Crypto-related exploits, hacks, and scams in Might resulted in practically $60 million in losses, in accordance with blockchain safety agency Certik.

On Might 31, CertiK confirmed that malicious gamers within the business stole $59.8 million by way of exit scams, flash mortgage assaults, and DeFi protocol exploits. This introduced the whole year-to-date malicious losses to $489.57 million.

In April, Certik reported whole malicious losses of $103 million, making Might’s determine a big discount over the earlier month.

Current main assaults

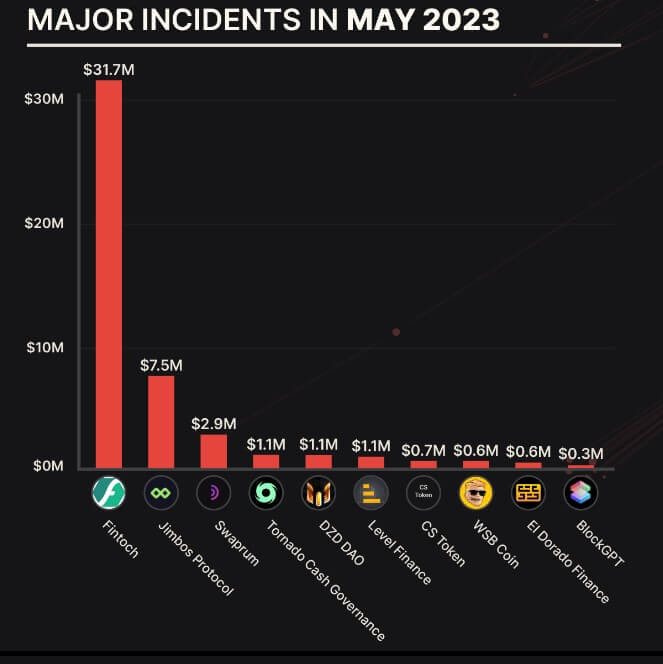

On-chain Dectective ZachXBT reported an exit rip-off by crypto funding platform Morgan DF Fintoch, which allegedly stole $31.6 million. starcrypto reported that the corporate made a number of faux claims and used a paid actor as its CEO.

The Jimbos protocol’s $7.5 million flash mortgage exploit misplaced 4,000 Ethereum (ETH) on Might 28. The group mentioned it was now working with regulation enforcement businesses after its 10% bounty provide to return stolen funds was ignored.

Different notable incidents embrace The Twister Money (TORN) governance assault, which led to a big drop within the token worth, and the Deus DAO burn perform exploit, leading to a $6.5 million loss.

Moreover, copycat meme cash stay an issue. One such case was the launch of a token imitating $PSYOP. The token’s creator, eth_ben, accused @3orovik of taking the PSYOP title, including that customers couldn’t distinguish the 2 tokens.

Hackers are nonetheless counting on mixers to maneuver their ill-gotten funds. As of Might 31, Peckshield reported that malicious gamers transferred 956 ETH and eight,410 BNB into Twister Money, whereas 450 BNB have been despatched to Fastened Float.

The put up Crypto scams and exploits in Might led to $60M loss: CertiK appeared first on starcrypto.