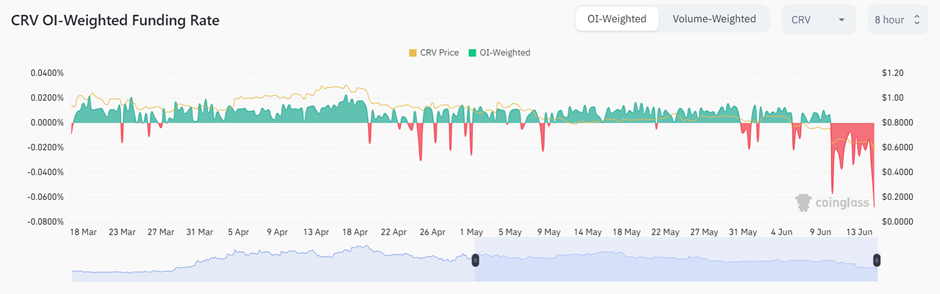

- Curve DAO’s CRV token’s funding fee has fallen to a brand new yearly low.

- Over the previous 24 hours, the CRV token has fallen by 10%.

- The imbalance within the Curve ecosystem resulted within the 0.25% fall within the worth of USDT.

Based on a current evaluation, the Curve DAO token CRV’s funding fee has fallen to a brand new yearly low, with a fee of -0.0733% over the previous 8 hours. Over the previous 24 hours, the token has fallen by greater than 10%.

Following the imbalance within the Curve ecosystem, there was a big change of USDT for DAI and USDC, ensuing within the 0.25% low cost in USDT’s worth. At press time, USDT is buying and selling at a worth of $0.998, down 0.26%, whereas CRV is at $0.5683, down 12.17%.

A outstanding Chinese language reporter Collin Wu, shared a collection of threads on Twitter by way of his official web page Wu Blockchain, throwing insights into the attainable causes for CRV’s yearly low.

Reportedly, just a few days earlier than, the Curve Finance founder Michael Egorov deposited $24 million price of CRV tokens, accounting for 34% of the overall provide. The huge deposit to the decentralized protocol Aave was an try and mitigate a liquidation threat of a $65 million stablecoin mortgage. Based on the crypto sleuth, Lookonchain, Egorov deposited 291 million CRV and borrowed $65 million USDT and USDC.

At this time, Wu asserted that CRV’s decline within the funding fee might be attributed to the Curve founder michwill’s guess:

The primary purpose for this can be as a result of a guess on the liquidation of the place held by Curve founder michwill (0x7a…5428) by brief sellers. This tackle holds 430 million CRV tokens (about 50% of the circulating provide) as collateral for lending protocols.

The reporter has integrated the michwill’s pockets tackle, highlighting that the tackle holds greater than 400 million CRV tokens, equal to a complete quantity of $2,342,134.