- Scamming and stolen funds lower; ransomware and darknet markets see income will increase.

- Stablecoins surpass Bitcoin as the popular foreign money for illicit transactions on account of stability and ease of use.

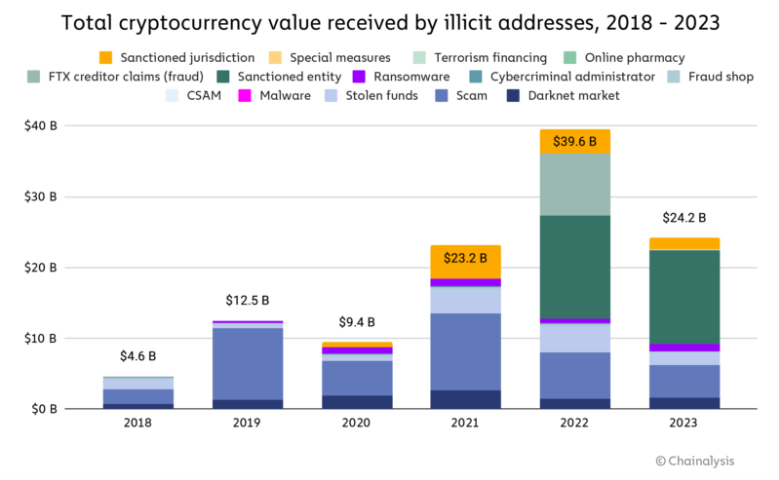

- Chainalysis reviews a 39% drop in whole crypto worth despatched to illicit addresses from $39.6B in 2022 to $24.2B in 2023.

Fears of rampant cryptocurrency-fueled crime could also be cooling, as a brand new report from blockchain knowledge platform Chainalysis reveals a major drop in crypto worth acquired by illicit addresses all through 2023.

Whole cryptocurrency worth acquired by illicit addresses, 2018-2023

The report reveals a 39% drop within the whole worth despatched to illicit addresses, from a staggering $39.6 billion in 2022 to simply $24.2 billion final 12 months. This lower was accompanied by a dip within the share of all crypto transaction quantity related to illicit exercise, down from 0.42% to 0.34%.

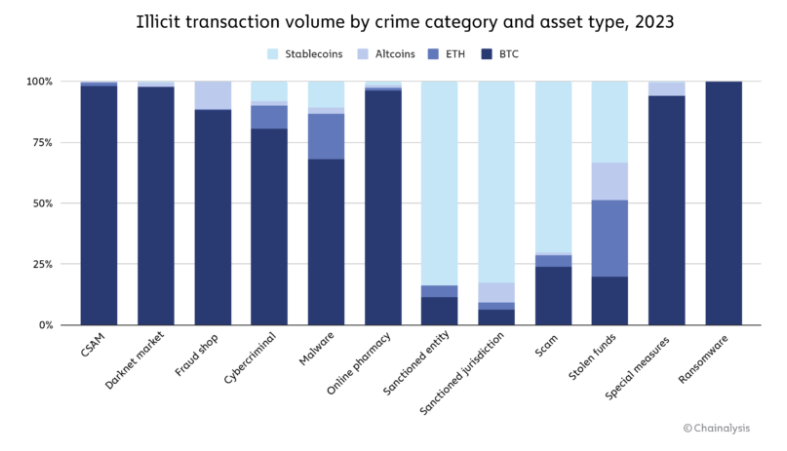

The report additionally highlights a altering panorama of crypto-based crime, with stablecoins now dethroning Bitcoin, as soon as the go-to foreign money for cybercriminals, as the popular foreign money for illicit transactions. This recognition will be attributed to its inherent stability and relative ease of use.

Illicit transaction quantity by crime class and asset sort, 2023

Nevertheless, the dominance of stablecoins varies relying on the kind of crime. Bitcoin stays the first foreign money for darknet market gross sales and ransomware extortion, whereas scams and transactions linked to sanctioned entities gravitate in direction of stablecoins. Notably, these crimes associated to stablecoin actions occur to be the most important types of crypto crime by transaction quantity.

The largest declines had been seen in scamming and stolen funds, down by almost 30% and 50%, respectively. Nevertheless, regardless of the general decline in crypto crime, ransomware and darknet markets bucked the pattern, seeing their revenues rise in 2023. Maybe essentially the most stunning discovering is the dominance of sanctions-related transactions, which account for over 60% of all illicit exercise.

Whereas this lower provides a welcome reprieve, the report cautions in opposition to decoding it as a victory lap. Chainalysis emphasizes that these figures are “decrease sure estimates,” which means the true scope of crypto-crime is probably going greater because of the fixed discovery of latest illicit addresses.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be answerable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.