- Injective’s latest upgrades have considerably improved blockchain velocity, enhancing its scalability and efficiency.

- Ethereum’s derivatives market reveals excessive liquidation charges for lengthy positions, highlighting elevated market volatility.

- Avalanche’s derivatives market exhibits bullish sentiment with rising buying and selling quantity and a robust choice for lengthy positions.

Injective (INJ) is main the cost with spectacular blockchain upgrades, whereas Ethereum (ETH) experiences a slight value dip. Kadena (KDA) and Brett (BRETT) additionally see value decreases, whereas Avalanche (AVAX) bucks the development with constructive positive factors. Allow us to break down the newest cryptocurrency market exercise with their corresponding buying and selling volumes.

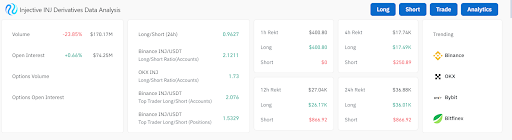

Injective’s latest upgrades have considerably boosted its blockchain scalability, lowering block occasions to a formidable 0.65 seconds. This makes it one of many quickest layer 1 blockchains out there. At the moment, INJ is buying and selling at $18.46, reflecting a slight 0.38% dip prior to now 24 hours.

Buying and selling quantity over the past 24 hours reached $58,569,854, contributing to a market cap of $1,802,172,729. There are at present 97,622,780 INJ cash in circulation. Derivatives open curiosity has climbed 1.40% to $75.06M, and platforms like Binance and OKX are seeing extra merchants take lengthy positions on INJ than brief positions.

Ethereum (ETH) has seen a value of $2,542.73, marking a 3.87% decline prior to now 24 hours. Even with this dip, ETH stays a serious participant with a buying and selling quantity of $11.9 billion and a market cap of $305.9 billion. The circulating provide is 120.3 million ETH cash.

The ETH derivatives market continues to favor lengthy positions, evident from excessive lengthy/brief ratios. Nevertheless, liquidations for lengthy positions have been notably greater, indicating elevated market volatility. Binance, OKX, Bybit, and Bitfinex stay the highest platforms for ETH derivatives buying and selling.

Kadena has skilled a value lower, at present at $0.497440, down 5.52% within the final 24 hours. Its buying and selling quantity stands at $4.6 million, with a market cap of $142.2 million. Kadena has a circulating provide of 285.9 million KDA cash and a max provide of 1 billion KDA cash.

The KDA derivatives market is experiencing decreased exercise. The lengthy/brief ratio displays blended sentiment with extra brief positions than lengthy on Binance. Moreover, each lengthy and brief positions face related liquidation ranges, with brief positions barely extra pressured.

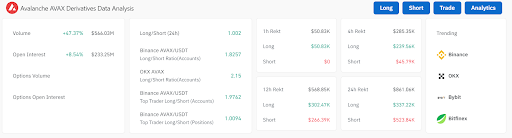

Avalanche (AVAX) has seen a constructive 3.86% change, buying and selling at $22.99. The 24-hour buying and selling quantity is $304.7 million, and its market cap is $9.3 billion. AVAX has a circulating provide of 404.8 million AVAX cash and a most provide of 720 million AVAX cash.

The derivatives marketplace for AVAX is booming with elevated buying and selling quantity and open curiosity. A bullish sentiment prevails, as proven by extra lengthy positions. Liquidations are greater for lengthy positions, suggesting elevated danger. Binance, OKX, and Bybit are the main platforms for AVAX derivatives.

Brett (BRETT) is buying and selling at $0.087416, with a 24-hour buying and selling quantity of $39.7 million. It’s down 0.17% over the past day, with a market cap of $866.3 million. The circulating provide stands at 9.9 billion BRETT cash, with a most provide of 10 billion BRETT cash.

The BRETT derivatives market has seen a decline in buying and selling exercise. Lengthy positions dominate the market, with extra lengthy positions in comparison with brief ones. Moreover, brief positions face greater liquidation strain. Binance, OKX, and Bybit are key platforms for BRETT derivatives.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t chargeable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.