- In Might, the in-house spot buying and selling quantity within the crypto market hit a brand new low, says Blofin.

- The market skilled a extreme lack of liquidity in June as a result of ongoing strain & traders’ desire for promoting volatility.

- The present market efficiency displays low realized volatility, and decreased buying and selling quantity.

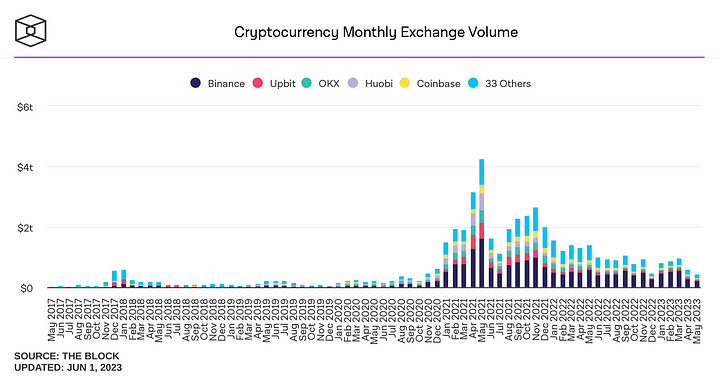

In accordance with a current evaluation by Blofin, the amount of in-house spot buying and selling in Might has reached a brand new low in comparison with December 2020. This decline in buying and selling exercise could be attributed to the rising affect of synthetic intelligence (AI) within the monetary markets.

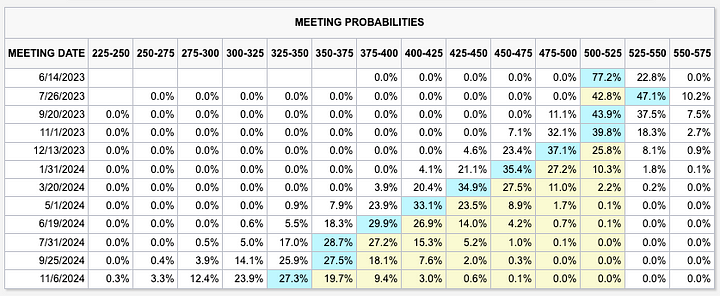

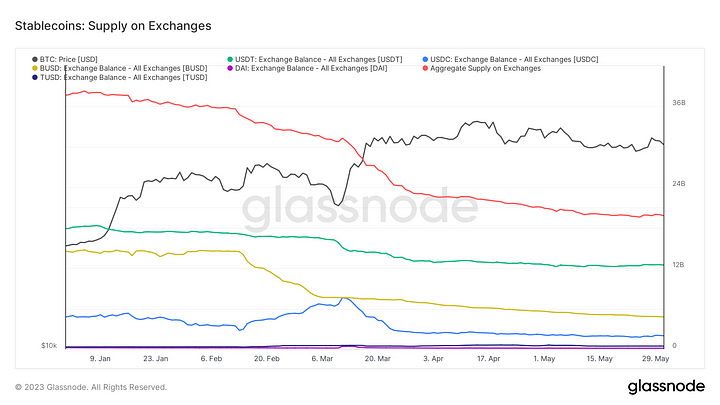

In June, the crypto market skilled a extreme lack of liquidity as a result of ongoing liquidity strain, shifting market narratives, and reducing uncertainty ranges. Buyers’ desire for different methods, akin to promoting volatility, additional contributed to low market volatility.

The article means that though the uncertainty surrounding the June fee hike might introduce some liquidity, the crypto market will proceed to face a scarcity till the rate of interest hike cycle concludes.

The stagnant buying and selling quantity has resulted in persistently low realized volatility for mainstream crypto belongings. Regardless of some deviations from the standard patterns, the present market efficiency aligns with the shut relationship between the crypto market and the macroeconomy.

Moreover, the rise of AI has led speculative liquidity to favor US shares over the crypto market. Whereas BTC’s macro fundamentals stay stagnant, investing in shares like NVDA can present rapid good points upon monetary report releases.

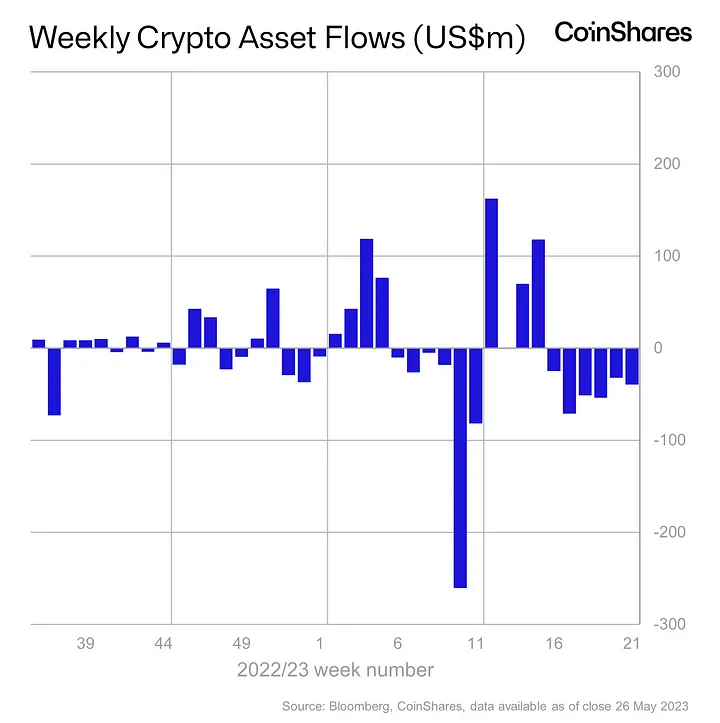

In the meantime, Bitcoin’s volatility has decreased, leading to a 5% drop in Might. Rational liquidity suppliers, together with establishments and high-net-worth traders, are decreasing their positions within the crypto market as a result of difficulties in reaching extra returns. This has led to consecutive weeks of outflows and a decline in crypto fund managers’ belongings below administration.

The evaluation highlights that because the crypto market at present experiences a liquidity scarcity, traders search alternatives in different markets. Promoting volatility has develop into a big earnings supply for crypto traders, resulting in a cycle of volatility suppression.

Moreover, the rise in choice sellers have pushed down bid costs and implied volatility. Choice market makers have transitioned to relative volatility consumers, impacting market volatility. The period of the liquidity scarcity is unsure, and macro occasions present restricted reduction. Buyers’ buying and selling enthusiasm has decreased, and liquidity challenges are anticipated to persist till the top of the rate of interest hike cycle.