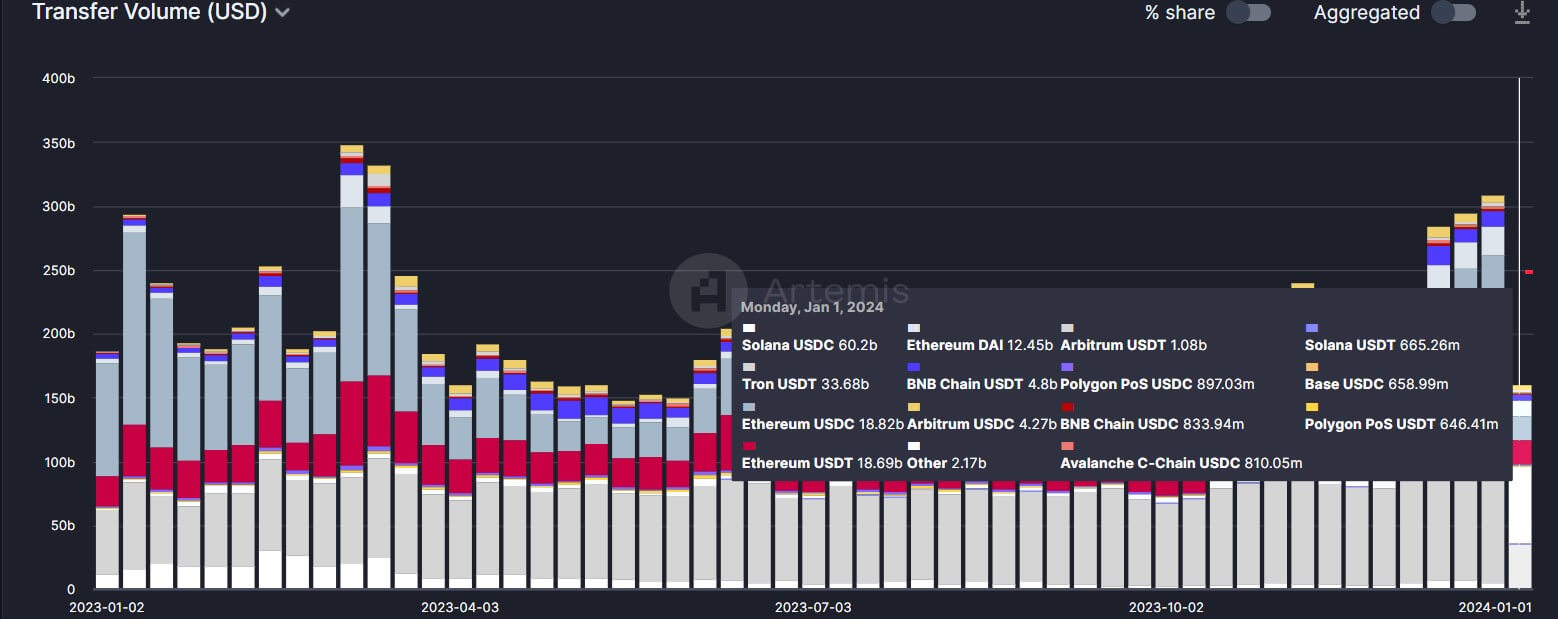

Solana-based USD Coin (USDC) transaction quantity surpassed that of USDT on the Tron blockchain, in keeping with knowledge from blockchain intelligence platform Artemis.

Knowledge from the platform reveals that Solana USDC switch quantity reached greater than $60 billion on Jan. 1, whereas that of Tron USDT was round $34 billion.

This continues a development noticed in December when Solana USDC’s month-to-month switch quantity was almost that of Tron’s USDT. Per Artemis knowledge, Solana USDC noticed $24.58 billion in quantity, whereas Tron’s USDT was $6.54 billion.

USDT and USDC are the highest two largest stablecoins by market capitalization. These stablecoins account for almost 90% of the trade provide and buying and selling quantity.

Circle’s CEO, Jeremy Allaire, expressed pleasure on the milestone, noting that it was solely the start of the 12 months. Circle is USDC’s issuer.

“Unimaginable! What’s much more unimaginable is that it’s solely Jan 2nd, think about the place we’ll be a 12 months from now,” Allaire stated.

starcrypto had beforehand recognized that Solana-based USDC contributed a good portion of buying and selling actions on decentralized exchanges. On the time, Allaire said that 90% of all stablecoin transaction quantity on Solana was USDC.

Solana’s thriving ecosystem

Solana’s blockchain ecosystem is having fun with a resurgence that has helped it regain a pole place inside the crypto trade.

The blockchain ecosystem has skilled vital progress regardless of its previous connections with Sam Bankman-Fried, the embattled FTX founder. This improvement has led to an inflow of latest customers and essential partnerships with main world monetary entities reminiscent of Visa and Shopify.

Moreover, Solana’s DeFi sector has witnessed outstanding enlargement, leading to an unprecedented surge for its blockchain-based tokens like Helium’s HNT.

Knowledge from starcrypto reveals Solana’s native SOL token closed final 12 months as one of many top-performing belongings, up greater than 850% to a peak of $120. Nonetheless, it has retraced to $98 as of press time.