- Bullish Curve DAO Token (CRV) value prediction ranges from $0.799 to $0.8334.

- Evaluation suggests CRV value may additionally attain $1 this 2023.

- CRV’s bearish market value prediction for 2023 is $0.509.

Curve (CRV) is an Ethereum token used to energy Curve.fi, a decentralized trade, and automatic market maker protocol. The protocol is meant to make it easy to trade ERC-20 tokens akin to stablecoins (akin to USDC and DAI) and Ethereum-based Bitcoin tokens. Many of the protocol’s liquidity swimming pools are made up of comparable belongings to reduce impermanent loss, although, in June 2021, it launched a USDT-WBTC-ETH “tricrypto” pool. The CRV token will be locked for varied durations (as much as 4 years) to vote on governance and declare protocol charges as a reward.

In case you are concerned about the way forward for CRV and need to know its predicted worth for 2022, 2023, 2024, 2025, and 2030, preserve studying!

Curve DAO Token (CRV) Market Overview

HTTP Request Failed… Error: file_get_contents(https://api.coingecko.com/api/v3/cash/curve-dao-token): Did not open stream: HTTP request failed! HTTP/1.1 429 Too Many Requests

What’s Curve DAO Token (CRV)?

Curve.fi is a blockchain-based decentralized trade that employs an automatic market maker, and the Curve DAO Token, an Ethereum-based token, powers its ecosystem. The Curve DAO Token is essential to the modern consumer interface that harnesses the facility of the decentralized monetary system.

Tokens constructed on Ethereum and stablecoins like DAI could also be simply traded with each other and with Bitcoin by way of the Curve protocol. As a decentralized trade that hyperlinks customers to these with the very best pricing, Curve gives low slippage charges and low cost prices when buying and selling tokens.

On account of its focus as an AMM on stablecoin buying and selling, Curve has garnered a variety of consideration. Given CRV’s utilization for governance, since it’s distributed to customers primarily based on liquidity dedication and time period of possession, the debut of the DAO and CRV token resulted in elevated earnings.

AMMs churning over huge quantities of liquidity and associated consumer features has assured Curve’s existence because of the increase in DeFi buying and selling. Thus, Curve is designed for customers concerned about yield farming, liquidity mining, or maximizing earnings whereas minimizing danger by proudly owning stablecoins which are theoretically nonvolatile. The platform generates income by a nominal cost paid to the liquidity suppliers.

There was a variety of pleasure across the not too long ago launched Curve DAO token. On account of its low slippage and low charges for exchanging related stablecoins and ERC-20 tokens, Curve DAO noticed important progress within the second half of 2020.

Due to its cutting-edge expertise and technological prowess, Curve DAO units itself out as a promising DeFi trade: Curve. It eliminates the necessity for conventional order books by pooling liquidity by way of digital contracts. Merchants and trade protocols facilitate the shopping for and promoting tokens and stablecoins whereas customers are linked to probably the most advantageous trade paths. Curve’s expertise and talent to trade tokens and stablecoins have made it a darling for decentralized finance.

Incurable loss is feasible utilizing Curve, as is the case at any time when cash is deposited into a wise contract or transacted with an AMM. Whereas Curve’s unique assist for stablecoins mitigates the hazard of fast market motion, customers nonetheless stand to lose out when values are rebalanced to reflect these in different markets. Even when Curve has undergone auditing, there’s nonetheless a hazard of getting uncovered to a particular cryptocurrency.

Newest Information on Curve DAO Token (CRV)

On July 31, 2023, it was reported that Curve Finance confronted a lack of greater than $47 million brought on by a “malfunctioning reentrancy lock.” This additional triggered CRV’s downtrend, dropping its value even downwards. Despite the fact that CRV confronted an unsightly downfall, it was noticed that buyers and establishments nonetheless present a eager curiosity in CRV.

For example, Lookonchain, an on-chain analytics platform, seen that a number of buyers bought CRV by over-the-counter. It was famous that Machi Massive Brother bought 3.75 million CRV, DWF Labs purchased 2.5 million CRV, and Cream Finance bought 2.5 million CRV.

Whereas the aim behind these purchases will not be clear, we may speculate that buyers are holding on to CRV and anticipate the costs to stand up sooner or later, regardless of its market hiccup.

Curve DAO Token (CRV) Present Market Standing

CRV is ranked within the 74 place primarily based on its market capitalization, based on CoinMarketCap. The present circulating provide of the CRV community’s native token is 883,625,768 CRV, whereas its most provide is 3,303,030,299.

