in quite a few posts on X.

Citing knowledge from Glassnode, they claimed short-term Bitcoin holders have unloaded over $4 billion in revenue via crypto exchanges. The large sell-off was stated to have occurred in two waves. The primary was between final Thursday and Friday, adopted by the second batch over the weekend.

In accordance with CoinMarketCap knowledge, BTC broke into the $44k to $45k vary between Thursday and Friday, marking a brand new threshold since its decline to $38,740 final month. BTC merchants reportedly cashed out $2 billion this era.

Curiously, Bitcoin maintained its momentum and climbed additional into the $47k vary by the weekend, with merchants cashing out a further $2 billion. Primarily, these substantial will increase in worth have prompted short-term holders to shortly dump their positions to safeguard towards potential losses in case of a market correction.

Furthermore, a chart from Glassnode confirms the rise in funds transferring from short-term Bitcoin holders to exchanges. The graph indicated that since late 2023, the rise in Bitcoin’s worth has intently adopted the sample of funds being transferred to exchanges for liquidation.

Regardless of the reported important sell-offs which have occurred lately, Bitcoin’s worth has continued to climb to increased ranges. Specifically, Bitcoin has notably surpassed the $50,000 threshold. This can be a worth level that crypto market contributors final witnessed in the course of the peak of the earlier bull season, particularly in 2021.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t liable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.