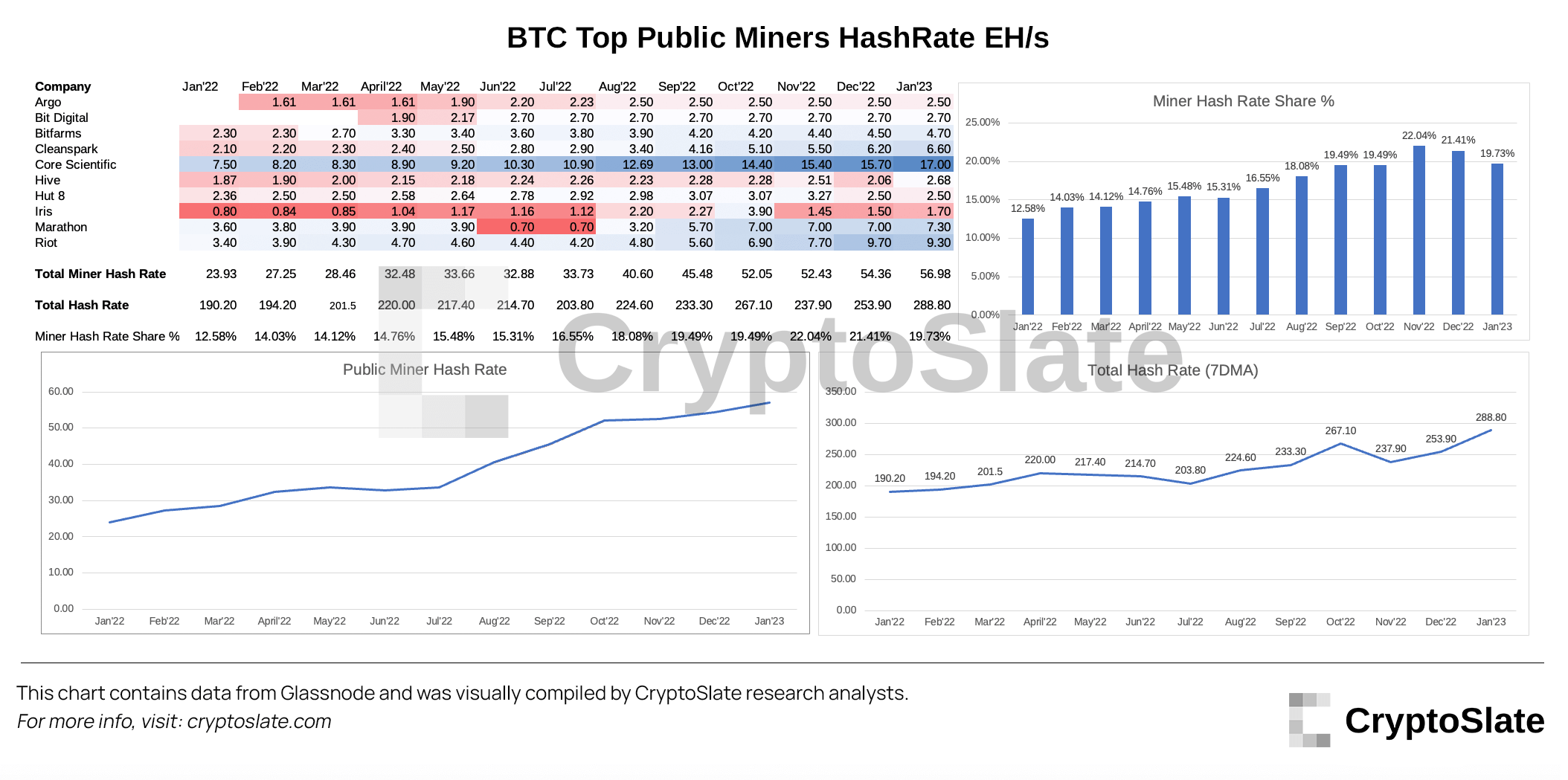

Bitcoin (BTC) mining from public corporations has grown exponentially in recent times, with the hash price share of the highest mining corporations rising from 23.93 EH/s to 56.98 EH/s between Jan. 2022 and Jan. 2023. The rise represents a staggering 82% progress in hash price YOY.

Prime public miners

StarCrypto analyzed ten of the highest public Bitcoin miners and their hash charges to realize additional perception into this progress.

Main the pack is Core Scientific, which has roughly 30% of the hash price share. Riot and Marathon are available second and third place, respectively. Mixed, they account for nearly 60% of the hash price share taken up by public corporations. The vast majority of the ten public miners on the record have both elevated or equaled their hash price share YOY.

These ten corporations maintain roughly 60 EH/s, which accounts for roughly 20% of the entire hash price over a seven-day transferring common (7DMA,) an indicator that measures the typical hash price over a 7-day interval. Though the share has decreased barely in earlier months, it has elevated by nearly 50% YOY from simply 12.58%.

