- Bitcoin is wanting more healthy in the course of the present cycle than within the earlier one.

- The present cycle lacks “a dominating narrative.”

- Meme cash would possibly quickly attempt to meet up with POPCAT’s large features.

The crypto market is due a rally and is displaying indicators of energy, as identified by Miles Deutscher, a crypto analyst and DeFi knowledgeable. Deutscher highlighted that the bearish efficiency of digital belongings will lead to traders taking “large offside positioning,” pushing costs larger.

In a thread on X (previously Twitter), Deutscher gathered bullish sentiment from throughout the platform, predicting a This fall rally resulting in a market high in 2025. He believes Bitcoin is in a more healthy place than within the earlier cycle and suggests “VC cash” (tokens backed by enterprise capital) might attain new highs quickly.

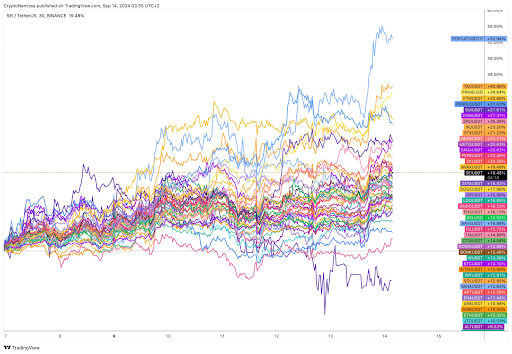

The Prime Performers

Deutscher highlighted the top-performing sectors because the latest market low on September sixth. Infrastructure tokens, Layer 1 tokens, omnichain tokens, and Layer 2 belongings are all displaying bullish indicators. In the meantime, the ETH/BTC ratio continues to say no, with analysts predicting a backside is close to.

Meme Cash and NFTs: Blended Alerts

Meme cash, aside from Popcat (POPCAT), have but to affix the uptrend. Nevertheless, there’s a likelihood that different memecoins like dogwifhat (WIF), Pepe (PEPE), and Dogecoin (DOGE) might catch as much as POPCAT’s efficiency.

Learn additionally: Prime 10 Most Centralized Cryptos: Ought to You Be Fearful?

Deutscher additionally famous that the crypto market at the moment lacks a “dominating narrative,” leaving room for AI, RWA, or modular blockchains to take middle stage on this cycle. Moreover, NFTs and GameFi tokens are additionally displaying indicators of a slight surge in costs within the close to future, forming decrease highs.

Up to now 24 hours, the whole market capitalization of the crypto house dipped 3.9% and its worth stands at $2.12 trillion. Moreover, the whole quantity traded available in the market stands at $74.78 billion.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be chargeable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.