Key Takeaways

- The following Bitcoin halving is slated for April 2024, the fourth of Bitcoin’s existence

- Litecoin has simply undergone its fourth halving, however the worth results of Litecoin halvings up to now haven’t been as robust

- Pattern measurement is small which means it’s onerous to conclude with confidence whether or not halvings have tangible worth results within the short-term

- Bitcoin is a really totally different proposition to Litecoin, however the worth motion going ahead of the latter can be fascinating to trace as we method Bitcoin’s subsequent halving in April 2024

Whether or not Bitcoin halvings are priced in has change into a fervent subject of debate among the many neighborhood. We put collectively an evaluation of this query a number of weeks in the past, as we now quick method the fourth halving of Bitcoin’s younger life.

Slated for April 2024, the halving will lower the Bitcoin block subsidy from 6.25 Bitcoins to three.125 Bitcoins per block, halving the issuance charge of newly created provide.

We is not going to rehash (pun supposed!) our aforementioned evaluation of the upcoming halving right here. As a substitute, we are going to deal with one other coin: Litecoin. One of many world’s first altcoins, it’s a spinoff of Bitcoin and, intriguingly, simply underwent the fourth halving of its life.

Can Litecoin due to this fact be seen as a guinea pig forward of Bitcoin’s personal halving subsequent 12 months? Nicely, probably not, however we might be able to achieve sure insights.

First, allow us to look at Litecoin’s efficiency via previous halvings. Worth information is kind of illiquid previous to 2015, so the beneath chart omits the primary halving.

The log scale of the chart considerably obscures it, however the second halving in 2015 preceded robust worth efficiency for Litecoin. Alternatively, the third halving in 2019 noticed falling costs, earlier than the development reversed after COVID struck in 2020, when the complete crypto sector surged into the mainstream.

It’s too quickly to attract conclusions relating to the fourth halving, which occured simply over per week in the past on August fifth. Nonetheless, Litecoin’s halvings don’t provide compelling proof of a robust relationship so far not less than. Moreover, like most questions in crypto, the pattern measurement is so small that even when they did precipitate aggressive worth rises instantly, that will not essentially imply there may be causation.

Bitcoin is just not Litecoin, however once more, we might be able to derive clues from the sample in ascertaining the impact of halvings on the previous, even when we will’t be assured given the pattern measurement points. First, allow us to now have a look at Bitcoin’s worth motion whereas marking the halving occasions:

The sample is evident. Usually, we’ve seen outsized volatility within the months main as much as a halving, earlier than robust outperformance on the opposite aspect. The outperformance has additionally grown smaller with every halving, maybe unsurprising given the market cap has grown a lot within the 4 years between every occasion.

So, why has the impact of halvings on Bitcoin been, not less than optically, bigger than the identical occasions on Litecoin? The primary principle takes us to the guts of the controversy on whether or not halvings are actually priced in: whereas earlier occasions have preceded steep inclines for Bitcoin, they’ve additionally lined up effectively with international liquidity cycles.