It’s value noting that the hash price share of public miners is prone to be nearer to 25%, as solely the highest ten mining corporations had been included on this record, and the hash price has already exceeded 300 EH/s.

Hash price & problem improve

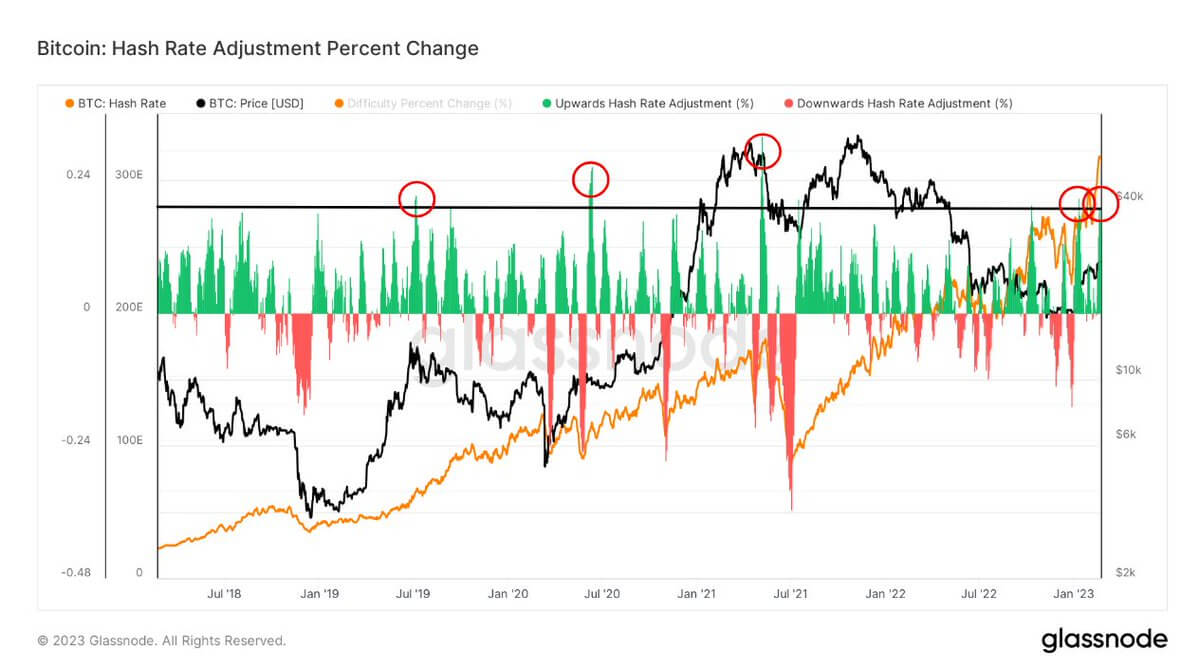

The rise in Bitcoin’s hash price is depicted within the chart beneath, with the orange line exhibiting a strong optimistic pattern line since July 2021 following the China mining ban.

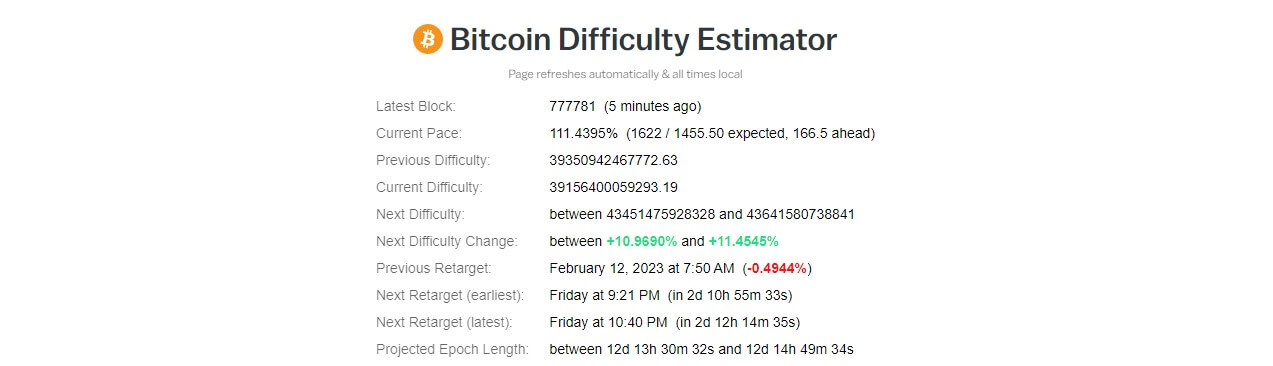

The exponential progress in hash price has had a knock-on impact on mining problem. On account of this progress, the mining problem is ready to regulate by over 10% on Friday, Feb. 24, marking the largest optimistic adjustment since Oc. 2022 and Sept. 2021.

