Bitcoin (BTC) exchange-traded merchandise (ETPs) noticed inflows of 6,031 BTC up to now week, in keeping with information shared by Arcane Analysis’s Vetle Lunde.

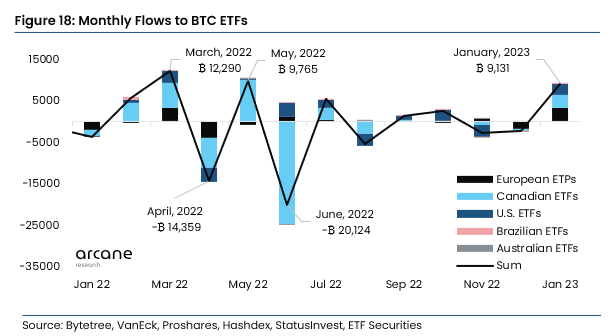

Lunde stated the ETPs recorded a cumulative web influx of 9,131 BTC over the previous month — the very best month-to-month influx since Could 2022, when ETPs recorded inflows of 9,765 BTC.

Outflows of 20,124 BTC adopted the Could 2022 influx in June 2022, when the flagship digital asset declined by 40% to lower than $20,000. Since then, Bitcoin ETFs have been treading water, recording extra outflows than inflows till January 2023.

In the meantime, there’s a notable distinction within the geographical composition of the ETFs that noticed probably the most inflows this month in comparison with Could 2022, when Canadian ETFs like Goal Bitcoin dominated it.

Nonetheless, the present inflows seem like shared equally amongst European, US, and Canadian ETFs in January 2023.

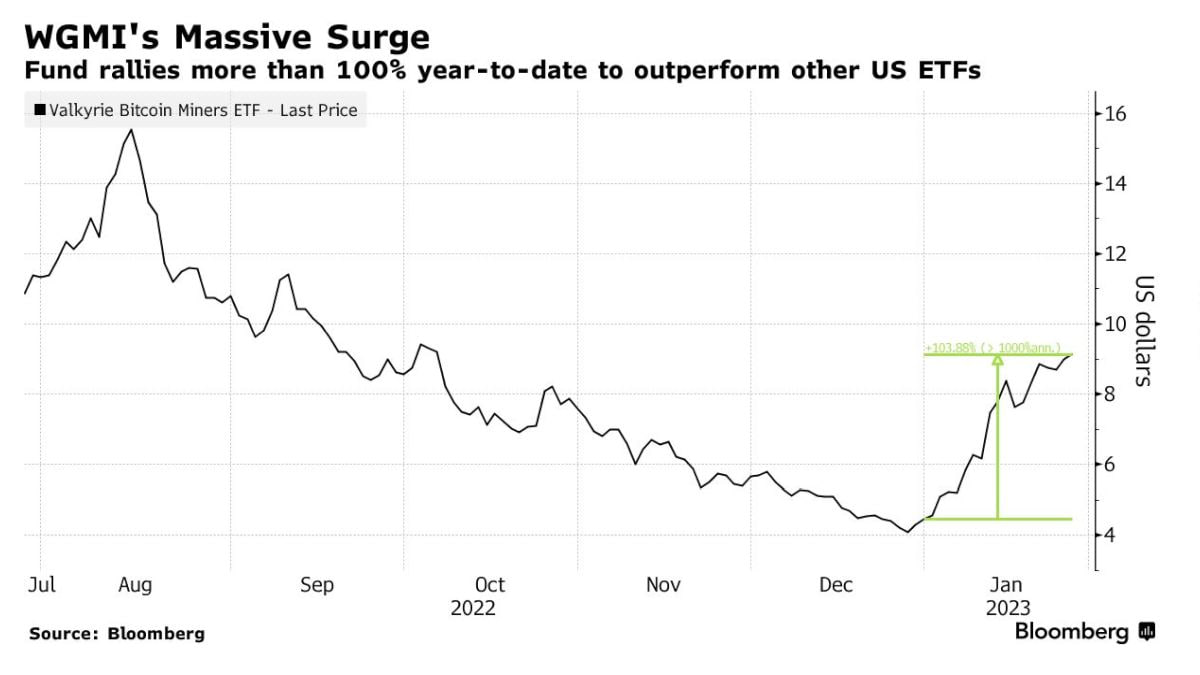

Valkyrie ETF rises 100% in 2023

Valkyrie Bitcoin Miners ETF “We’re Gonna Make It” (WGMI) has emerged because the best-performing fund in 2023, rising by over 100% up to now month, in keeping with Bloomberg’s information. The ETF, launched in February 2022, misplaced greater than 80% of its worth in 2022.

The ETF holds shares from mining firms like Hive Blockchain Applied sciences Ltd, Marathon Digital Holdings Inc., Bitfarms Ltd, and so on. All these miners have additionally seen their inventory worth rise considerably in 2023 following a brutal previous yr that noticed their worth decline.

Nonetheless, the early optimistic returns will not be sufficient to revive traders’ income, as most ETFs are nonetheless buying and selling under their all-time highs. For context, the WGMI is down 68.32% from its February 2022 beginning worth.

In the meantime, the optimistic efficiency of those ETFs is principally pushed by the present market sentiments across the crypto business. The crypto business has loved a blistering begin to the brand new yr, with Bitcoin and Ethereum (ETH) rising by greater than 30% up to now month.