Hong Kong, Hong Kong, February sixth, 2024, Chainwire

After a interval of tranquility, the Ethereum ecosystem is step by step regaining momentum with the rise of the Restaking. As seasoned DeFi members, DeSyn has persistently targeted on growing the Ethereum community. Beforehand, DeSyn initiated the launch of the 3x ETH Leveraged ETF primarily based on sharp market insights, aiming to advertise variety in Ethereum community merchandise and help customers in maximizing their returns throughout the Ethereum ecosystem.

At present, DeSyn proclaims the launching of the DeSyn ETH Restaking Fund I( 3x Factors), devoted to collaborating on this trade revolution alongside ecosystems corresponding to Eigenlayer and Renzo, collectively shaping the way forward for DeFi.

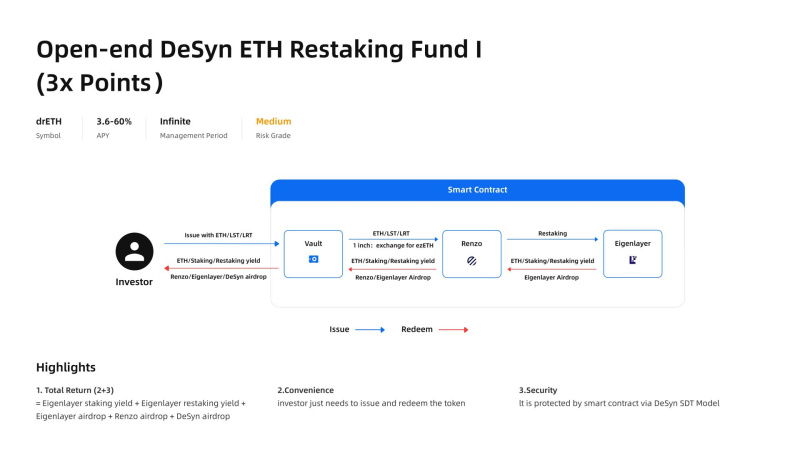

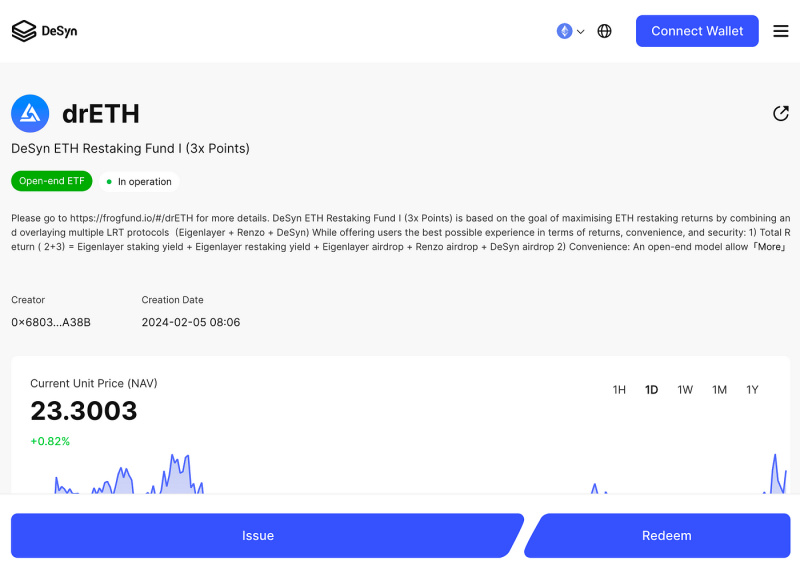

The DeSyn ETH Restaking Fund I( 3x Factors), drETH briefly, is an open-end fund product launched by Little Frog, an expert decentralized asset administration DAO group primarily based on the infrastructure of the DeSyn platform. This product integrates DeSyn and different two extremely acclaimed restaking platforms, Eigenlayer and Renzo. Customers can stake ETH, stETH, wETH, and ezETH by means of the DeSyn platform. The fund helps on-demand withdrawals and affords the prevailing APY from LST and LRT and the triple yield expectations from Eigenlayer, Renzo, and DeSyn. At present, this fund’s APY ranges from 3.6% to 60%. By way of safety, DeSyn solemnly declares that every one contract codes have undergone safety audits to make sure the protection of person property.

https://little-frog.gitbook.io/little-frog/merchandise/open-end-desyn-eth-restaking-fund-i-3x-points

How you can restake?