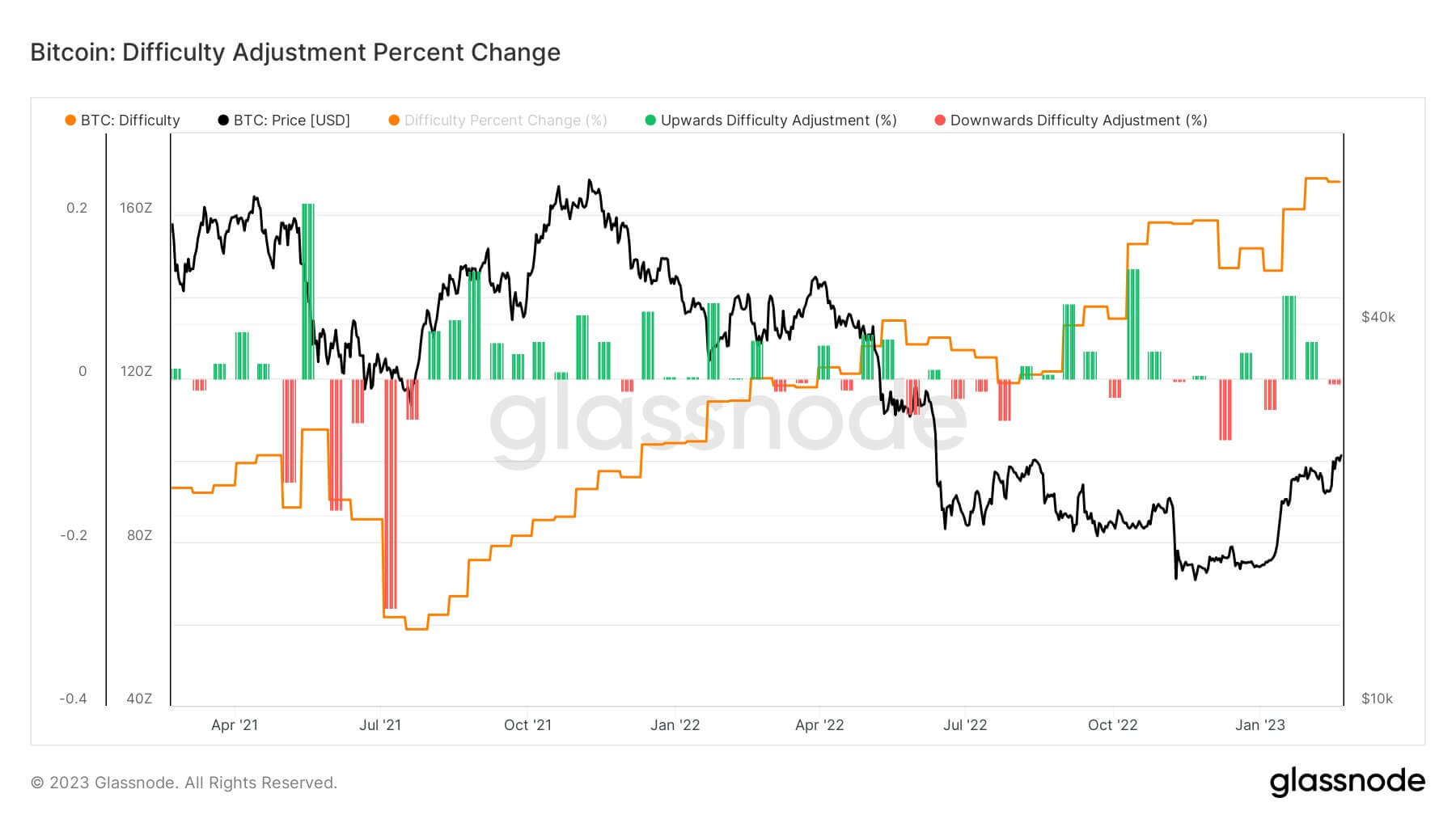

The expansion in problem signifies the ever-increasing demand for Bitcoin and the expertise that underpins it. Moreover, increased problem means the safety of the community can be extra strong. The chart beneath depicts the stark rise in BTC problem since Jul. 2021, with simply 13 unfavorable problem changes out of the final 32.

As well as, a latest evaluation of BTC public miner holdings discovered that they’re in higher well being than final 12 months, distributing Bitcoin to exchanges at multi-year lows.

In conclusion, the continued progress of the hash price, coupled with optimistic changes in mining problem, demonstrates that Bitcoin is in a robust place. Public mining corporations are enjoying a major function on this progress, and their rising hash price share displays the rising demand for Bitcoin.