- Distinguished figures within the crypto neighborhood strongly reply to Gary Gensler’s crypto statements, accusing him of spreading FUD.

- Ryan Selkis, CEO of Messari, counters Gensler’s claims, emphasizing that Bitcoin has constantly confirmed itself because the top-performing funding.

- Coinbase Chief Authorized Officer, Paul Grewal, questions the SEC’s credibility by highlighting current misrepresentations in DEBT Field case.

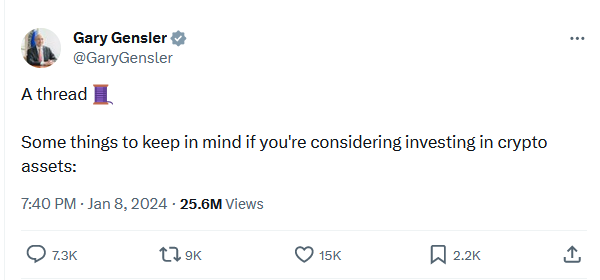

Current tweets from outstanding figures throughout the crypto neighborhood have responded strongly to Gary Gensler’s crypto statements, accusing him of spreading worry, uncertainty, and doubt (FUD) in regards to the crypto business.

The SEC Chair laid out numerous dangers related to crypto, together with non-compliance with securities legislation, volatility and danger, and the rise of fraudsters.

Plenty of main platforms and crypto belongings have grow to be bancrupt and/or misplaced worth. Investments in crypto belongings proceed to be topic to vital danger.

The founder and CEO of Messari, Ryan Selkis, took to X to counter Gensler’s claims. Selkis emphasised that Bitcoin has constantly confirmed itself because the top-performing funding over its 15-year historical past. He criticizes Gensler for omitting this very important info from his statements, calling consideration to what he perceives as fear-mongering.

Coinbase Chief Authorized Officer, Paul Grewal, introduced consideration to the SEC’s current misrepresentations in a courtroom case concerning DEBT Field. Grewal highlighted the SEC’s regrettable actions and questioned the sincerity of their apologies. By juxtaposing Gensler’s statements with the SEC’s courtroom troubles, Grewal implies a scarcity of credibility and consistency throughout the regulatory physique.

X account CryptoLaw contributed to the criticism by alleging that, below Gensler’s management, the SEC has been dishonest in a crypto case, dealing with potential sanctions. The tweet accuses Gensler of permitting fraudulent actions, such because the scenario involving SBF (Sam Bankman-Fried), to happen below his watch.

The tweet requires Gensler’s resignation, citing him because the incorrect regulator and an incompetent chief. CryptoLaw additionally perceives him as a serious legal responsibility, with doubts rising in regards to the veracity of his statements. Gensler’s current crypto thread went viral, with impressions reaching over 25.4 million for a tweet that isn’t even a day previous.

Whereas Gensler acquired backlash from the crypto neighborhood, the timing of the tweet gave many anticipation {that a} spot Bitcoin ETF could be authorised quickly.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t answerable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.