Customers can navigate to Desyn’s web site and choose the “restaking” choice to entry the DeSyn ETH Restaking Fund I (3x Factors) situation. Upon choice, customers have the chance to amass drETH, related to the potential of triple returns.

https://www.desyn.io/#/pool/0x8F92265FE1F875d1985cD9D4275dd4Cfec9eb1E7

Enhanced Incentives by means of Triple-Level Staking with DeSyn

As talked about earlier, choosing the fund not solely grants probably primary LST and LRT returns but in addition yields triple factors from Eigenlayer, Renzo, and DeSyn.

DeSyn is dedicated to maximizing incentives for staking customers. Ranging from February 6, 2024, any person collaborating on this Fund can earn corresponding factors, depending on the staking quantity and length.

- DeSyn Factors Components: DeSyn factors = (Quantity of LST) * Variety of staked days * 10,000

- Eigenlayer Factors Information might be discovered right here.

- Renzo Factors Information might be discovered right here.

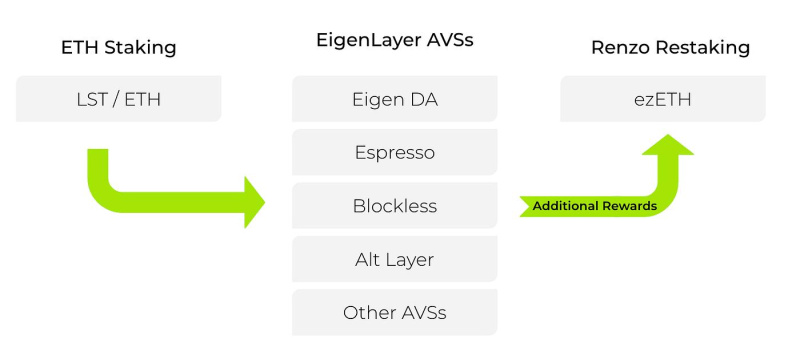

EigenLayer: Elevating Ethereum Safety by means of Restaking

EigenLayer is a protocol constructed on Ethereum that introduces restaking, a brand new primitive in crypto-economic safety. This primitive permits the reuse of ETH on the consensus layer. Customers that stake ETH natively or with a liquid staking token (LST) can opt-in to EigenLayer sensible contracts to restake their ETH or LST and prolong crypto-economic safety to extra functions on the community to earn extra rewards.

Customers can be taught extra by visiting EigenLayer’s official web site.

Renzo: Pioneering Restaking on the EigenLayer Mainnet

Renzo is the primary native restaking protocol to launch on the EigenLayer mainnet. Though EigenLayer won’t start securing Actively Validated Providers (AVSs) I.e. EigenDA till mid-2024, they’ve been accepting deposits. Deposits for Liquid Staking Tokens (LSTs) are capped; nevertheless, native ETH deposits stay uncapped however very troublesome for many customers to entry. They require a person to have 32 ETH and run an Ethereum node that’s built-in with EigenLayer to run EigenPods.

Customers can be taught extra by visiting Renzo’s official web site.

About DeSyn

DeSyn Protocol is an revolutionary decentralized asset administration infrastructure on Net 3, empowering customers to securely and transparently create and handle personalized pool-based portfolios with varied on-chain property (tokens, NFTs, derivatives, and so forth.) by way of sensible contract.

For extra data customers can go to DeSyn’s:

Contact

DeSyn Group

DeSyn Protocol

[email protected]