- Crypto and shares reacted negatively to feedback about US inflation by Fed Chair Jerome Powell.

- Bitcoin traded to lows of $22,120 whereas the S&P 500 fell 1%.

- Buyers at the moment are more likely to flip their consideration to the following Fed assembly in March.

Cryptocurrencies fell early Tuesday, with Bitcoin buying and selling in direction of help round $22,100 on broader market response to feedback from Federal Reserve Chair Jerome Powell.

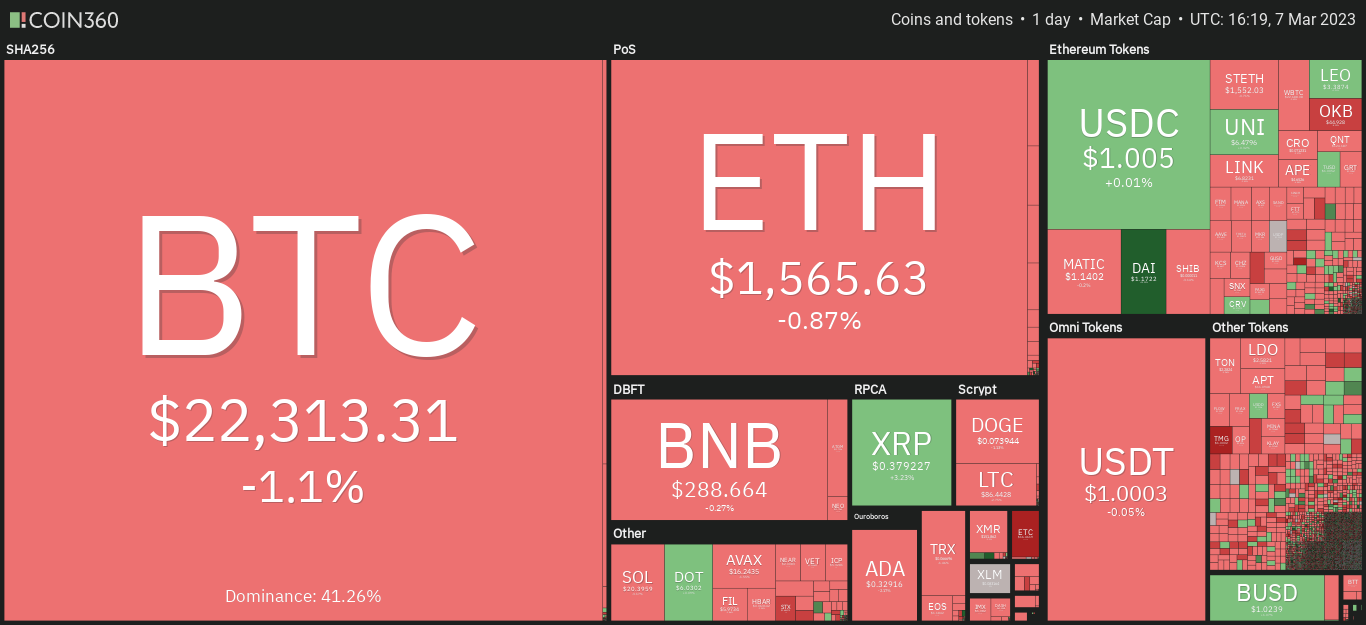

Coin360 crypto map exhibiting worth dump after Powell’s remarks. Supply: Coin360

Coin360 crypto map exhibiting worth dump after Powell’s remarks. Supply: Coin360

The response additionally noticed US shares slip after Monday’s features, with traders showing to have been spooked by Powell’s remarks on rates of interest.

Crypto, shares fall on Fed Chair remarks

Powell was on Tuesday making his first of two appearances earlier than US Congress – first on the Senate Banking Committee and on the second day, on the Home Monetary Companies Committee. The central financial institution’s financial coverage, notably on inflation, is a key ingredient of the Fed Chair’s ready testimony.

Notably, Powell advised lawmakers that it’s potential the Fed will look to boost rates of interest additional given current financial knowledge that got here in hotter than anticipated. Based on the Fed, these units of financial metrics recommend rates of interest may nonetheless go up. This, he famous, might be warranted if outlook indicated there’s want for sooner tightening.

Following the information, crypto, shares and bonds reacted decrease because the greenback index rose. Bitcoin touched 24-hour lows of $22,120, whereas Ethereum fell to help close to $1,540. Throughout the inventory market, the S&P 500 dropped by 1%, whereas the Dow Jones Industrial Common and the Nasdaq Composite shed 0.6% and 0.9% respectively.

Economist Mohamed El-Erian identified the market’s response and what Powell’s testimony initiatives.

A lot for the repeated dovish mentions of disinflation on the final press convention#Fed Chair Powell’s ready feedback now tilt to the hawkish aspect, together with the quote beneath that may go viral#Shares and #bonds dump as they look ahead to his responses to Senators’ questions pic.twitter.com/xOozIXczam

— Mohamed A. El-Erian (@elerianm) March 7, 2023

Whereas markets would possibly see a swift bounce from the losses, traders are more likely to stay jittery forward of the Fed’s subsequent coverage announcement anticipated on 22 March, 2023.