The crypto funding merchandise market recorded $57 million in inflows throughout the week of April 3, in response to CoinShares’ report.

This influx introduced the crypto funding merchandise market right into a internet influx place year-to-date, because the CoinShares report famous.

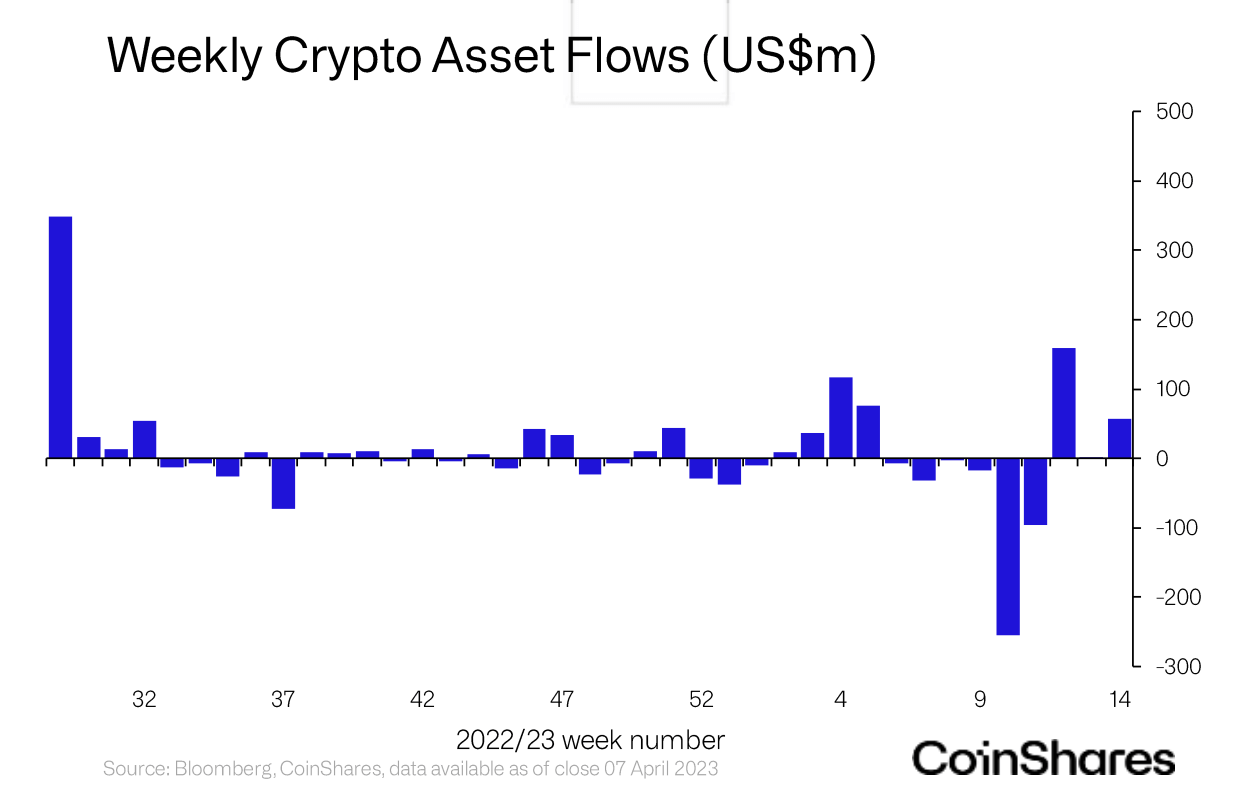

Up till the week of March 20, the crypto funding merchandise market has been recording outflows for six weeks straight. The full losses throughout this time added as much as $408 million.

The most important outflow throughout these six weeks was recorded within the week of March 6, when the market misplaced $255 million, which accounted for 1% of the market on the time.

