Bitcoin regained the $66,000 degree within the evening between Could 15 and Could 16, recovering a number of the losses it incurred previously week. This spike considerably impacted the derivatives market, considerably influencing each open curiosity and buying and selling quantity.

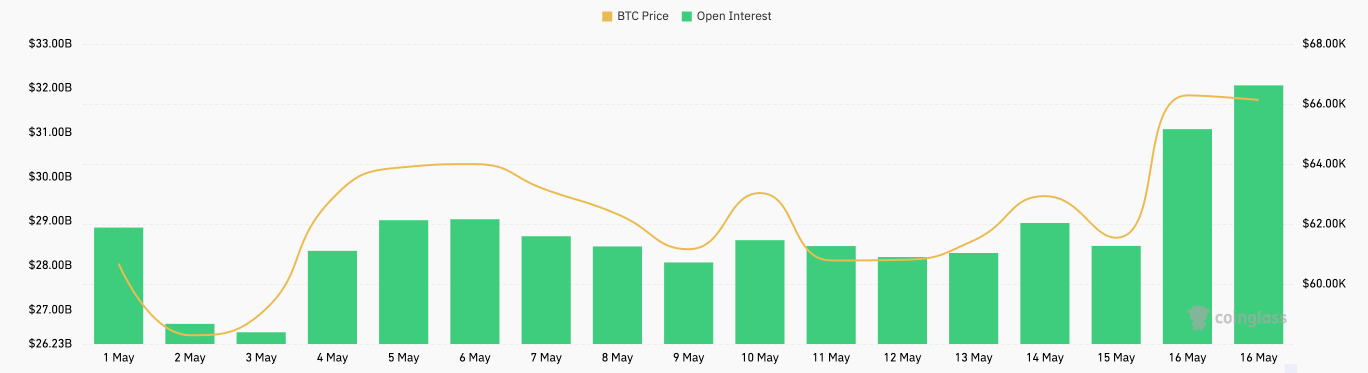

Futures open curiosity, which signifies the whole worth of excellent futures contracts but to be settled, skilled a marked improve. On Could 15, futures open curiosity stood at $28.45 billion however surged to $31.18 billion by Could 16. This represents a considerable improve of roughly 9.6%. This rise suggests a rising investor curiosity in Bitcoin futures, pushed by the anticipation of additional value actions. The rise in OI is crucial because it exhibits an inflow of latest capital into the market, signaling merchants’ expectations and potential value course.

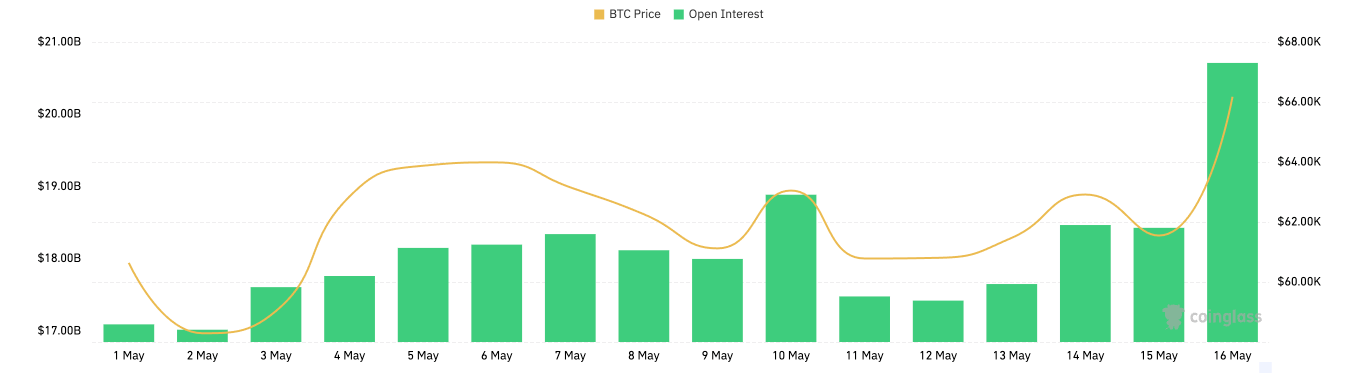

Within the choices market, open curiosity additionally noticed a big uptick. On Could 15, choices open curiosity was $18.43 billion, rising to $20.71 billion by Could 16. This improve of roughly 12.4% highlights the heightened exercise and curiosity in choices contracts as merchants positioned themselves for the worth surge.