Furthermore, CRV is priced at $0.5644, dealing with a 21.95% fall in seven days. With a market cap of $498,796,851, CRV additionally witnessed a 5.81% fall in 24 hours. Furthermore, CRV could also be witnessing a fall in its demand because the buying and selling quantity, valued at $285,095,123, after a fall of 29.67%% in at some point.

Now, let’s dive additional and talk about the value evaluation of SingularityNET’s native token, CRV, for 2023.

Curve DAO Token (CRV) Worth Evaluation 2023

Will CRV’s most up-to-date enhancements, additions, and modifications assist the value of cryptocurrencies rise? Furthermore, would the adjustments within the blockchain business have an effect on CRV’s sentiment over time? Learn extra to search out out about CRV’s 2023 value evaluation.

Curve DAO (CRV) Worth Evaluation – Bollinger Bands

With Bollinger Bands, it’s doable to find out and analyze the value motion and the volatility of an asset. Furthermore, Bollinger Bands is used primarily based on the empirical regulation of ordinary deviation because the higher band is calculated by including 2 customary deviations from the center line, and the decrease band is calculated by subtracting 2 customary deviations from the center line. Lastly, the empirical regulation of ordinary deviation states that 95% of the information units can be inside the two customary deviations.

Trying on the candlesticks, CRV’s current fall expanded the higher band and the decrease band, making a extremely unstable market. Although the candlesticks crossed the decrease band, CRV might proceed to fall if the bulls don’t rally to the altcoin’s protection. Furthermore, in the long run interval, CRV might climb up quickly brought on by the value correction impact.

Curve DAO (CRV) Worth Evaluation – Relative Power Index (RSI)

Just like an oscillator, the Relative Power Index (RSI) is often valued between 0 and 100. The RSI helps merchants and potential buyers to know the present development of an asset. Ideally, most merchants reap the benefits of RSI’s characteristic to create a sign on deciding when to purchase or promote an asset. When RSI reaches or goes under 30, merchants typically see this as an ‘oversold area’. In the meantime, if RSI crosses above or reaches 70, then, there’s a excessive likelihood {that a} specific asset is buying and selling within the overbought area. It’s anticipated that at any time when an asset reaches any of the intense zones within the overbought area or the oversold area, there may very well be a reversal.

The RSI is valued at 29.03, indicating that CRV is at present buying and selling within the oversold area. Furthermore, the indicator can be under the SMA, which additional signifies that there may bearish development within the present market. It’s anticipated that when the belongings enter the oversold area {that a} value correction might occur quickly. Nonetheless, it is very important notice that CRV might stay within the oversold area and merchants want to attend for extra confirmations.

Curve DAO (CRV) Worth Evaluation – Shifting Common Convergence Divergence (MACD)

The Shifting Common Convergence Divergence (MACD) indicator helps the dealer to simply establish the development of an asset, and its present sentiment. Mainly, MACD reveals the distinction between two Exponential Shifting Common (EMA) and helps merchants to see the crossover between them. By default, MACD has a set worth of 12-day EMA, 26-EMA, and 9-day EMA. The MACD permits customers to simply see the value development by its line and histogram visualization.

The MACD indicator continues to type a pink bar by observing the histogram mannequin. The continual formation of pink bars may very well be an indication that CRV might face a downtrend for a while earlier than anticipating a shift within the development. Moreover, the hole between the MACD line and the sign line continues to develop additional confirming the CRV’s bearish development nonetheless exists.

