- Bullish value prediction ranges of MANA from $0.9 to $2.

- MANA value may additionally attain $1 this 2023.

- MANA’s bearish market value prediction for 2023 is $0.5.

Metaverse has additionally performed a key function within the adoption of Web3 because it opened the doorways for a brand new world. Decentraland (MANA) is one such rising metaverse pattern that has purchased new people into this revolutionary world.

Decentraland, as described on the web site, is a digital world owned by its customers. This digital world powered by the Ethereum blockchain permits customers to create, expertise, and monetize varied content material and providers throughout the ecosystem.

Moreover, MANA is the native token of Decentraland. MANA can be utilized to accumulate NFTs, and make funds throughout the Decentraland community. Because the demand for metaverse initiatives continues to develop, there’s a excessive probability that MANA’s value may be affected.

In case you are inquisitive about Decentraland’s future, and MANA’s value forecast and evaluation for 2023, 2024, 2025, 2026, and as much as 2050, hold studying this Coin Version’s value prediction article.

Decentraland (MANA) Market Overview

HTTP Request Failed… Error: file_get_contents(https://api.coingecko.com/api/v3/cash/decentraland): Didn’t open stream: HTTP request failed! HTTP/1.1 429 Too Many Requests

What Is Decentraland (MANA)?

Decentraland, as described on the web site, is a digital world owned by its customers. This digital world powered by the Ethereum blockchain permits customers to create, expertise, and monetize varied content material and providers throughout the ecosystem. Decentraland was co-founded by Ariel Meilich and Esteban Ordano, nonetheless, they at present act as advisors.

Breaking down the structure, Decentraland is split into three fundamental elements: the Catalyst community, the World Explorer, and the CLI. The Calayst community is a distributed peer server that hosts content material and supplies the core APIs. In the meantime, the World Explorer acts as an app the place gamers can log into Decentraland and discover the land. The CLI is a command line interface enabling creators to develop and publish content material.

Customers may also buy ERC-721 tokens aka NFTs comparable to LAND and Property. The LAND is the digital area throughout the Decentraland’s digital area, which might be bought with MANA, whereas the Property is commonly outlined as parcels of LAND which might be merged and instantly adjoining to one another.

One of many key highlights of Decentraland is that it’s a place the place the choices are made by the neighborhood via the decentralized autonomous group (DAO) governance construction. The Decentraland’s DAO permits the neighborhood to make votes and partake within the determination course of relating to the issuance of grants and making adjustments to the lists of banned names, POIs, and catalyst nodes. These choices are made solely after the proposal is ready.

Moreover, MANA is the native token of Decentraland. MANA might be utilized to accumulate NFTs, and make funds throughout the Decentraland community. MANA additionally permits customers to take part in proposals that make choices about Decentraland’s administration and developments.

Analyst View on Decentraland (MANA)

MANA has been beneath the highlight for a lot of crypto analysts. One such crypto analyst, Simon Hayes, predicted that the hourly chart appears bullish for MANA. Hayes shared a picture that indicated his forecast was right as MANA skilled a surge after two hours.

Furthermore, one other crypto analyst and YouTuber beneath the pseudonym of “CryptoJack” addressed the Twitter neighborhood asking, “What’s the very best metaverse altcoin?” CryptoJack, then, gave three choices for the neighborhood comparable to SAND, MANA, and another altcoin. This is a sign that MANA, just like SAND, is among the greatest metaverse altcoin. At the moment, MANA is among the prime three metaverse tokens based mostly on market capitalization, in keeping with CoinMarketCap.

Decentraland (MANA) Present Market Standing

After its current launch, MANA already ranked within the 45 place based mostly on its market capitalization, in keeping with CoinMarketCap. The present circulating provide of Decentraland’s native token is at 1,855,084,192 MANA, whereas its whole provide is 2,193,539,027.

Furthermore, MANA is priced at $0.6799, experiencing a 9.83% surge in seven days. With a market cap of $1,261,320,443, MANA additionally witnessed a 7.15% spike in 24 hours. Despite the fact that MANA had an enormous demand initially, the buying and selling quantity, valued at $385,269,691, skilled a spike of 289.50%% in someday, indicating that the demand for this token remains to be rising.

Among the crypto exchanges for buying and selling MANA are at present Binance, OKX, CoinBase, KuCoin, SushiSwap, Uniswap, and Bybit.

Now, let’s dive additional and talk about the value evaluation of Decentraland’s native token, MANA, for 2023.

Decentraland (MANA) Worth Evaluation 2023

Will the MANA blockchain’s most up-to-date enhancements, additions, and modifications assist its value rise? Furthermore, will the adjustments within the Metaverse trade have an effect on MANA’s sentiment over time? Learn extra to search out out about MANA’s 2023 value evaluation.

