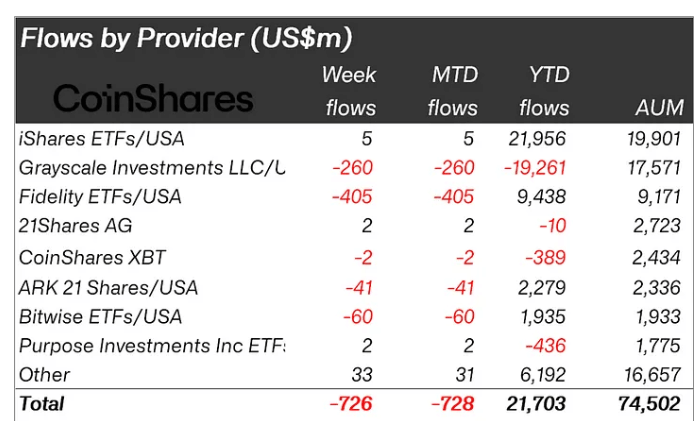

Digital asset funding merchandise noticed vital outflows totaling $726 million, matching the best outflow recorded earlier this yr in March, based on CoinShares‘ newest report.

James Butterfill, head of analysis at CoinShares, attributed this detrimental sentiment to stronger-than-expected macroeconomic knowledge from the earlier week. This elevated the chance of a 25-basis level rate of interest hike by the US Federal Reserve.

He added:

“Every day outflows slowed later within the week as employment knowledge fell wanting expectations, leaving market opinions on a possible 50bp price reduce extremely divided. The markets are actually awaiting Tuesday’s Shopper Worth Index (CP|) inflation report, with a 50bp reduce extra probably if inflation is available in under expectations.”

US, Bitcoin lead outflows

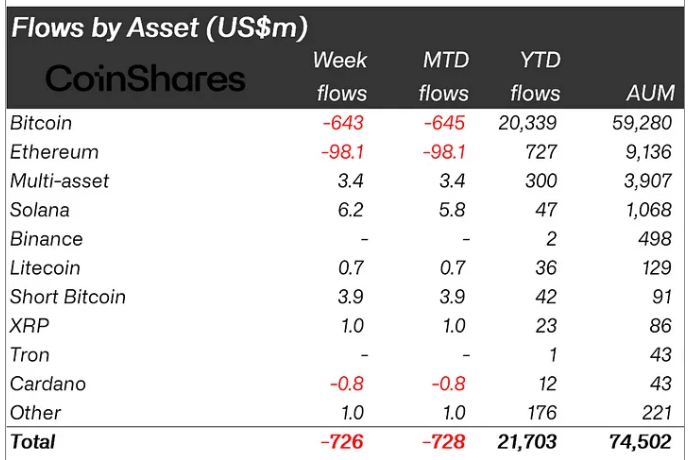

Bitcoin led the outflows, dropping $643 million, bringing its month-to-month outflows to $645 million. Brief BTC funds, nevertheless, noticed minor inflows of $3.9 million.

In the meantime, US Bitcoin exchange-traded funds (ETFs) noticed an eight-day outflow streak, inflicting web outflows of $721 million within the nation. Constancy’s FBTC fund was answerable for most of this, with $405 million in outflows final week.

It was adopted by Grayscale’s GBTC, which noticed $280 million in outflows. Bitwise ETFs accomplished the highest three for final week with losses of round $60 million.

Canada additionally recorded outflows of $28 million. In distinction, Europe had extra constructive sentiment, with Germany and Switzerland seeing inflows of $16.3 million and $3.2 million, respectively.

Altcoins undergo contrasting fates.

Ethereum-based funding merchandise recorded $98 million in web outflows final week.

This was primarily as a result of Grayscale’s transformed ETHE fund, which misplaced $111 million throughout the interval. This meant the minimal inflows into different spot Ethereum ETF merchandise couldn’t offset the numerous outflows, additional fuelling ideas that there was no demand for these funding merchandise.

Nonetheless, Solana-based funding merchandise secured $6.2 million in web inflows, the most important amongst digital asset merchandise.

Different digital belongings like Cardano noticed outflows of round $800,000 regardless of finishing the primary section of its extremely anticipated Chang Onerous Fork. Compared, Litecoin and XRP merchandise noticed cumulative inflows of $1.7 million.