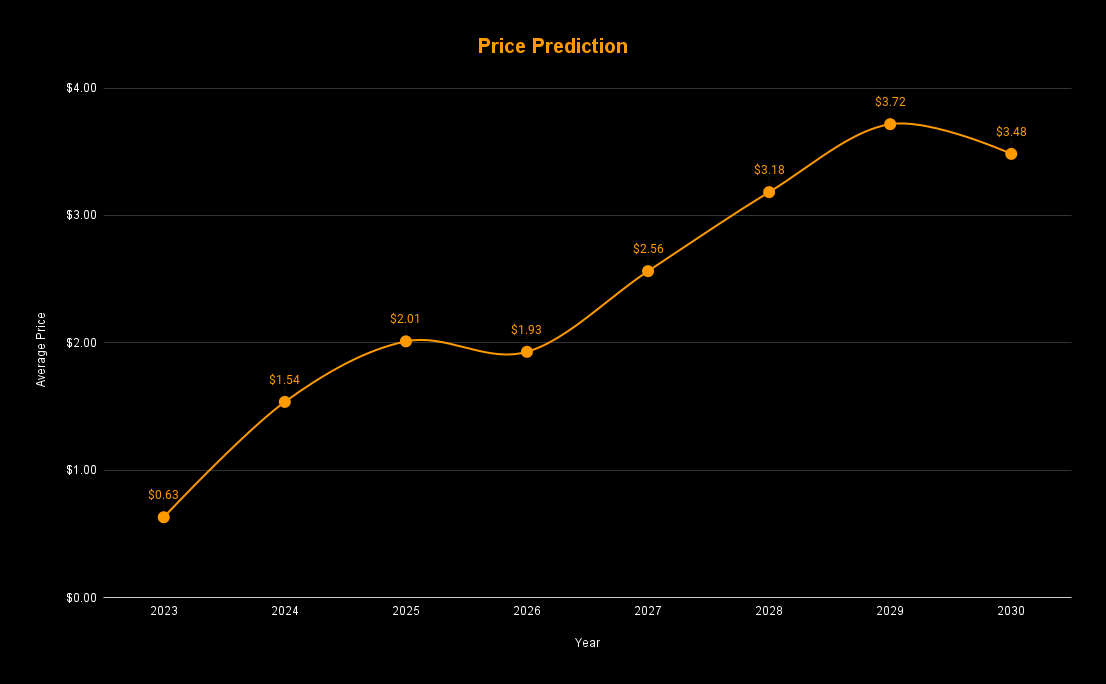

Curve DAO (CRV) Worth Prediction 2023 – 2030

| 12 months | Minimal Worth | Common Worth | Most Worth |

| 2023 | $0.509 | $0.632 | $0.833 |

| 2024 | $1.453 | $1.537 | $1.692 |

| 2025 | $1.978 | $2.012 | $2.171 |

| 2026 | $1.742 | $1.93 | $2.223 |

| 2027 | $2.481 | $2.563 | $2.644 |

| 2028 | $2.718 | $3.183 | $3.292 |

| 2029 | $3.457 | $3.716 | $3.801 |

| 2030 | $3.281 | $3.483 | $3.752 |

| 2040 | $10.34 | $11.46 | $12.52 |

| 2050 | $20.13 | $21.87 | $22.57 |

Curve DAO (CRV) Worth Prediction 2023

The candlesticks are at present struggling to remain above the essential line of $0.567. There’s a likelihood that the candlesticks might bounce again and attain the road at $0.799, which may very well be the restoration stage. Nonetheless, there’s a lengthy hole between them, and the candlesticks are nonetheless under 200SMA suggesting that it could take a while earlier than a restoration. Nonetheless, one other doable means CRV might expertise a serious spike is thru bulls entry.

In the meantime, the value prediction of CRV for 2023 stays to be bullish and is anticipated to succeed in past the extent of $0.799. The bearish value prediction vary for CRV is between $0.509 to $0.567 Nonetheless, if CRV experiences excessive bullish sentiment, then it could attain the $1 stage.

| Bullish Worth Prediction | Bearish Worth Prediction |

| $0.799 – $0.8334 | $0.509 – $0.567 |

Curve DAO (CRV) Worth Prediction 2024

Merchants are trying ahead to this yr because it may very well be a historic second for cryptocurrencies, because the Bitcoin halving is anticipated to occur in 2024. More often than not, at any time when BTC rises, merchants have noticed the same surge within the altcoins. CRV may be affected by Bitcoin halving and will commerce past the value of $1.6 by the tip of 2024.

Curve DAO (CRV) Worth Prediction 2025

CRV may nonetheless expertise the after-effects of the Bitcoin halving and is anticipated to commerce above its 2024 value. Many commerce analysts speculate that BTC halving may create a huge effect on the crypto market. Furthermore, just like many altcoins, CRV will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that CRV would commerce past the $2 stage.

Curve DAO (CRV) Worth Prediction 2026

It’s anticipated that after an extended interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, CRV may tumble into its assist area of $1.8. Furthermore, when CRV stays within the oversold area, there may very well be a value correction quickly. CRV, by the tip of 2026, may very well be buying and selling past the $2.2 resistance stage after experiencing the value correction.

Curve DAO (CRV) Worth Prediction 2027

Naturally, merchants anticipate a bullish market sentiment after the crypto business was affected negatively by the bears’ claw. CRV is anticipated to rise after its slumber within the bear season. Furthermore, CRV may even break extra resistance ranges because it continues to get better from the bearish run. Due to this fact, CRV is anticipated to commerce at $2.6 by the tip of 2027.

