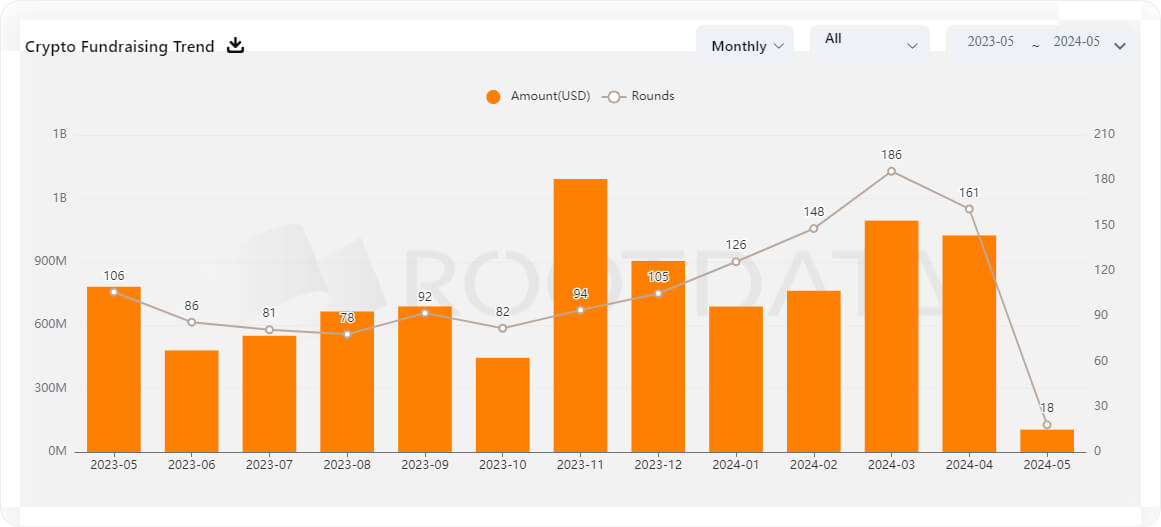

- Crypto enterprise fundraising reached $1.02 billion in April, in comparison with $10.9 billion in March.

- RootData’s web site exhibits complete funding rounds by VCs hit 161 in April, barely down from 186 the earlier month.

Enterprise capital funding throughout the cryptocurrency house surpassed the $1 billion mark in April, a feat which means the trade has now hit this milestone for 2 consecutive months.

In line with particulars on Web3 asset knowledge platform RootData, VC funding in April reached $1.02 billion. This represented quantities raised throughout 161 rounds.

Whereas April’s complete quantity raised from enterprise capital buyers didn’t match the $1.09 billion raised in March, it represents the third-highest mark up to now 12 months. March noticed 186 funding rounds, up from 148 in February when VC companies injected over $762 million into crypto initiatives.

Crypto VC funding year-to-date has seen over $3.67 billion, capturing investments throughout 639 rounds to this point.

The main points counsel this 12 months might see VC participation within the crypto house surpass the earlier 12 months’s figures in each the quantity invested and the whole variety of crypto initiatives. In 2023, crypto initiatives throughout infrastructure, DeFi, gaming and DAOs recorded over $9.3 billion.

Crypto optimism as VC funding soars

Already, hitting the billion greenback mark for a second consecutive month suggests continued broader optimism from the funding neighborhood.

Animoca Manufacturers, Polychain Capital, Paradigm, Coinbase Ventures, Pantera, Binance Labs, Dragonfly and NGC Ventures have been a number of the most energetic gamers within the house to this point this 12 months. a16z additionally stays a prime participant within the house.

Amongst notable fundraises in April was the $47 million funding in real-world asset tokenization platform Securitize. Asset administration large BlackRock led the funding spherical. Coinbase Ventures and Pardigm backed layer-1 blockchain Monad’s $225 million spherical.

When it comes to funding scale, the overwhelming majority of initiatives (over 82%) have secured investments of between $1 million and $10 million. Nevertheless, a complete of 74 fundraising rounds have seen investments of greater than $10 million.

Of those, 9 Web3 startups have attracted greater than $50 million every from prime VC companies.