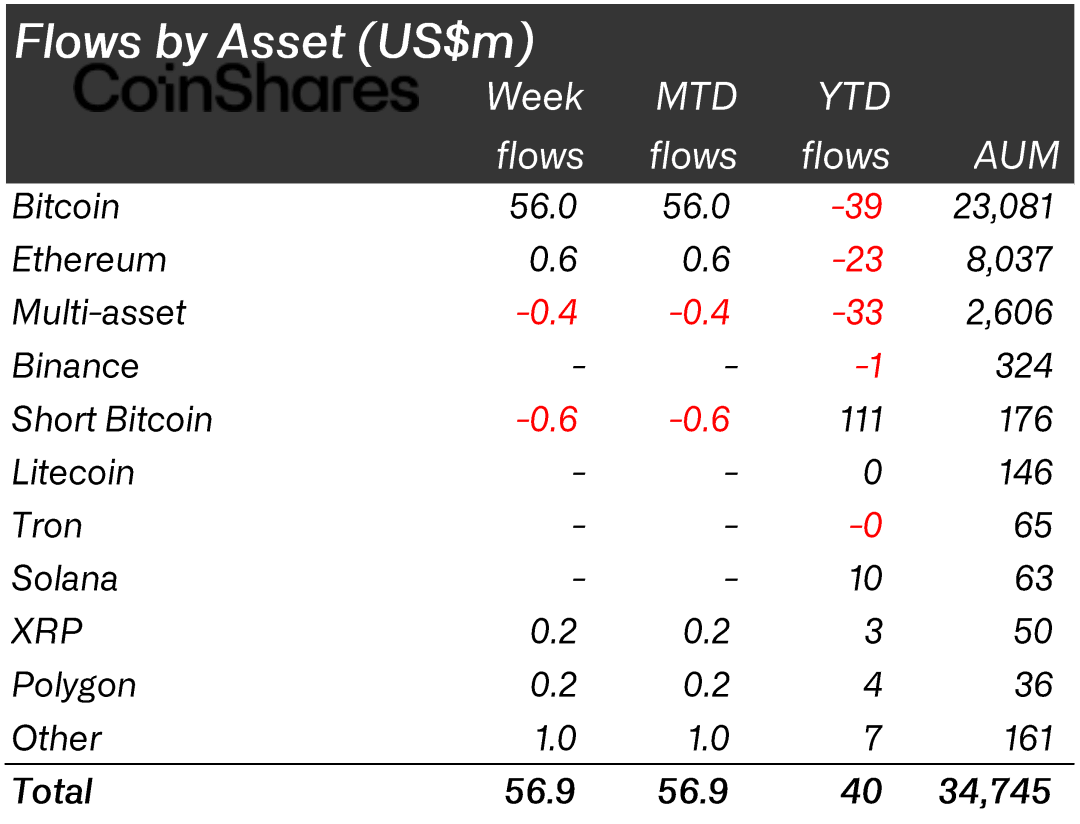

Flows by asset

Bitcoin (BTC) primarily based funding merchandise almost accounted for all of the influx recorded throughout the week. Of the $57 million value of inflows in complete, BTC merchandise noticed $56 million in inflows.

Ethereum (ETH) primarily based merchandise contributed the second largest quantity, seeing $600,000 in inflows. Ripple (XRP) and Polygon (MATIC) additionally contributed $200,000 in inflows every.

In the meantime, short-BTC-based merchandise and multi-asset merchandise recorded outflows value $600,000 and $400,000, respectively.

