- Ripple CTO David Schwartz emphasizes understanding tax implications in AMM transactions.

- Consumer shares tweet exhibiting an instance of upto 24% AMM excessive yields upon XRP withdrawal.

- David Schwartz takes lead within the twitter dialog and sheds gentle on AMM’s tax challenges.

David Schwartz, co-founder of Ripple, highlights the significance of understanding the tax implications related to AMM transactions. The CTO went on to elucidate that Depositing and withdrawing property from these swimming pools can set off taxable occasions, as customers successfully convert their cryptocurrency into liquidity supplier (LP) tokens upon deposit and again into cryptocurrency upon withdrawal.

The idea of “foundation” is of nice significance in navigating the tax panorama of AMM transactions. The worth of property deposited into the AMM pool on the time of entry serves as the premise for LP tokens, guiding the calculation of capital positive factors or losses upon redemption or sale.

The CTO requested the traders to contemplate a hypothetical state of affairs the place an investor deposits a combination of property into an AMM pool, subsequently redeeming a portion of their LP tokens. The positive factors or losses realized are contingent upon adjustments in asset values and the established foundation on the time of deposit.

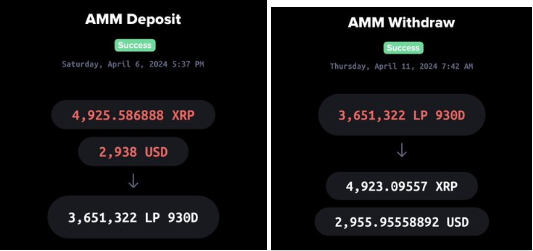

David Schwartz was replying to an ongoing dialog on twitter the place he hailed the XRP AMM Yeild Within the tweet, Hartner particulars an AMM deposit he made for 4926 XRP and 2938 USD. Then, 4.6 days later, he did a withdrawal and obtained 4923 XRP and 2956 USD. He calculates that over the 4.6 days, he had a mixed annualized earnings of 24%.

Customers like Niel Hartner shared their spectacular returns achievable via AMM swimming pools, with some customers boasting annualized positive factors exceeding 20%. These swimming pools permit members to earn yields by depositing their cryptocurrency holdings, capitalizing on the liquidity offered to facilitate decentralized buying and selling.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t answerable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.