The overall crypto market cap fell $51 billion because the disaster at Silvergate Financial institution deepened.

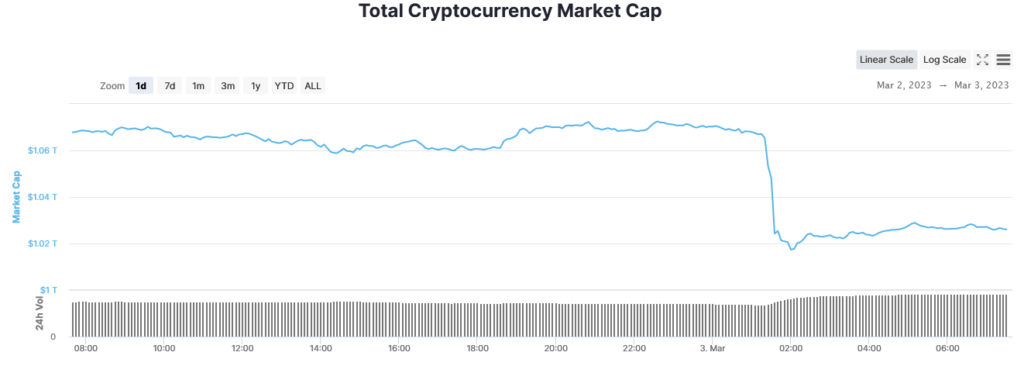

Over the past 24 hours, the full market cap misplaced $50.62 billion to backside at $1.017 trillion round 02:00 GMT on Feb. 3.

A muted bounce noticed a gradual uptick that peaked at $1.028.5 trillion three hours later. However, within the aftermath of the sell-off, market sentiment stays braced for additional drops as Silvergate uncertainty takes maintain.

Crypto market weak spot

Market chief Bitcoin dipped briefly beneath $22,000 as bears ran riot – marking a 16-day low.

Zooming right into a smaller timeframe confirmed a right away bounce at assist to shut with a top-heavy candle physique. An try and recapture $22,470 was rejected, resulting in a contraction of exercise – as denoted by lowering candle sizes.

An extra rejection on the $22,470 zone occurred at 09:00 GMT, suggesting one other drop decrease is on the playing cards as a result of purchaser weak spot.

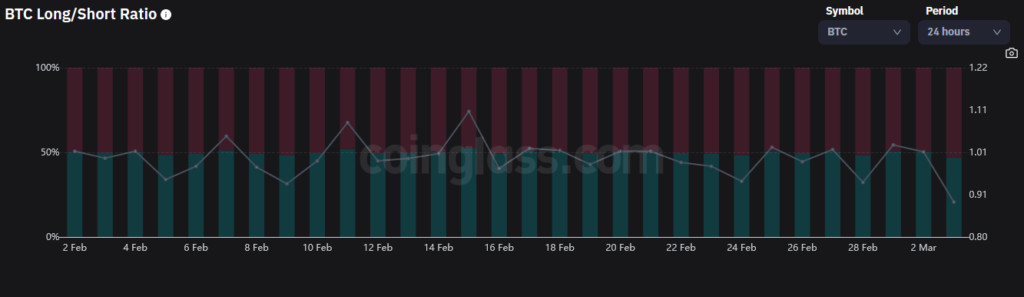

Bitcoin merchants flipped majority quick, at 53%, resulting in the bottom lengthy/quick ratio in a month. Likewise, longs have been liquidated to $243.5 million within the final 24 hours – a 303% enhance over yesterday.

The highest 10 (excluding stablecoins) noticed Litecoin fare worst, down 8% during the last 24 hours, adopted by Dogecoin, which fell 6%. Nonetheless, the largest high 100 loser was dYdX, sinking 13.9% over the identical interval.

Silvergate uncertainty

On March 1, Silvergate stated it couldn’t meet the March 16 10-Ok report submitting deadline. The accompanying assertion talked about unspecific occasions that contributed to the submitting delay.

“Various circumstances have occurred which can negatively affect the timing and the unaudited outcomes beforehand reported within the Earnings Launch, together with the sale of extra funding securities past what was beforehand anticipated…”

The announcement was met with an almost 50% drop in inventory worth. Analysts have raised the alarm on the corporate as a going concern amid rumors of FTX overexposure. A number of crypto corporations moved to chop ties with the beleaguered financial institution, together with Coinbase, Circle, and Paxos.

In the meantime, underneath preliminary investigations, FTX disclosed an $8.9 billion black gap in buyer funds. The agency stated it had recognized $2.7 billion of buyer funds, however excellent balances owed quantity to $11.6 billion.

Firm CEO John Ray reiterated earlier feedback on incomplete information, including that the figures are topic to vary.