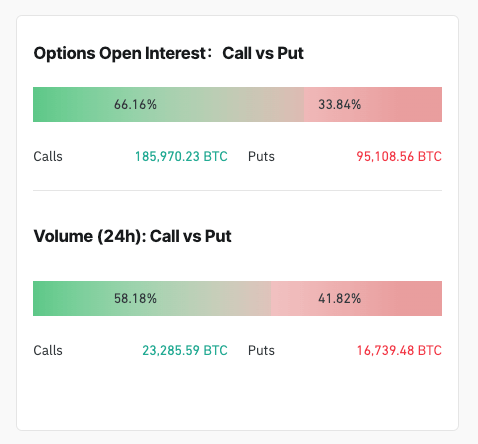

The distribution of choices open curiosity on Could 16, with calls accounting for 66.16% and places for 33.84%, signifies a bullish sentiment amongst merchants, anticipating additional upward motion in Bitcoin’s value. A deeper take a look at the choices quantity additional confirms the overwhelmingly bullish sentiment. On Could 16, the amount of name choices constituted 58.18%, in comparison with 41.82% for places, displaying that merchants have been predominantly betting on the worth improve.

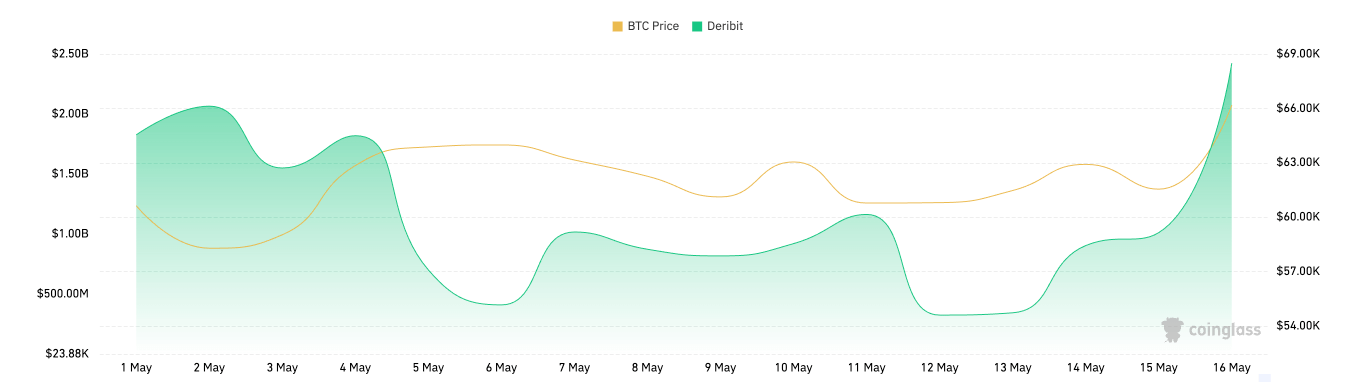

Deribit’s each day choices quantity dramatically elevated, leaping from $1.01 billion on Could 15 to $2.42 billion on Could 16.

The quantity and distribution between shorts and longs present additional insights into the state of the market. On Could 16, the whole liquidations amounted to $150.52 million, with lengthy liquidations at $40.76 million and brief liquidations at $109.76 million. The considerably larger brief liquidations point out that many merchants have been caught off guard by the worth improve, ensuing within the pressured closure of brief positions. This liquidation asymmetry reinforces the bullish pattern noticed throughout this era, as shorts have been squeezed out of the market.

Analyzing the adjustments in OI and volumes is essential for understanding how the derivatives market responds to cost actions. As soon as a distinct segment market catering to a small subset of subtle traders, Bitcoin derivatives have grown to grow to be a market basis. The tens of billions in open contracts throughout merchandise present that derivatives are important and necessary sufficient to have an effect on the broader crypto market.

Information from CoinGlass signifies a rising bullish sentiment amongst merchants, with a notable desire for name choices and a excessive quantity of brief liquidations. This conduct means that merchants are positioning for additional value appreciation in Bitcoin. If this bullish sentiment persists and is supported by continued optimistic value motion, we might even see additional will increase in open curiosity and buying and selling volumes, probably driving Bitcoin’s value larger.

The publish Derivatives noticed spike in Open Curiosity and quantity as Bitcoin broke $66k appeared first on StarCrypto.