Decentraland (MANA) Worth Evaluation – Bollinger Bands

The Bollinger Bands is a technical evaluation instrument that’s used to research value motion and volatility. Bollinger Bands (BB) makes use of the time interval and the stand deviation of the value. Usually, the default worth of BB’s interval is ready at 20. The Bollinger Bands consists of higher and decrease bands which can be utilized collectively, together with the center line(easy transferring common), to find out whether or not the value would rise or fall.

The higher band of the BB is calculated by including 2 occasions the usual deviations to the center line, whereas the decrease band is calculated by subtracting 2 occasions the usual deviation from the center line. Primarily based on the empirical regulation of normal deviation, 95% of the information units will fall throughout the two customary deviations of the imply. As such, the costs of the cryptocurrency, when the Bollinger bands are utilized ought to keep throughout the higher and decrease bands 95% of the time is the idea behind this.

Trying on the charts, MANA’s candlesticks has crossed past the higher band, indicating that the token is within the overbought area. If MANA follows an identical sample, then, the candlestick could proceed to commerce upwards. Nonetheless, the hole between the higher band and the decrease band is slim, indicating that MANA is observing low volatility. If the bands proceed to widen, then, MANA could proceed to maneuver upwards for a while earlier than going through a fall.

Nonetheless, if the hole between the bands continues to scale back, then, candlesticks could barely fall respective to MANA’s present place.

Decentraland (MANA) Worth Evaluation – Relative Energy Index (RSI)

The Relative Energy Index (RSI) is a momentum indicator utilized to search out out the present pattern of the value motion and decide whether it is within the oversold or overbought area. Merchants typically use this instrument to make choices about when to purchase or promote the tokens. When the RSI is commonly valued under or at 30, it’s thought of an oversold area, and a value correction might occur quickly. Furthermore, when the RSI is valued above or at 70, it’s thought of because the overbought area, and merchants anticipate the value might fall quickly.

The RSI is at present valued at 63.43, indicating that MANA is experiencing a robust pattern. Furthermore, the RSI is above the SMA which is one other sign that MANA is at present witnessing a bullish sentiment. Nonetheless, the RSI made a fast reverse and a slight fall. RSI can be pointed downwards, which confirms that it might proceed to maneuver downwards for someday. If RSI crosses the SMA, then, MANA could be beneath the facility of the bears.

Decentraland (MANA) Worth Evaluation – Transferring Averages

At first of April, MANA confirmed indicators of consolidation because the candlesticks fashioned between the 50MA and the 200MA. Nonetheless, after just a few days handed, MANA broke via the 50 MA, indicating the beginning of the bull run. At the moment, MANA’s candlesticks are buying and selling above the 50MA and 200 MA, indicating that the facility is with the bulls.

The gap between the 50MA and 200MA is lowering, indicating that the indications might kind a loss of life cross. The formation of a loss of life cross will sign the beginning of the bears period. Nonetheless, if the hole between the indications continues to widen, then, the bulls will proceed to stay in energy.

Decentraland (MANA) Worth Evaluation – Transferring Averages Convergence Divergence

The Transferring Common Convergence Divergence (MACD) indicator can be utilized to establish potential value developments, momentums, and reversals in markets. MACD will simplify the studying of a transferring common cross simpler. The MACD indicator is calculated by subtracting the long-term EMA (Exponential Transferring Common) indicator from the short-term EMA. Usually, the default values for the MACD are set at 12-day EMA, 26-day EMA, and 9-day EMA. Furthermore, MACD is taken into account a lagging indicator because it can not present commerce alerts with none previous value information.

Merchants have reported that sometimes the Transferring Common might create false alerts concerning the value momentum, nonetheless, MACD performs an vital function as it could affirm the developments and establish the potential reversals.

Moreover, there are two strategies via which merchants can speculate the value’s momentum: the crossover methodology and the histogram methodology. Within the crossover methodology, when the MACD line crosses above the sign line, the pattern might change from a downtrend to an extended pattern. Nonetheless, if MACD crosses under the sign line, this might point out the beginning of a downtrend.

Within the Histogram methodology, the bars above the sign line point out an uptrend. In the meantime, the Histogram bars under the sign line point out a bearish pattern.

Trying on the charts, MANA observes a bullish sentiment because the histogram has fashioned inexperienced bars. The MACD line can be above the sign which confirms the facility stays to be with the bull. Furthermore, the bars within the histogram mannequin proceed to develop, indicating that the MANA could transfer upwards. The hole between the MACD line and the sign line could widen barely, which additional confirms the bullish market. Nonetheless, if the MACD line falls under the sign line, then, MANA might fall beneath the bears’ spell.

