- DAI stablecoin holders are including to positions as crypto costs vary.

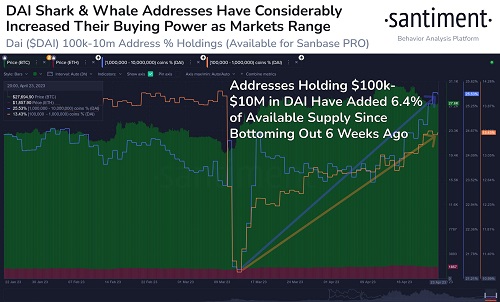

- Addresses with 100k-10 million DAI added 6.4% of provide previously six weeks.

- The general holdings for this cohort had dropped considerably as Bitcoin and Ethereum costs pumped in mid-March, Santiment knowledge reveals.

On-chain knowledge reveals giant buyers, the sharks and whale addresses with $100,000 to $10,000,000 value of DAI have lately added to their positions. Addresses with 100,000-1 million DAI maintain over 13% of provide whereas these with 1 million- 10 million DAI at present maintain over 25% of provide.

Whales purchase DAI stablecoin as markets vary

Because the crypto markets see recent volatility, market knowledge supplier Santiment has highlighted that after the rotation that adopted Bitcoin and Ethereum costs pumping in mid-March, sharks and whales have added 6.4% of DAI.

“Even with crypto markets rollercoastering in April, high stablecoins like $DAI are being gathered by sharks & whales. Since $DAI was exchanged for pumping $BTC & $ETH in mid-March, $100k-$10m DAI addresses have added 6.4% of the provision again since,” Santiment famous.

As of 23 April 2023, addresses with $100k- $1 million in DAI held 13.43% of the stablecoin’s provide, whereas addresses with $1 million-$10 million of DAI held about 25.53% of present provide. These cohorts have elevated their shopping for energy since their holdings bottomed out round mid-March, on-chain knowledge confirmed.

The chart beneath that Santiment shared on Twitter signifies the above state of affairs.

Dai stablecoin whale and sharks holdings. Chart courtesy of Santiment on Twitter

Dai stablecoin whale and sharks holdings. Chart courtesy of Santiment on Twitter

What’s Dai (DAI)?

DAI is the native stablecoin for main lending protocol Maker, whose governance token MKR at present trades round $688. Dai is the primary decentralised, crypto-collateralised stablecoin, with its worth pegged 1:1 to the US Greenback.

One of many advantages of Dai is with its use in mitigating value volatility in a crypto market the place digital asset costs can swing wildly at any given time. The token can be extremely composable with dApps, together with DeFi business’s main tasks Uniswap and Compound.

What does whales’ shopping for of DAI imply for crypto costs?

Usually, giant whale transactions involving stablecoins has preceded main accumulation of crypto tokens akin to Bitcoin and Ethereum. That is so as a result of shopping for of stablecoins akin to DAI, Tether and USD Coin have normally indicated whales positioning of cash in readiness for getting.

BTC and ETH costs have lately retreated from highs above $31k and $2.1k respectively as those that purchased on the high seemingly promote.