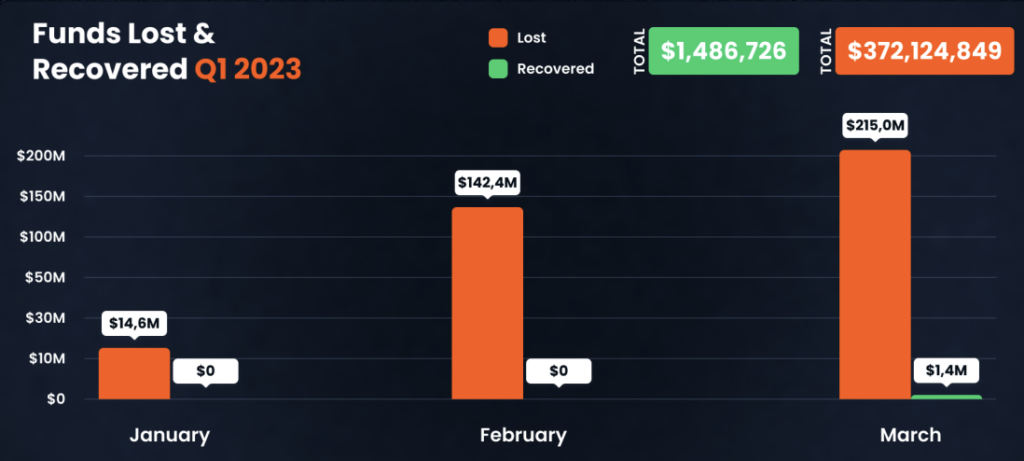

The crypto sphere misplaced $372 million to scams and exploits within the first quarter of 2023, in accordance with a latest report from the creators of Rekt Database, De.Fi (previously DeFiYieldApp.)

In response to the report, Euler Finance, BonqDAO, and CoinDeal suffered the highest three most appreciable losses with $196 million, $120 million, and $45 million, respectively.

Q1 losses

The quantity misplaced to scams and exploits recorded a gradual progress from January to March. The $14.6 million recorded in January grew by 875% in February and reached $142,4 million. This quantity grew by one other 50% to see $215 million in March.

It’s value noting that this yr’s $372 million displays a 71% lower from the $1.2 billion recorded within the first quarter of 2022.

Largest losers

The report additionally famous that Euler Finance, BongDAO, and CoinDeal contributed probably the most to the quantity misplaced to exploits and schemes.

On March 13, Euler Finance suffered a flash mortgage assault and misplaced $197 million, which positioned Euler on the high of the charts as probably the most important lack of the primary quarter of 2023. BonqDAO adopted Euler Finance by shedding $120 million to an oracle concern on Feb. 2. CoinDeal scheme is positioned third because it raised $45 million till it obtained busted on Jan. 4.

The mixture quantity misplaced by Euler Finance and BonqDAO added as much as $317 million, which accounts for 85% of the full losses recorded since January. The report additionally famous that flash mortgage assaults resulted in probably the most appreciable losses through the first three months of the yr, whereas oracle points adopted because the second, corresponding with the strategies of the 2 most important assaults of the primary quarter.

Chains most attacked

When the assaults are categorized based mostly on their chain, BNB Chain (BNB) emerged as the preferred chain for crypto criminals. BNB Chain suffered 18 episodes out of 47 recorded through the first three months of the yr, which account for over 38% of the assaults.

Ethereum (ETH) adopted BNB Chain because the second hottest alternative by being the goal of 10 assaults, accounting for 21% of the assaults. Arbitrum (ARB) was positioned third by struggling seven assaults through the first quarter of 2023.

Restoration charge

In response to numbers, the losses recorded in January and February accounted for 42% of the full losses recorded within the first quarter of 2023, with a zero restoration charge. Solely $1.4 million was recovered in March, compensating for lower than 0.3% of the full losses recorded since January.

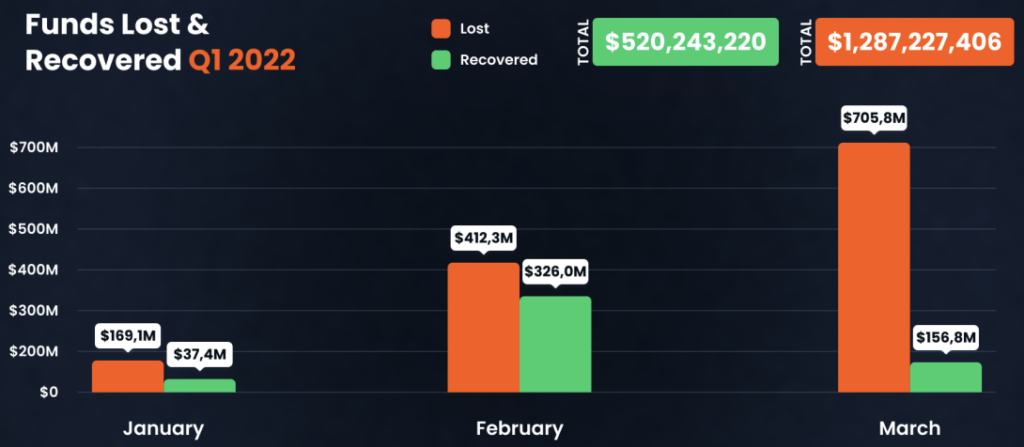

This charge seems significantly decrease than the restoration charge recorded within the first quarter of 2022. Over $1.2 billion was misplaced to scams and exploits through the first three months of 2022. Of that quantity, $520 million was recovered, which accounted for 40% of the full quantity misplaced.