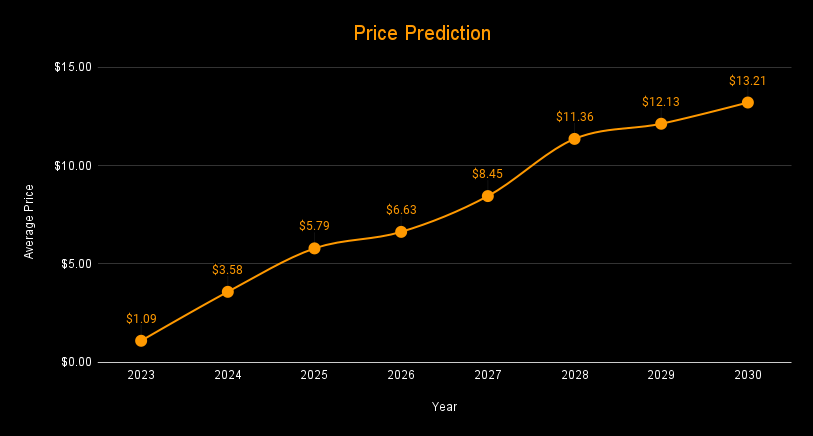

Decentraland (MANA) Worth Prediction 2023 – 2030 Overview

| Yr | Minimal Worth | Common Worth | Most Worth |

| 2023 | $0.56 | $1.09 | $2.31 |

| 2024 | $2.97 | $3.58 | $4.56 |

| 2025 | $4.76 | $5.79 | $6.24 |

| 2026 | $5.49 | $6.63 | $7.94 |

| 2027 | $7.87 | $8.45 | $9.82 |

| 2028 | $9.81 | $11.36 | $12.02 |

| 2029 | $11.56 | $12.13 | $14.53 |

| 2030 | $12.05 | $13.21 | $15.78 |

| 2040 | $22.62 | $23.19 | $25.53 |

| 2050 | $37.27 | $38.88 | $40.15 |

Decentraland (MANA) Worth Prediction 2023

Trying on the charts, MANA is at present above the 200MA and transferring nearer to the Resistance. The MACD additionally confirms that MANA is at present observing a bullish market as bars have fashioned above the sign line. Nonetheless, earlier, the MACD line was under the sign line, indicating that MANA was exhibiting indicators of bearish sentiment.

Furthermore, the bars proceed to develop above the sign, indicating that there’s a probability that MANA would proceed to maneuver upwards. If MANA continues to maneuver upwards and stays within the bullish sentiment, then, the candlesticks would attain the Resistance degree. MANA might additionally transcend the Resistance degree, if the upsurge continues, transferring towards the Sturdy Excessive area.

Nonetheless, if there’s a pattern reversal noticed, then, MANA might fall again to the Weak low. From the Weak Low, MANA might restart its trajectory in direction of the Resistance. If MANA continues to face the bearish sentiment, then, the value might tumble to the Assist area.

Finally, our value prediction for MANA stays to be bullish, anticipating it to achieve $1 or much more by the tip of 2023. The bearish value prediction for MANA could be $0.31, anticipating that it might not break via the present Assist degree.

| Bullish Worth Vary | Bearish Worth Vary |

| $0.9 – $2 | $0.3 – $0.5 |

Decentraland (MANA) Worth Prediction – Resistance and Assist Ranges

Trying on the charts, MANA is at present transferring nearer to the Weak Resistance, which is at $0.85. If MANA’s present trajectory breaks past the weak resistance degree, there’s a excessive chance that the candlesticks might attain the Resistance 1 degree at $1.5 . Furthermore, MANA might additionally attain past the Resistance 1 degree and will attain the Resistance 2 degree at $2.5, which is taken into account the very best bullish degree for 2023.

Nonetheless, If MANA comes beneath the affect of the bears, then, the candlesticks would attain the Assist degree and will go even decrease than $0.26

Decentraland (MANA) Worth Prediction 2024

Merchants are wanting ahead to this 12 months because it may very well be a historic second for cryptocurrencies, because the Bitcoin halving is anticipated to occur in 2024. More often than not, at any time when BTC rises, merchants have noticed an identical surge within the altcoins. MANA may be affected by Bitcoin halving and will commerce past the value of $4 by the tip of 2024.

Decentraland (MANA) Worth Prediction 2025

MANA might nonetheless expertise the after-effects of the Bitcoin halving and is anticipated to commerce above its 2024 value. Many commerce analysts speculate that BTC halving might create a big impact on the crypto market. Furthermore, just like many altcoins, MANA will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that MANA would commerce past the $6 degree.

