- CYBER’s surge to $5.68 signifies rising investor curiosity and potential for a $6.00 breakthrough.

- Optimistic MACD hints at shopping for strain, however its southward development signifies consolidation.

- Overbought CYBER at 78.47 on stochastic RSI alerts a nearing pullback.

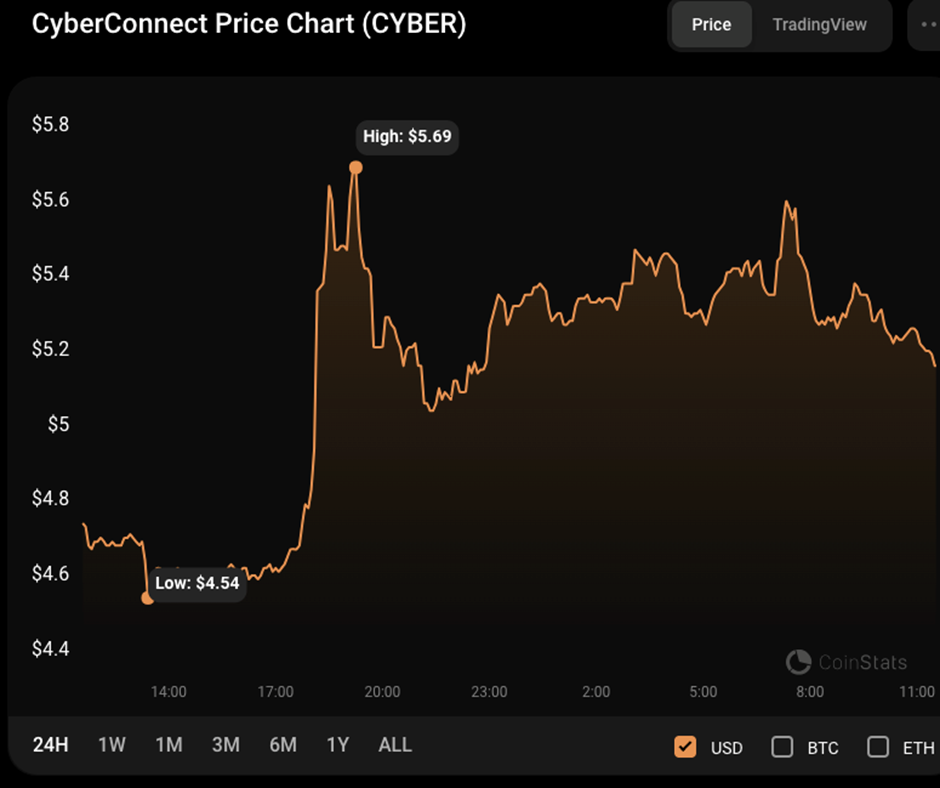

Regardless of a bearish begin to the day, CyberConnect (CYBER) bulls managed to rectify the damaging temper, surging from an intraday low of $4.57 to a 24-hour excessive of $5.68. CYBER was buying and selling at $5.20 at press time, a 9.77% enhance over the day past’s closing value.

CYBER’s market capitalization and 24-hour buying and selling quantity elevated by 9.90% and 378.56%, respectively, to $57,321,177 and $197,802,683. Because the market capitalization and commerce quantity have elevated, this means elevated curiosity from traders and certain elevated buying exercise.

If bulls handle to transcend $5.68, they might have their sights set on the $6.00 barrier. Furthermore, if this degree is breached, it would sign a big psychological threshold for traders. Moreover, the rise in buying and selling quantity suggests substantial liquidity within the CYBER market, which can quickly result in heightened value volatility.

Optimistic Transferring Common Convergence Divergence (MACD) motion, at 0.04129254, reinforces the bullish stance for CYBER. This sample implies that buying strain is growing, which could result in a value enhance. Nevertheless, the MACD blue line is transferring south, suggesting a possible decline in momentum that alerts a quick consolidation or a possible reversal quickly.

Moreover, the Chaikin Cash Stream development with a degree of 0.02 signifies an inflow of cash into CYBER, suggesting modest buying exercise. Whereas costs proceed to rise, the CMF indicator is comparatively weak, that means that purchasing strain could also be inadequate to assist a sustained uptrend. If the CMF shifts into damaging territory, it would suggest a surge in promoting strain and an additional drop within the value of CYBER.

With a Fisher Rework ranking of 0.69 and a crossing beneath its sign line, CYBER’s bullish momentum could also be waning. This sample suggests latest buying exercise is fading, and the value could shortly start to fall.

As well as, the 78.47 worth on the stochastic RSI signifies that CYBER is overbought and could also be prepared for a pullback. This excessive ranking exhibits that CYBER has been quickly rising, but it surely additionally alerts that it might be nearing the top of its run. If the stochastic RSI stays at such excessive ranges or begins to fall, it might be a sign for merchants to think about taking positive aspects or promoting their holdings in CYBER.

In conclusion, CYBER’s latest surge alerts rising curiosity, however warning is suggested as overbought indicators counsel a possible pullback.

Disclaimer: The views, opinions, and knowledge shared on this value prediction are printed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates is not going to be accountable for direct or oblique harm or loss.