Bitcoin (BTC) whales holding lengthy BTC positions on Bitfinex instantly cashed out on March 25 at round 13:00 UTC, in response to knowledge from Datamish.

These wallets have been dormant since June 2022, and their combination worth sits at 12,000 BTC, as the information signifies. This motion represents a small section of buyers who’re motivated to exit their lengthy and quick BTC positions to reap the benefits of the current value pump.

Bitfinex exits

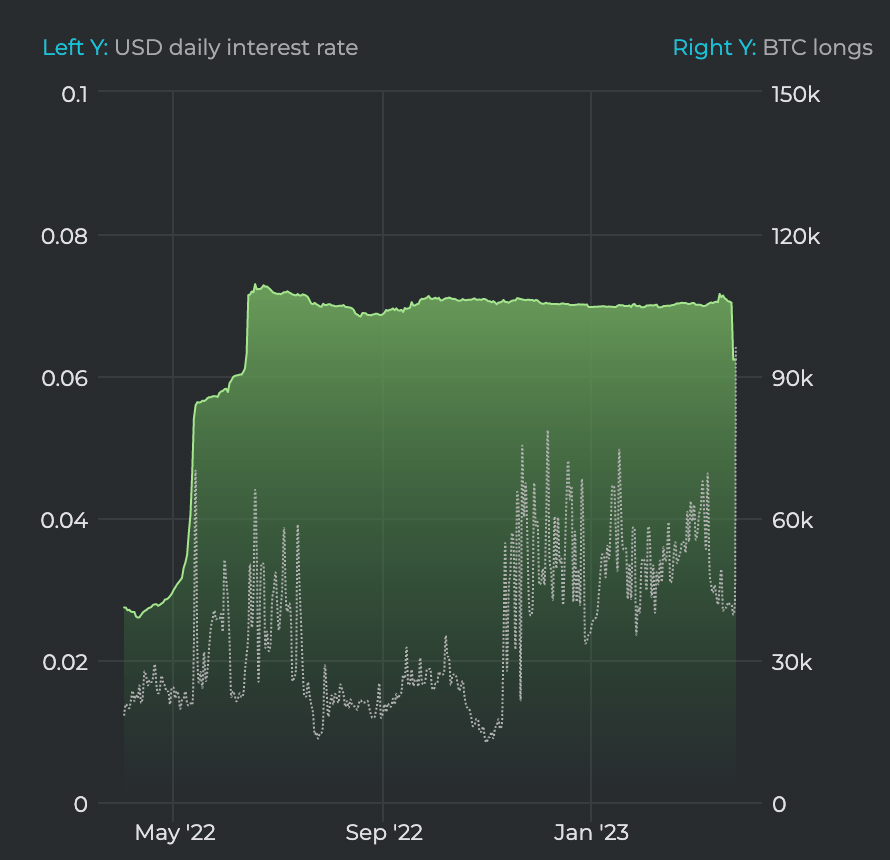

The money out on March 25 marks probably the most important change in BTC’s lengthy positions since June final yr. The chart beneath represents the quantity of lengthy BTC positions since Might 2022.

The 12,000 BTC drop occurred when the combination quantity of lengthy BTC positions was simply above 110,000 BTC. Regardless that the whale exits could point out a bearish sentiment, the general image will not be so pessimistic. On the time of writing, the entire quantity of BTC sitting at lengthy positions is at 93,511, which displays a powerful bullish market sentiment.

Quick positions

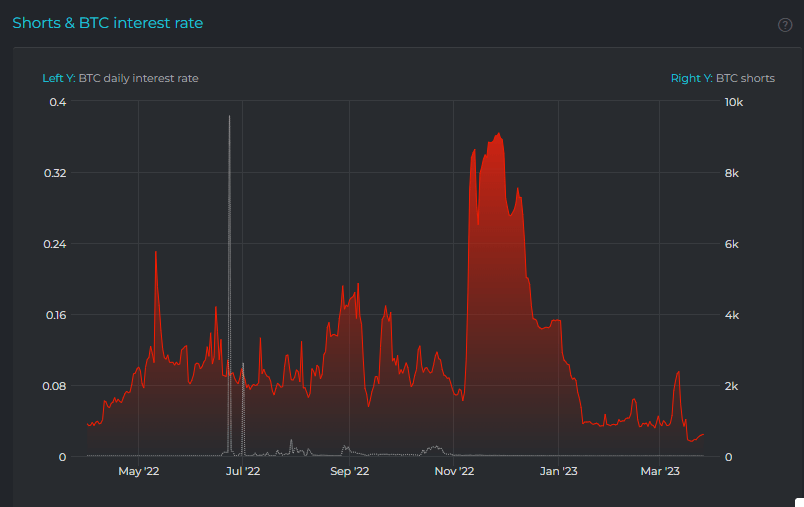

The behaviors of buyers who maintain quick BTC positions additionally assist the bullish market sentiment. In line with StarCrypto analysts, quick BTC positions have been recording a gradual decline because the finish of 2022.

At the moment, they sit at their one-year lowest. This means that “buyers don’t need to guess in opposition to BTC,” as StarCrypto analyst James V. Straten states.

BTC value pump

BTC’s current value pump significantly contributed to the present bullish market sentiment.

BTC surged previous $28,000 on March 21, which led liquidations to boost over $230 million inside 24 hours. The surge additionally motivated the long-term holders to liquidate their positions, StarCrypto analysis revealed on March 21.

“Lengthy-term holders are one of the crucial vital components,” the analysis states, “as their conduct determines native bottoms and fuels future value rallies.” As quickly as BTC broke by way of $28,000, long-term holders rushed to promote a portion of their holdings, main the BTC value to lower barely.

The identical motion was recorded throughout the slight BTC value improve recorded on March 15. Lengthy-term BTC holders offered off over 43,000 BTC between March 15 and March 17.

On the time of press, Bitcoin is ranked #1 by market cap and the BTC value is up 1.2% over the previous 24 hours. BTC has a market capitalization of $538.66 billion with a 24-hour buying and selling quantity of $14.2 billion. Be taught extra ›

BTCUSD Chart by TradingView

Market abstract

On the time of press, the worldwide cryptocurrency market is valued at at $1.16 trillion with a 24-hour quantity of $33.34 billion. Bitcoin dominance is at the moment at 46.32%. Be taught extra ›