- USDT holdings have risen sharply amid a sluggish crypto market.

- Since August, a large surge in USDT holdings on exchanges have been witnessed.

- The buildup/distribution indicator means that the pattern may proceed.

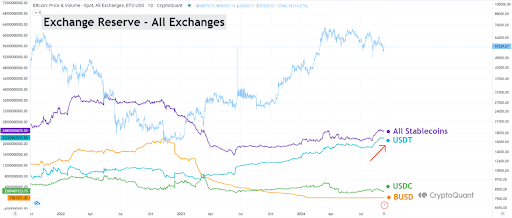

Crypto buyers have massively elevated their stablecoins holdings with USDT accumulation on the rise amid a sluggish market. Knowledge from CryptoQuant reveals a pointy rise in USDT holdings since August’s market downturn.

In line with CryptoQuant analyst “Yonsei Dent,” the rise in USDT reserves on exchanges is a major shift. “USDT remained comparatively steady regardless of worth swings from March to July,” Dent famous.

The rising presence of stablecoins on exchanges might be a sign of buyers ready to purchase cryptocurrencies. Nevertheless, this doesn’t essentially imply that the value of digital property will rise, Dent warned. It might additionally imply that buyers anticipate a market crash or have transformed their crypto to stablecoins, which might consequence available in the market plunging.

Dent additionally believes that it might be potential that buyers received’t trade their stablecoins for cryptocurrencies as a result of the worldwide markets presently have an unsure future, together with digital property. He added:

“As a result of it’s ‘standing-by funds,’ it must be famous that if the market pattern is unclear or the worldwide economic system is troublesome, there could also be no purchases as a result of danger aversion.”

In line with the info from CoinMarketCap, Bitcoin (BTC) has been fairly risky since January and in addition achieved its all-time excessive in March this 12 months at $73,750. Since then, the cryptocurrency has plunged 22.68% regardless of quite a few makes an attempt to interrupt increased. On the time of writing, the market chief is buying and selling at $57,014.20.

Learn additionally: Bitcoin’s September Stoop: Can Historical past Repeat with an October Surge?

Accumulation of USDT

The buildup of USDT, the biggest stablecoin by market capitalization, has began to climb once more after a major drop final week. Nevertheless, it stays beneath the degrees seen in Could.

The steep rise within the Accumulation/Distribution line’s gradient suggests buyers could proceed so as to add extra USDT to their portfolios within the close to future.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version is just not chargeable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.