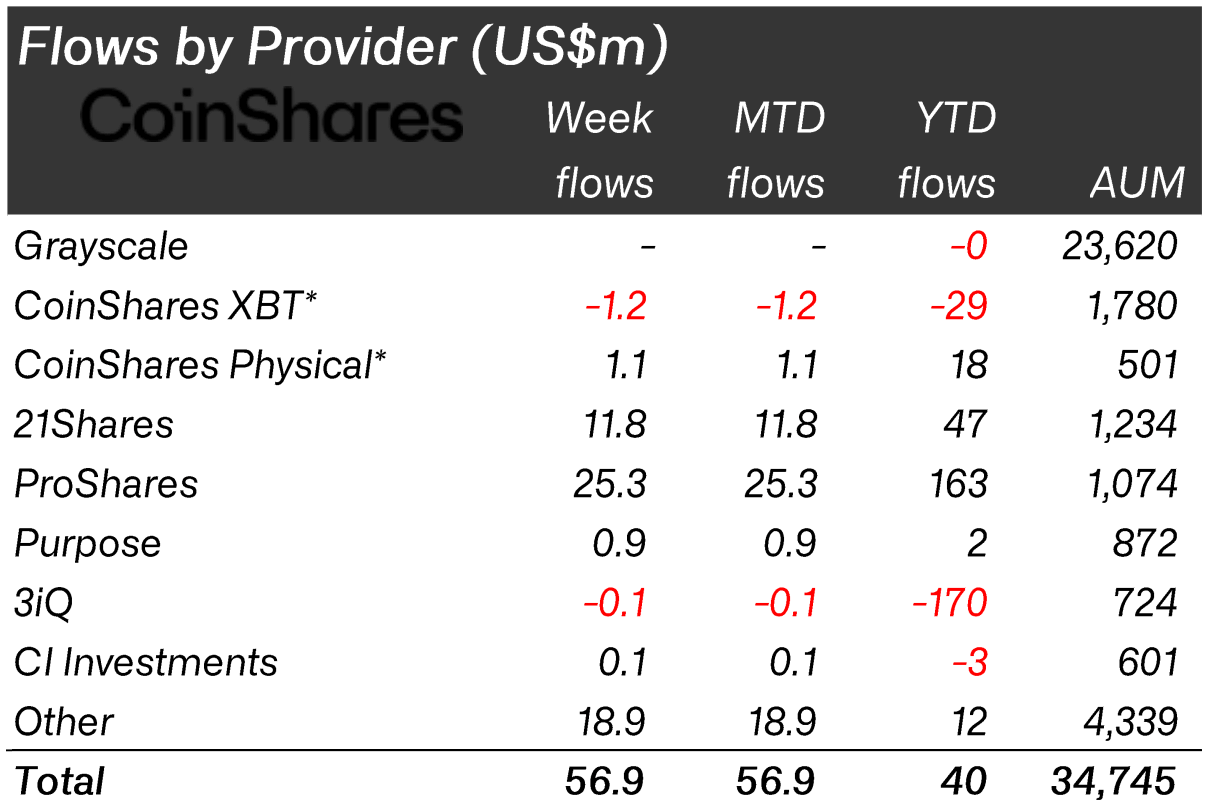

Flows by supplier

When the flows are categorized by the supplier, ProShares come ahead because the group that recorded probably the most important influx at $25.3 million — accounting for over 44% of the whole quantity.

21Shares adopted ProShares because the second largest contributor to inflows with $11.8 million. Regardless that CoinShares Bodily recorded $1.1 million in inflows, CoinShares XBT noticed $1.2 million in outflows — which introduced CoinShares’ ultimate rating to $100,000 in outflows.

In the meantime, Goal and CI Investments recorded $900,000 and $100,000 in inflows — whereas 3Qi noticed $100,000 in outflows.

US leads in inflows

Based on the numbers, the U.S. is answerable for including $26.8 million in inflows — accounting for almost 50% of the whole quantity.

Germany and Switzerland adopted the U.S. by contributing the second and third most important share in inflows with $16.6 million and $12.8 million, respectively. Canada additionally contributed $2.2 million in inflows because the fourth in line.

In the meantime, Sweden and Brazil recorded $1.2 million and $300,000 in outflows, respectively.

The submit Crypto funding merchandise market reaches YTD internet influx appeared first on StarCrypto.