- DeFi exploit losses dropped considerably to $1B in 2024, displaying improved protocol safety.

- April 2021 had peak losses of $2.5B as a consequence of mechanism flaws, highlighting DeFi’s early dangers.

- Terra/Luna’s $50B collapse underscored dangers in algorithmic stablecoins, impacting DeFi belief.

Losses from exploits in decentralized finance (DeFi) have decreased in 2024, with reported losses hovering simply round $1 billion. It is a marked enchancment over earlier years, when the business confronted quite a few breaches.

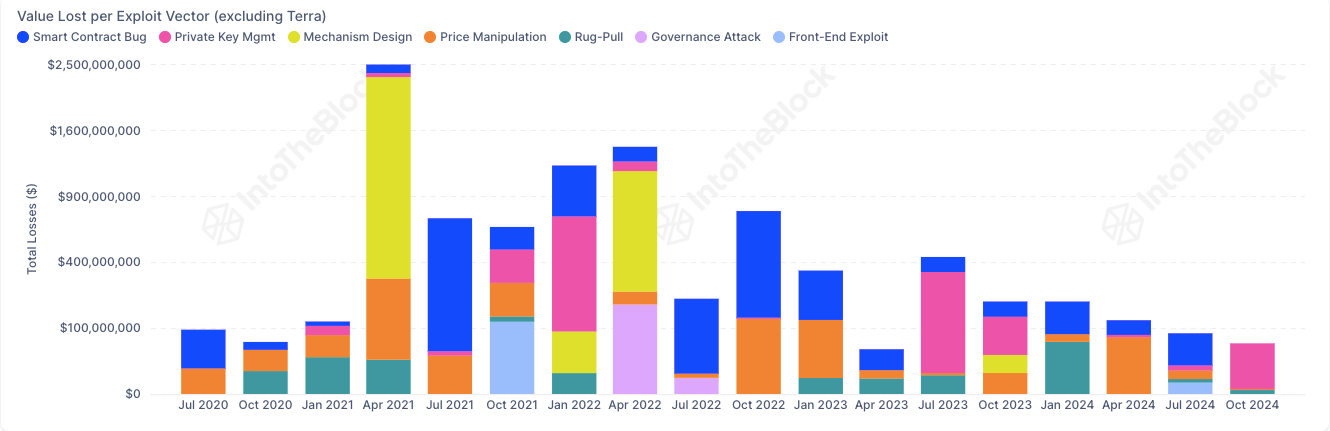

Knowledge on “Worth Misplaced to Exploits (Excluding Terra)” from July 2020 to October 2024 reveals modifications in crypto asset losses, with theft actions rising by means of 2021 and 2022. The decreased exploit-related losses in 2024 recommend that safety enhancements in DeFi protocols are working, with current losses falling beneath $250 million.

Evaluation of DeFi Exploit Losses Over Time

Since July 2020, the crypto market has suffered losses from DeFi exploits. The largest spike occurred in April 2021, with losses over $2.5 billion, as a consequence of weaknesses in mechanism design.

Learn additionally : Pendle Saves $105 Million in DeFi Exploit, Halts Penpie Hack

From January 2022 to October 2022, there have been further surges, significantly in January, April, and October, with losses ranging between $500 million and $1 billion. By October 2024, reported losses have been beneath $250 million, seemingly due to improved threat administration and safety infrastructure inside DeFi.

The Terra/Luna Disaster: A Distinctive Case

Not like different exploit-related losses, the Terra/Luna disaster brought on a large lack of over $50 billion. This incident concerned the collapse of the TerraUSD (UST) stablecoin and its related token LUNA as a consequence of flaws in its mechanism design.

Learn additionally : Institutional Buyers Flock to Ethereum, Betting on DeFi and Lengthy-Time period Development

Though believed to have resulted from an financial assault, the UST’s de-peg was largely as a consequence of inadequate design practices. The occasion had a serious influence on DeFi, affecting over 25% of its complete worth locked (TVL) and decreasing belief in algorithmic stablecoins. In April 2021, over $2.5 billion in loss was pushed by mechanism design points, with further difficulties in worth management and personal key administration.

Value manipulation, governance assaults, and sensible contract bugs have been persistent exploit vectors, with sensible contract vulnerabilities inflicting important losses from mid-2023 onward. Whereas rug-pulls occurred in some intervals, they have been much less frequent than different exploit varieties.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be chargeable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.