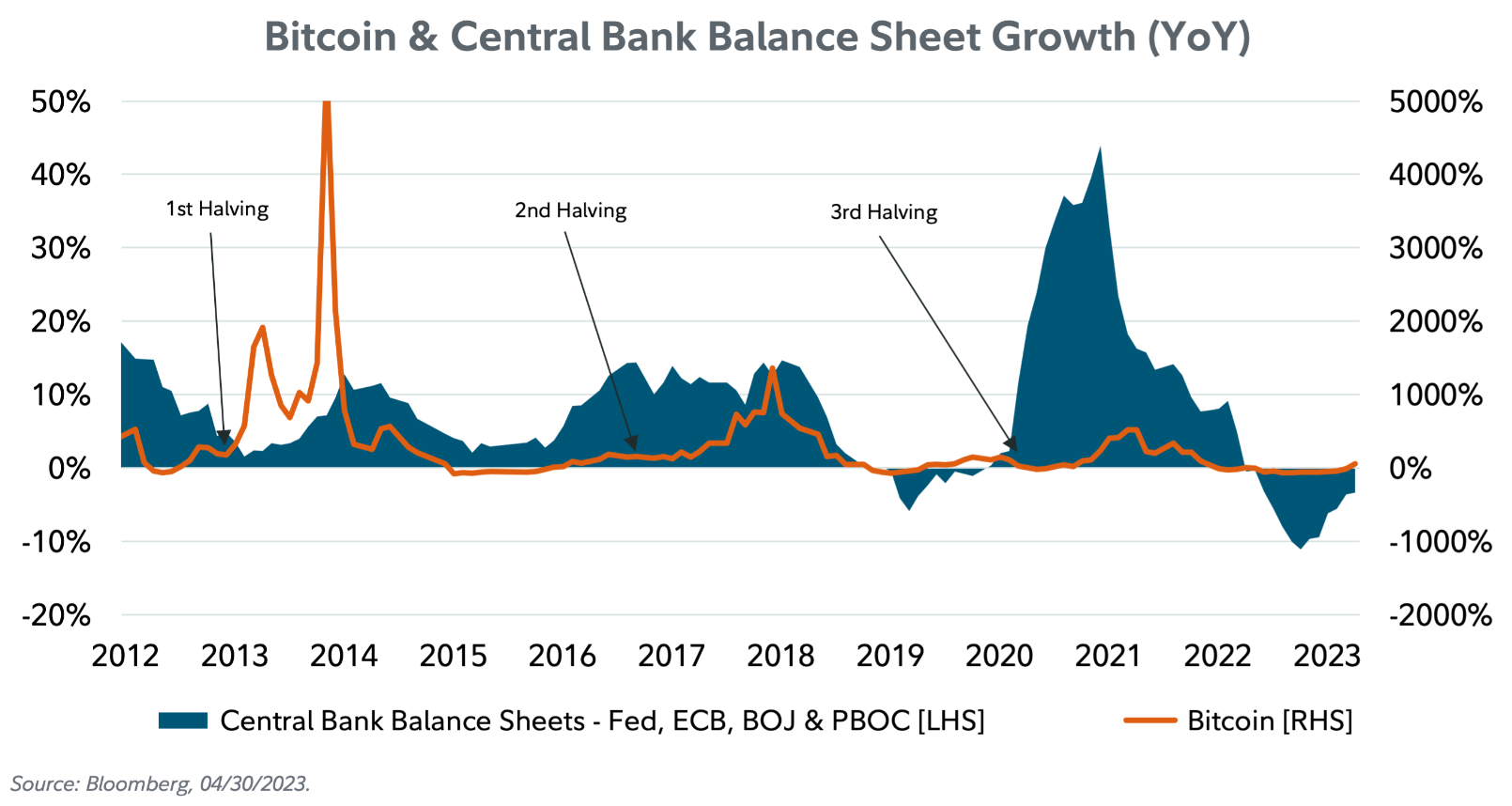

The beneath chart from Constancy reveals this effectively. There’s maybe no higher affect on the valuations of threat property than central financial institution steadiness sheets, and the halvings have lined up extremely effectively with the growth of those self same steadiness sheets.

The factor is, the following halving might effectively line up with an growth in liquidity once more. The earlier eighteen months have seen one of many quickest rate-hiking cycles in current historical past, with the Fed funds charge now above 5%. Now, taking a look at possibilities implied by the futures market, the market is anticipating that the hikes are coming to a detailed (in the event that they haven’t achieved so already).

Wanting additional ahead in the direction of the time interval across the halving (April), futures suggest that charge cuts might come into play. To not point out, after we have a look at the yield curve, it’s at the moment on the deepest degree of inversion for the reason that early 80s. The underside line is that this: the fourth halving, via sheer likelihood, might once more line up miraculously effectively with international liquidity cycles.

In fact, the macro scenario has been altering incessantly, and there may be each likelihood that forecasts across the liquidity cycle might flip, and the halving received’t line up in addition to it has achieved up to now.

That is the place Litecoin could are available. With its halvings touchdown at totally different dates to Bitcoin up to now, but not boosting costs as a lot because the orange coin noticed, maybe it’s only a timing factor, whether or not macro-related or different? Litecoin’s worth motion in comparison with Bitcoin, the duo are tightly correlated, like many altcoins within the house. If Litecoin’s halving doesn’t trigger a slight outperformance this time in comparison with Bitcoin or different cash, what could be the reason?

Finally, like we maintain saying, the pattern measurement is small. Bitcoin has solely skilled three halvings, and one might even argue that it was solely the current occasion in 2020 that occurred whereas the asset was buying and selling with ample liquidity.

Litecoin’s much less explosive worth motion after its personal halvings do maybe throw additional doubt on the idea {that a} 50% lower to the brand new provide issuance will inevitably kick up the worth. And but, Litecoin is just not Bitcoin, so the controversy will rage on.

Both method, revisiting Litecoin’s worth efficiency across the time of Bitcoin halving can be fascinating, as a result of by then it should have had round eight months post-halving and should current a extra related reference level.