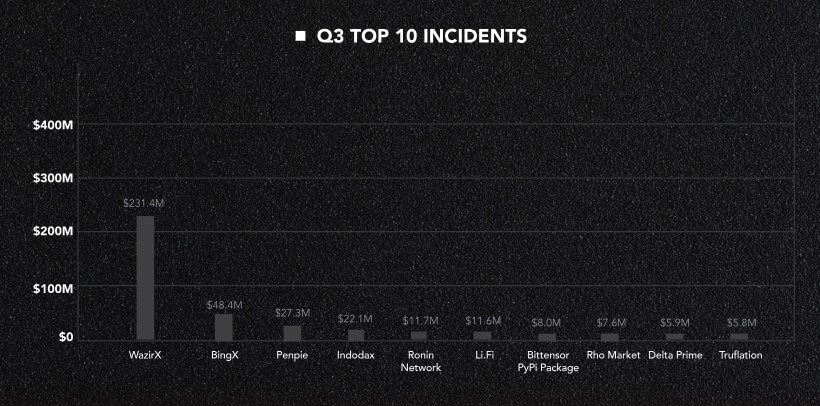

Malicious actors stole greater than $750 million in varied crypto-related hacks and scams through the third quarter, pushing complete losses for the 12 months to over $1.9 billion, in response to CertiK’s quarterly Hack3d safety report.

The losses have been incurred in 155 separate incidents, exhibiting a 9.5% rise in stolen funds in comparison with the earlier quarter. Nonetheless, there have been 27 fewer incidents than within the second quarter.

Based on the report, three main occasions have been liable for a lot of the funds stolen through the quarter. Two of the most important incidents have been a $238 million phishing assault concentrating on a Bitcoin whale and a $231 million hack of India-based centralized alternate WazirX. The third largest incident concerned a person investor who fell sufferer to a phishing rip-off that resulted in a $55.4 million loss.

In the meantime, roughly $30.9 million was recovered throughout 9 incidents, reducing the adjusted internet losses to round $722 million for the quarter.

Phishing stays a priority

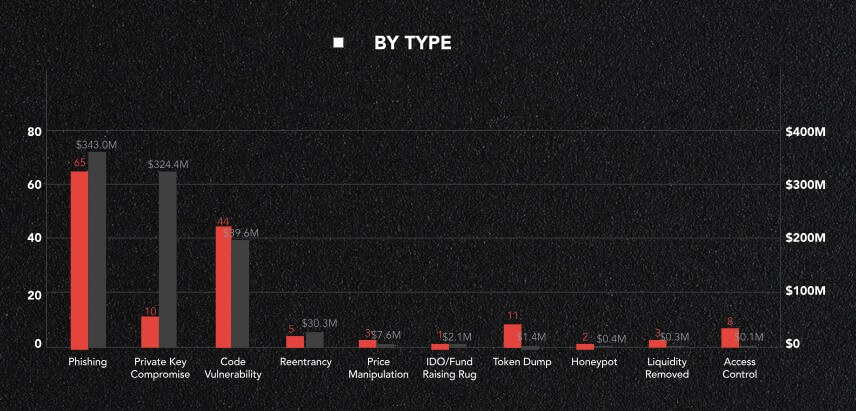

Phishing assaults and personal key compromises have been probably the most dominant assault strategies utilized by malicious actors through the third quarter.

Phishing alone prompted losses exceeding $343 million in 65 circumstances. Usually, these scams contain attackers posing as trusted entities to deceive victims into sharing delicate data like passwords.

Personal key compromise ranked second, with over $324 million misplaced throughout 10 circumstances. In these eventualities, attackers acquire management of personal keys, permitting them to switch funds while not having additional authentication.

Different notable vulnerabilities concerned code flaws, reentrancy bugs, worth manipulation, and fundraising-related scams, amongst others.

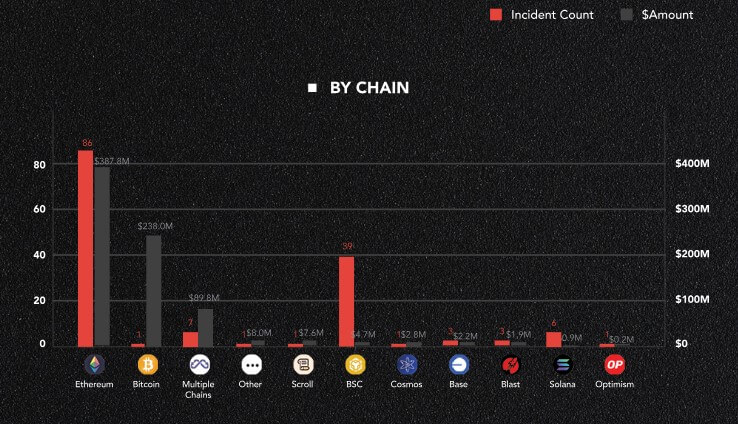

Ethereum suffered most losses

Throughout blockchain networks, Ethereum noticed probably the most safety breaches, with 86 hacks and scams leading to losses of over $387 million. The Bitcoin community adopted, with $238 million stolen in a single phishing incident.

CertiK defined that the 2 prime blockchain networks have been probably the most focused due to their “excessive transaction quantity, massive userbase, and TVL.”

In the meantime, multi-chain platforms additionally suffered important losses of round $90 million, whereas different blockchain networks like Binance Good Chain (BSC), Cosmos, Scroll, Solana, Base, Blast, and Optimism accounted for the remaining incidents.