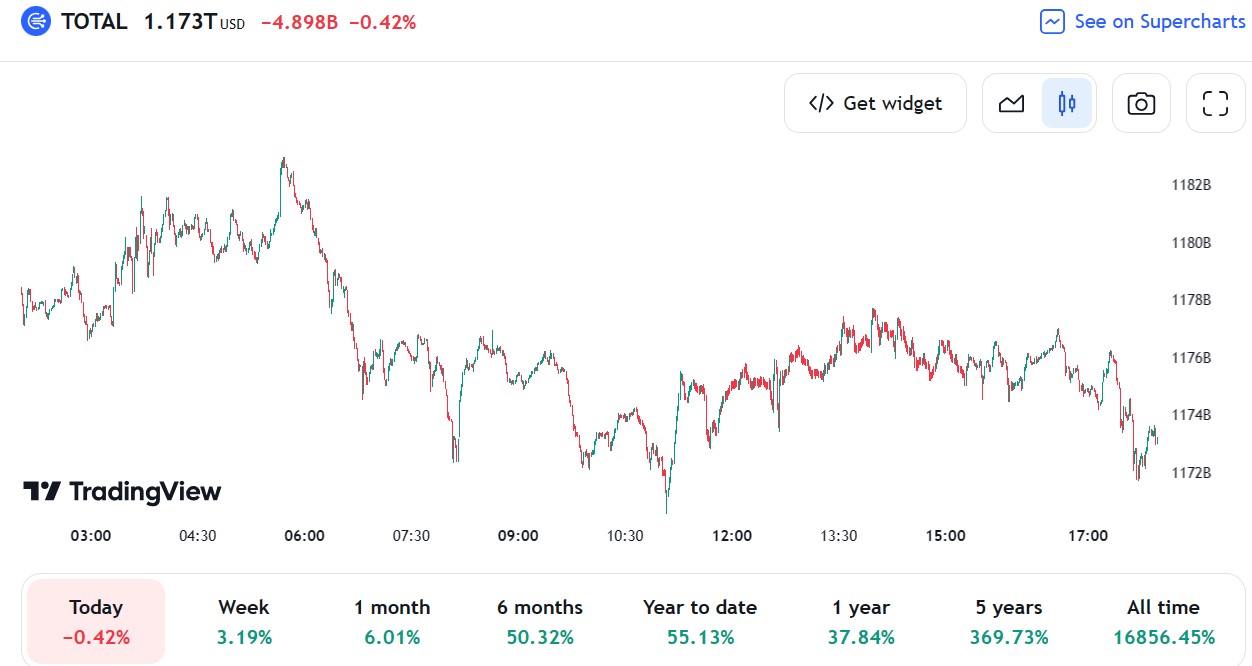

- The overall cryptocurrency market capitalization grew by greater than 50% within the final six months

- Buyers are optimistic as Bitcoin’s value holds close to the yearly excessive

- Ethereum, Litecoin, and Ripple have adopted Bitcoin larger

The primary half of the buying and selling 12 months is behind us, and some of the notable developments is the rise within the whole crypto market capitalization. Following 2022, when many crypto buyers obtained fed up with business scandals and left, the 2023 rally appears like the beginning of a brand new bullish market.

The efficiency is much more spectacular, provided that the US greenback is buying and selling with a blended tone towards its fiat rivals.

Buyers’ renewed curiosity in cryptocurrencies led to the full market capitalization rising by greater than 50% within the 12 months’s first half. Solely within the final week, the market grew by greater than 3%, and buyers are optimistic as a result of Bitcoin, the main cryptocurrency, holds close to the yearly excessive.

Ethereum, Litecoin, and Ripple have adopted Bitcoin larger

Bitcoin is the principle cause why buyers are optimistic concerning the cryptocurrency business regardless of the continuing scandals, frauds, and lawsuits. Ultimately, all that issues for market watchers is that Bitcoin’s value holds near the yearly excessive, regardless of rallying in 2023 by over +85%.

Due to this fact, the trail of least resistance within the 12 months’s second half appears to be the upside.

Bitcoin chart by TradingView

Not all currencies carried out like Bitcoin, although. As an illustration, Dogecoin is flat on the 12 months, up by about +0.3% within the first six months of 2023. This can be a large divergence from what Bitcoin and different cryptocurrencies did (e.g., Ethereum, Litecoin, Ripple), and it displays the crypto buyers’ focus in a couple of cryptocurrencies.

Shifting ahead within the 12 months’s second half, crypto buyers may wish to watch the developments within the conventional foreign money market. Extra exactly, what is going to the Fed do with the funds fee?

If the US greenback loses floor towards its rival fiat currencies within the subsequent six months, Bitcoin and the opposite main cryptocurrencies are nicely positioned to rally some extra. Because the Fed paused the speed hikes in June, one ought to embrace the opportunity of the present funds fee being the terminal one for this tightening cycle.