Curve DAO (CRV) Worth Prediction 2028

As soon as once more, the crypto group is trying ahead to this yr as there might be a Bitcoin halving. Alike many altcoins, CRV will proceed to type new greater highs and is anticipated to maneuver in an upward trajectory. Therefore, CRV can be buying and selling at $3.2 after experiencing an enormous surge by the tip of 2028.

Curve DAO (CRV) Worth Prediction 2029

2029 is anticipated to be one other bull run because of the aftermath of the BTC halving. Nonetheless, merchants speculate that the crypto market would regularly develop into steady by this yr. In tandem with the steady market sentiment and the slight value surge anticipated after the aftermath, CRV may very well be buying and selling at $3.8 by the tip of 2029.

Curve DAO (CRV) Worth Prediction 2030

After witnessing a bullish run available in the market, CRV and lots of altcoins would present indicators of consolidation and may commerce sideways for a while whereas experiencing minor spikes. Due to this fact, by the tip of 2030, CRV may very well be buying and selling at $3.7.

Curve DAO (CRV) Worth Prediction 2040

The long-term forecast for CRV signifies that this altcoin may attain a brand new all-time excessive(ATH). This could be one of many key moments as HODLERS might anticipate to promote a few of their tokens on the ATH level. Nonetheless, CRV might face a slight fall earlier than beginning its upward journey as soon as once more. It’s anticipated that the value of CRV may attain $12.52 by 2040.

| Minimal Worth | Common Worth | Most Worth |

| $10.34 | $11.46 | $12.52 |

Curve DAO (CRV) Worth Prediction 2050

The group believes that there might be widespread adoption of cryptocurrencies, which may keep gradual bullish features. By the tip of 2050, if the bullish momentum is maintained, CRV may surpass the resistance stage of $22.57.

| Minimal Worth | Common Worth | Most Worth |

| $20.13 | $21.87 | $22.57 |

Conclusion

To summarize, if buyers proceed to point out curiosity in CRV and add these tokens to their portfolio, then, it may proceed to stand up. CRV’s bullish value prediction reveals that it may cross past the $0.799 stage. Furthermore, CRV may surpass the $22.57 stage by the tip of 2050.

FAQ

Curve.fi is a blockchain-based decentralized trade that employs an automatic market maker, and the Curve DAO Token, an Ethereum-based token, powers its ecosystem. The Curve DAO Token is essential to the modern consumer interface that harnesses the facility of the decentralized monetary system.

Tokens constructed on Ethereum and stablecoins like DAI could also be simply traded with each other and with Bitcoin by way of the Curve protocol. As a decentralized trade that hyperlinks customers to these with the very best pricing, Curve gives low slippage charges and low cost prices when buying and selling tokens.

CRV will be traded on many exchanges like different digital belongings within the crypto world. Binance, Coinbase Alternate, KuCoin, Gemini, and Kraken are at present the most well-liked cryptocurrency exchanges for buying and selling CRV.

CRV has the potential to assist buyers achieve revenue by a number of alternatives. Furthermore, if there’s a steady entry of bulls into the market, then, CRV has the potential to type new All-Time Excessive.

CRV is among the few lively crypto belongings that proceed to rise in worth. So long as this bullish development continues, CRV may break by $6 and attain as excessive as $10. After all, if the present market favoring crypto continues, it is going to seemingly occur.

CRV’s upward development may proceed as merchants present curiosity over time. Together with many options, CRV may proceed to develop over time making it a very good funding over time.

The bottom CRV value is $0.3316, attained on October 25, 2020, based on CoinMarketCap.

CRV was launched in January 2020.

Michael Egorov co-founded CRV.

CRV has a most provide of three,303,030,299 CRV.

CRV will be saved in a chilly pockets, scorching pockets, or trade pockets.

CRV is anticipated to succeed in $0.7305 in 2023.

CRV is anticipated to succeed in $1.6 in 2024.

CRV is anticipated to succeed in $2 in 2025.

CRV is anticipated to succeed in $2.2 in 2026.

CRV is anticipated to succeed in $2.6 in 2027.

CRV is anticipated to succeed in $3.2 in 2028.

CRV is anticipated to succeed in $3.8 in 2029.

CRV is anticipated to succeed in $3.7 in 2030.

CRV is anticipated to succeed in $12.52 in 2040.

CRV is anticipated to succeed in $22.57 in 2050.

Disclaimer: The views and opinions, in addition to all the data shared on this value prediction, are printed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates is not going to be held accountable for any direct or oblique harm or loss.