Decentraland (MANA) Worth Prediction 2026

It’s anticipated that after an extended interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, MANA might tumble into its help areas of $6.01. Furthermore, when MANA stays within the oversold area, there may very well be a value correction quickly. MANA, by the tip of 2026, may very well be buying and selling past the $7 resistance degree after experiencing the value correction.

Decentraland (MANA) Worth Prediction 2027

Naturally, merchants anticipate a bullish market sentiment after the crypto trade was affected negatively by the bears’ claw. MANA is anticipated to rise after its slumber within the bear season. Furthermore, MANA might even break extra resistance ranges because it continues to recuperate from the bearish run. Subsequently, MANA is anticipated to commerce at $9 by the tip of 2027.

Decentraland (MANA) Worth Prediction 2028

As soon as once more, the crypto neighborhood is wanting ahead to this 12 months as there might be a Bitcoin halving. Alike many altcoins, MANA will proceed to kind new increased highs and is anticipated to maneuver in an upward trajectory. Therefore, MANA could be buying and selling at $12 after experiencing a large surge by the tip of 2028.

Decentraland (MANA) Worth Prediction 2029

2029 is anticipated to be one other bull run because of the aftermath of the BTC halving. Nonetheless, merchants speculate that the crypto market would step by step turn out to be steady by this 12 months. In tandem with the steady market sentiment and the slight value surge anticipated after the aftermath, MANA may very well be buying and selling at $14 by the tip of 2029.

Decentraland (MANA) Worth Prediction 2030

After witnessing a bullish run available in the market, MANA and lots of altcoins would present indicators of consolidation and would possibly commerce sideways for a while, whereas experiencing minor spikes. Subsequently, by the tip of 2030, MANA may very well be buying and selling at $15.

Decentraland (MANA) Worth Prediction 2040

The long-term forecast for MANA signifies that this altcoin might attain a brand new all-time excessive(ATH). This might be one of many key moments as HODLERS could anticipate to promote a few of their tokens on the ATH level. Nonetheless, MANA could face a slight fall earlier than beginning its upward journey as soon as once more. It’s anticipated that the common value of MANA might attain $25 by 2040.

Decentraland (MANA) Worth Prediction 2050

The neighborhood believes that there might be widespread adoption of cryptocurrencies, which might preserve gradual bullish positive aspects. By the tip of 2050, if the bullish momentum is maintained, MANA might surpass the resistance degree of $40.

Conclusion

As one of many prime metaverse tokens, MANA has been a part of the watch-out checklist for a lot of buyers. If buyers proceed to point out curiosity in MANA and these tokens of their portfolio, then, it might proceed to stand up. MANA’s bullish value prediction reveals that it might go past the $1 degree. Furthermore, MANA might surpass the $40 degree by the tip of 2050.

FAQ

Decentraland, as described on the web site, is a digital world owned by its customers. This digital world powered by the Ethereum blockchain permits customers to create, expertise, and monetize varied content material and providers throughout the ecosystem. MANA is the native token of Decentraland. MANA might be utilized to accumulate NFTs, and make funds throughout the Decentraland community.

MANA might be traded on many crypto exchanges comparable to Binance, OKX, CoinBase, KuCoin, SushiSwap, Uniswap, and Bybit.

Since MANA supplies buyers with a number of alternatives to revenue from their crypto lands and property, MANA appears to be a extremely good funding in 2023. Notably, MANA has a excessive risk of surpassing its present ATH in 2028.

MANA might break via the $10 Resistance in 2028 and commerce at a good increased degree.

MANA is among the prime metaverse tokens and continues to be a magnet for the crypto neighborhood. As buyers anticipate a bullish sentiment, they may add MANA to their portfolio for a attainable bull run. MANA is among the good investments in 2023, amongst different altcoins, because it focuses on breaking its Resistance degree.

MANA’s achieved its All-Time Excessive of $5.9 in November 2021.

The bottom value of MANA is $0.007883, which was attained on October 13, 2017, in keeping with CoinMarketCap.

MANA was launched on 2020.

MANA was based by Ariel Meilich and Esteban Ordano.

There isn’t any information.

MANA might be saved in a chilly pockets, scorching pockets, or trade pockets.

MANA value is anticipated to achieve $1 by 2023.

MANA value is anticipated to achieve $4 by 2024.

MANA value is anticipated to achieve $6 by 2025.

MANA value is anticipated to achieve $7 by 2026.

MANA value is anticipated to achieve $9 by 2027.

MANA value is anticipated to achieve $12 by 2028.

MANA value is anticipated to achieve $14 by 2029.

MANA value is anticipated to achieve $15 by 2030.

MANA Worth is anticipated to achieve $25 by 2040.

MANA Worth is anticipated to achieve $40 by 2050.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this value prediction, are revealed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be held answerable for any direct or oblique harm or loss.